Posts Global Market electricity prices 7022 07 February 2025

The first month of the year saw a rise in gas prices and a price rally in the carbon market

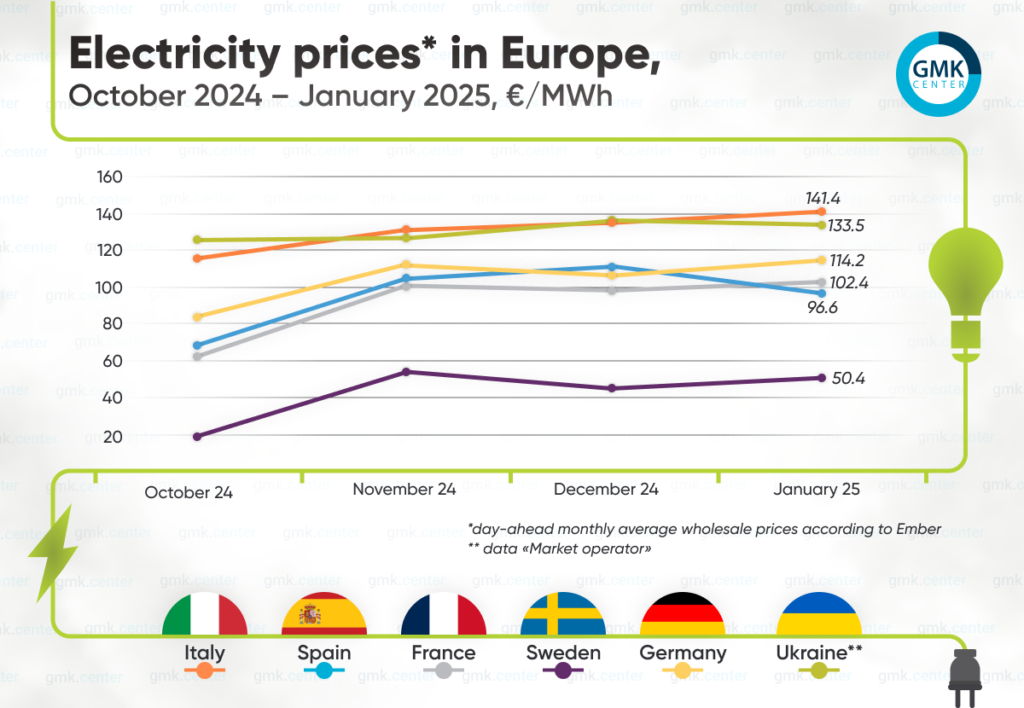

In the EU, average monthly wholesale day-ahead prices in January 2024 increased in most markets.

According to Ember, they amounted to:

- Italy – €141.36/MWh (+4.6% m/m);

- France – €102.45/MWh (+4.3%);

- Germany – €114.22/MWh (+7.9%);

- Spain – €96.59/MWh (-13.2%);

- Sweden – €50.45/MWh (+13).

January trends

As AleaSoft noted, in January, electricity prices rose in most major European markets, in some of them reaching the highest monthly average since March 2023. This was in line with the trend of rising gas prices (monthly average of 48.32/MWh) and CO₂ prices (the average price for the period was €78.2/t, and closed at €83.8/t on January 31). In addition, rising electricity prices led to an increase in demand.

In the first month of the year, the carbon market saw a strong price rally. The situation was driven by higher gas prices at the TTF hub and a change in investors’ positions.

In particular, in the week ended January 17, investment funds accumulated a total long position of more than 79 million EUA, the highest in the last three years. At the same time, they reduced their net short positions to 37 EUA (the lowest level since September 2023).

Analysts note that this is partly due to expectations that the market will move to an annual deficit in 2026 due to a reduction in free allowances and the completion of sales of additional unallocated allowances from the MSR (market stability reserve) to finance the REPowerEU plan (supports the phase-out of Russian fossil fuels). In addition, the shipping sector will make its debut in the EU ETS in 2025.

Europe

At the end of January, the European Commission presented a strategy for an innovative and environmentally friendly EU economy – the Compass of Competitiveness. It includes three main areas of action: innovation, decarbonization and security.

Under the decarbonization pillar, the EC sees high and volatile energy prices as a key issue and identifies areas for intervention to facilitate access to clean, affordable energy.

