Posts Global Market electricity prices 9850 11 December 2024

Ukraine reduced electricity imports during the period, the price of the DAM amounted to €126/MWh

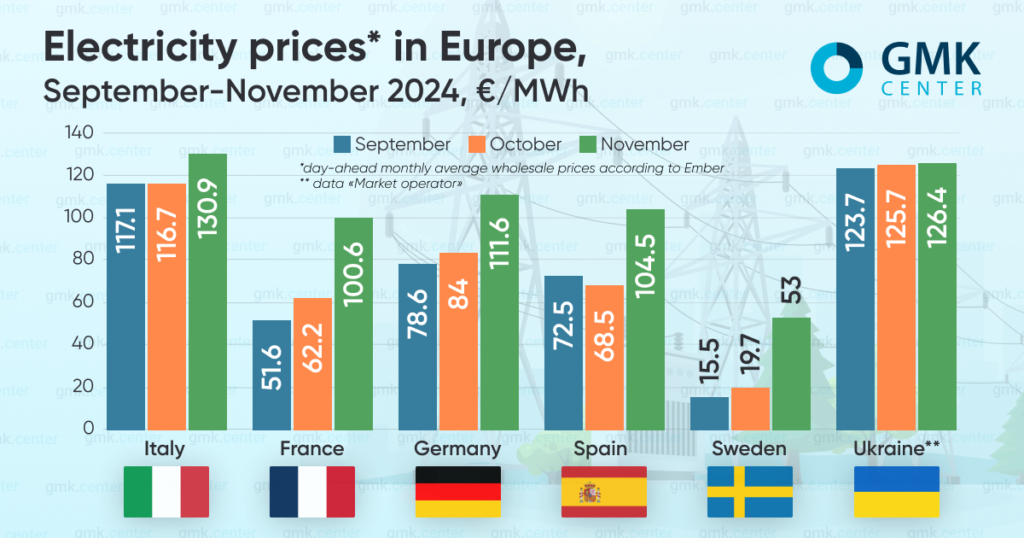

In the EU, average monthly wholesale day-ahead prices in November 2024 increased significantly compared to the previous month. The winter season started with colder temperatures, which led to an increase in demand. In addition, gas prices risen significantly during this period created tension in the continent’s energy market.

According to Ember, the prices were as follows:

- Italy – €130.93/MWh (+12.2% m/m);

- France – €100.55/MWh (+1.6 times);

- Germany – €111.61/MWh (+33%);

- Spain – €104.48/MWh (+1.5 times);

- Sweden – €53.04/MWh (+2.7 times).

November trends

According to AleaSoft Energy Forecasting, in November, monthly electricity prices in most major European electricity markets exceeded €100/MWh.For almost all of them, it has been the highest level, at least since May 2023.

The main factor was the rise in gas prices, which in November reached their highest average level since December 2023. Cold weather and a decline in renewable generation last month led to a 10% increase in the contract price for TTF. This coincided with a 15% year-on-year decline in LNG supplies. The increase in gas demand was met by withdrawing gas from storage facilities.

In addition, last month’s low temperatures in Europe increased demand for electricity, and carbon prices also rose.

According to the forecasts of The European Energy Exchange (EEX), as of December 6, the basic settlement price of electricity futures on the German market in January 2025 will be €110.88/MWh, on the French market – €133.35/MWh, on the Spanish market – €92.7/MWh, on the Italian market – €133.35/MWh.

Europe

The cost of energy is currently one of the central topics in discussions about Europe’s industrial future.

In particular, a number of anti-crisis initiatives for the EU’s steel sector presented to European policymakers in recent months by industry associations include this issue as one of the most pressing. The calls include ensuring competitive electricity prices in Europe, either through energy subsidies or by reducing other tariffs included in the price of electricity.

These proposals have a basis in fact. For example, in November, the average wholesale benchmark electricity prices in Germany, France, the Netherlands, Spain, and Poland, according to data collected by LSEG, rose to their highest levels in at least the last 20 months. This situation affects the industry in key economies.

Electricity consumption in Europe is likely to peak in the coming period due to increased seasonal demand, so the cost of electricity may continue to rise, creating new obstacles for the industrial sector.

