Posts Infrastructure electricity prices 5467 11 September 2024

In Ukraine, the weighted average price for DAM in August was €126.7/MWh, which is 40.4% more than the average for 2023

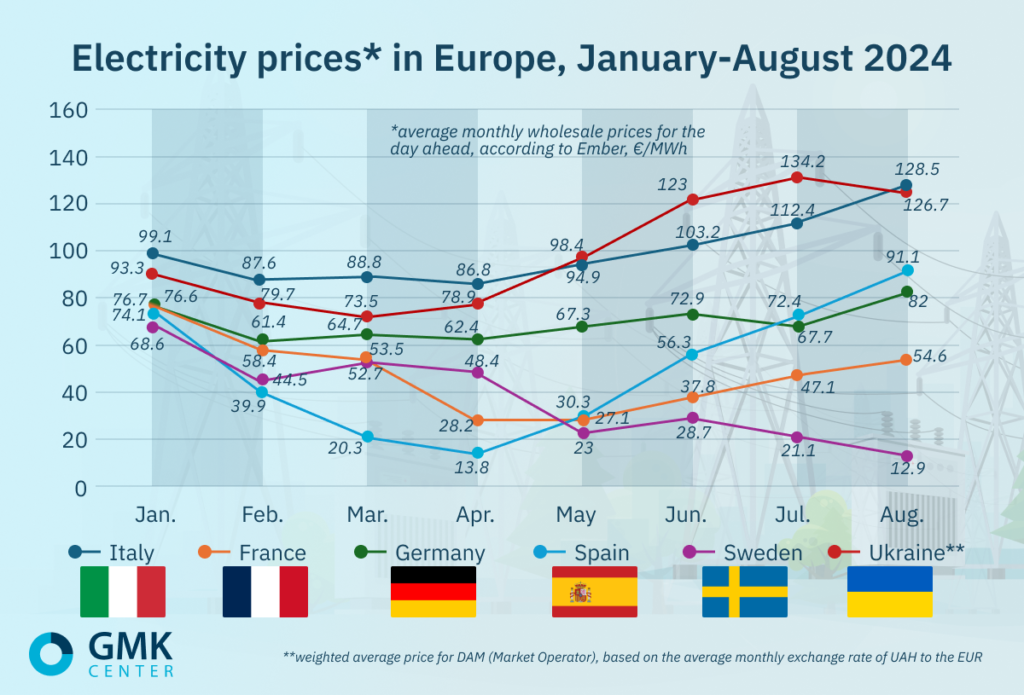

In August, the average monthly wholesale day-ahead prices in most European electricity markets increased compared to July.

According to Ember, they amounted to:

- Italy – €128.47/MWh (+14.3% m/m);

- France – €54.56/MWh (+15.8%);

- Germany – €82.09/MWh (+21.1%);

- Spain – €91.1/MWh (+25.7%);

- Sweden – €12.88/MWh (-38.9%).

Electricity prices in Europe, GMK Center

August trends

The rise in electricity prices in Europe in the last month of summer was driven by higher prices of gas and carbon allowances, as well as increased demand for electricity due to the heatwave that hit a number of European countries, including France and Italy, in the second half of August.

Ukraine’s neighbours, Romania and Hungary, also had to increase imports in August due to a significant increase in air temperature and consumption, as well as technical factors.

For example, on 26 August, unit 1 at Romania’s only nuclear power plant, Cernavoda NPP, was automatically disconnected from the national power grid due to a malfunction of equipment (protection of the power discharge transformer). According to Romanian Profit.ro, this happened at the worst possible time, coinciding with an increase in consumption due to the heat, a drop in renewable energy generation, and low hydroelectricity production due to drought. The country was therefore forced to import large amounts of electricity from Bulgaria and Serbia. The unit was restarted on 29 August, but day-ahead prices in Romania reached high levels during this period.

In Hungary, in August, consumption exceeded the level of the last 4 years due to the heat wave, while the country began scheduled maintenance (overhaul) of Unit 3 at the Hungarian Paks NPP on 23 August, with Unit 4 being completed on 19 August.

The situation in Ukraine

In Ukraine, according to the Market Operator, in August, for the first time in five months (since April), a decrease in the weighted average price of electricity on the DAM was recorded. Compared to July, it fell by 3.8% to UAH 5,738.6/MWh (€126.7/MWh at the average hryvnia/euro exchange rate in the period).

In August, electricity demand for DAM increased by 0.93% m/m, while supply increased by 5.19%.