One of the elements of the new strategy is an Affordable Energy Action Plan to support the industrial sector and households in the energy transition, to be presented on February 26 along with the Clean Industry Agreement. Earlier, at the World Economic Forum in Davos, European Commission President Ursula von der Leyen said that the basis of the future plan to reduce electricity prices would be a modernized EU supergrid.

However, the EU’s green course and the related issue of sustainable electricity prices are causing concern among industrialists and analysts. For example, the German GMH Group pointed to systemic problems in the country’s energy policy. They noted that the abandonment of nuclear power was not accompanied by the construction of new gas-fired power plants, and proposals to stabilize electricity prices were not implemented. In addition, network tariffs for enterprises have doubled in recent years, which further increases costs. This statement came amid the suspension of green steel production at one of the company’s electric arc furnace shops on January 20 due to a sharp jump in electricity prices (up to €400/MWh).

Ivan Fore Svegaarden, Head of Energy Analysis and Trading at TradeWpower, notes that the premature closure of nuclear, coal and gas power plants amid green ambitions could put Europe at risk of a new energy crisis. One of the most disturbing aspects of the current strategy, he says, is the disregard for critical recent atmospheric trends, such as the calming of wind patterns in Europe.

Reuters columnist Gavin Maguire notes that the growing tension in European electricity markets has focused attention on France as the most reliable and integrated exporter of clean electricity in the region. The country’s key advantage is nuclear power.

This status, he explains, may become even more important after the government of Norway, another major exporter, recently lost a key coalition partner in a dispute over EU energy policy. The analyst calls Germany especially dependent on electricity imports within mainland Europe, which last year imported volumes almost six times higher than the average annual volume from 2015 to 2021.

The main risk for the largest European importers is a potential decline in electricity production in France and other major exporting countries, including Switzerland and Denmark. The overall electricity situation may be affected by the decline in hydropower in Switzerland and Austria, and the continuation of the current period of below-nominal wind speeds in the region.

Situation in Ukraine

In Ukraine, the weighted average price for the purchase and sale of electricity on the DAM in January 2025, according to Market Operator, decreased by 2.5% month-on-month – to UAH 5817.56/MWh (€133.5/MWh at the average monthly exchange rate of hryvnia to euro).

Demand for DAM in the period under review decreased by 2.08% compared to December last year, while supply increased by 9.24% m/m.

In the first month of 2025, Ukraine reduced electricity imports by 56% compared to the previous month – to almost 189 thousand MWh, according to ExPro Electricity monitoring data. Compared to January 2024, it increased by more than 50%. The January figures are, among other things, due to the improvement of the situation in the Ukrainian power system.

Poland accounted for the largest share in the import structure in the period under review (30%), followed by Hungary (25.5%) and Slovakia (almost 25%).

Fullness of gas storage facilities

According to the AGSI platform, European gas storage facilities were 53.12% full as of February 1, 2025 (compared to 69.6% as of the same date in 2024).

Currently, the European gas market continues to be pressured by concerns about a faster-than-expected decline in EU storage volumes. However, the bloc was able to achieve the interim target for this indicator – filling at least 50% by February 1.

During the injection season, analysts believe that Europe will have to do more work. Currently, a new trend is emerging in the market. The summer period, traditionally a quiet time for traders, Bloonberg notes, seems to have ceased to be so. Stockpiling can be a challenge due to supply uncertainty, and summer gas futures are trading at a premium.

Adding to market nervousness, in January, German operator Trading Hub Europe reported talks with the economy ministry and the regulator about the possibility of contractors receiving dynamic, spread-based subsidies for filling storage facilities. Traders are concerned that German storage facilities are not filled sufficiently during the summer months, with price differences between seasons being a deterrent.

A little earlier, the German INES group said that storage facilities could be fully filled for the 2025/2026 season under any scenario, but called for increased financial incentives to encourage companies to book them.

On the back of the Trading Hub Europe report and fears that gas prices will remain high for a long time, Italy announced its intention to increase its stockpiles ahead of the official storage season.

According to the Minister of Environment and Energy Security Gilberto Pichetto Fratin during a parliamentary hearing in January, the country plans to announce auctions for gas storage for the next winter in February. He also said that the government is focusing on diversifying its supply sources to reduce dependence on individual suppliers. Typically, the gas storage season in Europe begins in April and lasts until the end of October.

In January, Dutch TTF futures prices were in the range of €45-50/MWh, and on the last day of the month they rose to €53.2/MWh.