The situation in Ukraine

In Ukraine, in November 2024, the weighted average purchase and sale price of electricity on the DAM, according to Market Operator, decreased by 1.6% compared to the previous month – to UAH 5567.45/MWh (€126.4/MWh at the average monthly exchange rate of hryvnia to euro). Demand for the DAM increased by 19.2% year-on-year in October, while supply increased by 15.56%.

According to D. Trading, Ukraine reduced electricity imports by 9% in November compared to the previous month, to 165 million kWh. The largest volumes were imported from Slovakia, followed by Poland and Hungary.

On November 13, for the first time since August 2024, NPC Ukrenergo introduced temporary restrictions for business and industrial consumers, arguing that this was due to a short-term decrease in the capacity of shunting generation and a significant reduction in imports.

On November 17 and 28, the Russians carried out another massive attack on the Ukrainian energy system, which seriously worsened the situation for all categories of consumers.

D. Trading analysts note that imports remained at a very low level until November 17. The capacity restrictions imposed on industry after that increased business demand for imported electricity. However, due to high prices in Europe, businesses did not use the quota to the maximum, so imports increased only to about 10 million kWh per day in the last decade of the month.

At the end of November, the Cabinet of Ministers lowered the threshold for electricity imports (from 80% to 60% of energy consumed by industrial facility) to guarantee absence of power outages for industrial consumers. Earlier, large industrial consumers had repeatedly called for a revision of this threshold. The Ministry of Energy noted that the decision was made taking into account the increase in capacity limits for electricity imports from Europe. In addition, it should further stimulate to increase commercial imports, allow the development of generation and ensure better resilience of the power system in the face of shortages.

Fullness of gas storages

According to the AGSI platform, European gas storage facilities were more than 85% full on average as of December 1, 2024, and 82.7% full as of December 6.

Due to the cold weather, Europe entered the winter with the lowest reserves in the last two years. In 2022 and 2023, European gas storage facilities were more than 90% full as of December 1. According to forecasts, this winter could be the coldest since Russia’s invasion of Ukraine.

European industrial enterprises, according to Reuters, are preparing for a new gas price increase in the coming months. The cold weather is leading to a faster decline in gas storage reserves, increased competition with Asia for LNG, and the prospect of reduced gas supplies from Russia.

In particular, concerns about the expiration of the Russian transit contract for supplies to Europe through Ukraine at the end of the year are contributing to the growth in gas demand. According to Francisco Blanche, head of commodities and derivatives research at Bank of America, this could lead to an increase in EU prices to €70/MWh in 2025 from almost €50/MWh now.

Analysts believe that the fact that the European Commission increased the target for filling storage facilities at the end of November could potentially increase pressure on prices. The EC has announced interim targets that the bloc countries must achieve next year for energy security. The target for February 1, 2025 is 50% compared to 45% set for February 2024.

On November 14, futures on the TTF hub in the Netherlands reached €45.3/MWh for the first time in a year. This happened amid a statement by Austrian gas trader OMV about a possible suspension of Russian gas supplies to the country after winning an arbitration dispute with a Gazprom subsidiary. On November 16, Gazprom stopped these supplies. However, the Austrian side reported that underground gas storage facilities were full and that alternative, non-Russian sources were available.

On November 21, the price of TTF futures jumped to €48.7/MWh due to another escalation of tensions in the Russian-Ukrainian war. On the same day, the US Treasury Department imposed sanctions on Gazprombank, making it virtually impossible for foreign buyers to pay for Russian gas. Although the Russian president later canceled the requirement to pay for gas exclusively through this financial institution, the EU is now calling on the United States to find ways to mitigate the consequences of this decision.

As for expectations, Goldman Sachs raised its TTF price forecast for 2025 to €40/MWh from €34/MWh earlier, justifying this by a colder than average start to winter and delays in the implementation of LNG projects. Under extreme scenarios (additional delays in LNG projects, higher demand in Asia, or colder weather), European gas prices, according to the bank’s analysts, could jump to €77/MWh. In 2026 and 2027, they are expected to fall to €36 and €24 per megawatt-hour, respectively.

At the same time, BMI Research in November maintained its forecast at €36/MWh for 2024 and €32/MWh for 2025. The company cited that market fundamentals point to stable revenues in the long term, and the election of Trump as US president opens up opportunities for a potential increase in LNG supplies.