According to D.Trading’s analytical report, in August this year, Ukraine reduced electricity imports by 44% compared to July, to 472 million kWh. The main reasons were a decrease in demand for imported electricity from businesses, as well as increased consumption in neighbouring countries, as higher demand there led to high spot prices on Ukraine’s western border.

As noted, in early August, prices at the border were attractive for electricity import, so it continued in significant volumes. However, from the second week of the month, imports declined as demand from businesses whose consumption was not restricted fell.

On 19 August, NPC Ukrenergo resumed hourly electricity outage schedules due to new heat wave in the country and increased consumption. Prior to that, they had not been applied to households and industry since 30 July. The exception was 8 August. Then, from 17.00 to 22.00, restrictions were imposed on industrial consumers and businesses due to a shortage of capacity in the power grid and high consumption caused by rising temperatures in the south and east of the country.

The schedules were applied from 19 to 23 August, when another nuclear unit came out of scheduled maintenance ahead of schedule. After that, the need for imported electricity dropped significantly. At the same time, however, a heatwave hit neighbouring European countries, causing electricity prices to rise significantly in those countries. They were significantly higher than the current price caps on the Ukrainian market, making it unprofitable for industrial consumers to import expensive electricity from abroad.

In late August, electricity imports increased. On 26 August, the Russians launched another missile and drone attack on Ukraine’s energy infrastructure, which Ukrenergo described as the most massive. This resulted in significant blackouts in all regions of the country.

At the same time, Ukraine is engaged in a dialogue with European partners to expand its electricity import capacity from 1.7 to 2.2 GW, Prime Minister Denys Shmyhal said. According to the Prime Minister, decentralised generation is being developed alongside the restoration of facilities damaged by Russian attacks that need to be rebuilt. In particular, large businesses can take advantage of loans at 14-16% per annum secured by purchased power equipment.

Fullness of gas storages

On 21 August, the EC announced that the unit had reached the goal of filling the storage facilities to 90% of capacity, more than 2 months before the deadline (1 November). As noted, this achievement is similar to last year’s, when the target was reached on 18 August.

‘Gas storage is a key factor in the security of energy supply in Europe, as it can cover up to one third of the EU’s gas needs in winter. The figures released today show that the level of gas storage reached 1,025 TWh or 90.02% of storage capacity (equivalent to just under 92 bcm of natural gas) on 19 August,’ the statement said.

During August, the settlement of futures at the TTF hub for the month ahead exceeded €40/MWh several times. The Dutch financial group ING explains the strength of the market by an increase in speculative activity due to growing supply risks, rather than fundamentals.

As for supply risks, concerns remain about the possible interruption of Russian gas flows due to the fighting in the Kursk region, although they remain uninterrupted so far. In addition, at the end of 2024, pipeline gas supplies from the Russian Federation through Ukraine are due to stop. The Ukrainian side has clearly confirmed that it does not intend to extend the transit agreement with Russia and is considering alternatives, including a theoretical gas swap with Azerbaijan, together with the EU.

ING analysts believe that the non-renewal of the transit agreement should not have a significant impact on prices, as Ukraine’s position was known in advance. However, there is still potential for a sharp market reaction, particularly in the event of a cold winter in 2024/2025. In addition, the market is under pressure from the ongoing maintenance at the Norwegian facilities, despite the fact that it is scheduled. The possibility of an extension of the work is a concern.

The financial group has revised its TTF price forecast for the fourth quarter to average €37/MWh.

The possibility of a harsh winter is also seen as a problem by analysts from Sweden’s SEB AB, Bjarne Schildrop and Ole Rodal Hvalbaj, who believe that in such a scenario prices could rise to €55/MWh or higher. Mild weather at this time of year will keep them at the current level.

‘Energy market players are paying attention to speculation in the gas market, noting record high long positions of financial intermediaries along with low long positions of the real sector. In other words, different participants view the market differently. This may indicate a likely market reversal, easing of overbought conditions and price cuts in September-October, when storage facilities will be fully filled and gas demand may decline,’ said Andriy Tarasenko, Chief Analyst at GMK Center.

As of 1 September 2024, according to AGSI, European gas storage facilities were 92.4% full. This summer, the FT writes, European traders are using only a fraction of Ukraine’s large storage facilities after Russian attacks on them in recent months. Although the reservoirs are located deep underground, which protects them from strikes, traders see damage to above-ground facilities as a significant risk. Last year, in the run-up to the winter months, European companies stored more than 2 bcm in Ukraine as incentives such as low storage tariffs were offered.