Posts Global Market steel consumption 4249 02 January 2024

Next year we can expect looser monetary policy, reduced inflation and high uncertainty

In 2023, the global economy showed quite good growth rates due to improved consumption in China and relatively high economic activity in the US, to which analysts generally predicted a short-term recession last year. Nevertheless, the global economy was constrained by geopolitical conflicts, tighter monetary policy (higher interest rates, expensive loans), weakening global demand, etc. The risks affecting the global economy were the following.

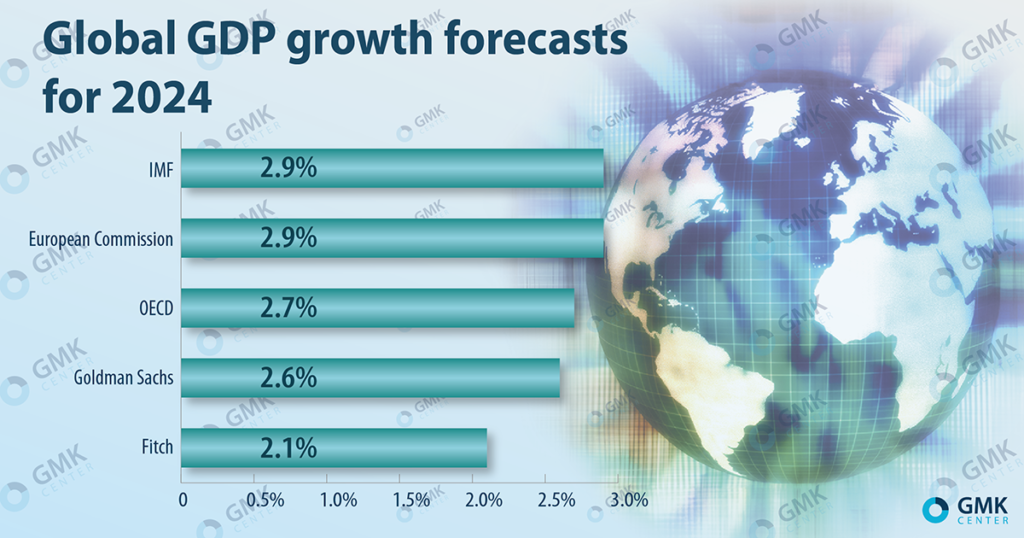

The risks affecting the global economy in 2023 remain relevant for 2024 – geopolitical instability, high interest rates and a significant level of uncertainty in general. In addition, other, as yet unknown factors remain in the “reserve”, which may manifest themselves throughout 2024 and have global consequences. Based on the currently existing facts and assumptions, analysts expect growth of the global economy in 2024 in the range of 2.1-2.9%.

Weak link

Europe cannot be considered a «shackle on the leg» of the global economy, but it is certainly not a driver. The European economy shows sufficient stability, but it has lost all its growth. The quarterly dynamics of the European economy balances on the minimum level. After growth in the second quarter of 2023 by 0.1% q/q, in the third quarter it declined by the same 0.1% q/q. However, much points to the fact that the eurozone will enter recession (decline for two consecutive quarters). The consensus forecast of analysts surveyed by Bloomberg indicates expectations that eurozone GDP will decline by 0.1% q/q in Q4.

High prices for goods and services as well as energy, slowing bank lending, weak export demand in 2023 limited economic activity in the eurozone. The downward trend is fully confirmed by the dynamics of industrial production, which, according to Eurostat, in the eurozone in October decreased by 0.7% compared to September and immediately by 6.6% compared to October-2022.

The key economy of Europe – Germany – is not formally in recession, but in the IV quarter it has all chances to enter it. Although in the II quarter the dynamics was zero, in the third quarter the German economy declined by 0.1% q/q. The German authorities expect a recession in the IV quarter and in 2023 – by 0.4%, the European Commission – by 0.3%. However, Germany will not be “alone” – the European Commission expects that in 10 European countries the economy will go into recession in 2023.

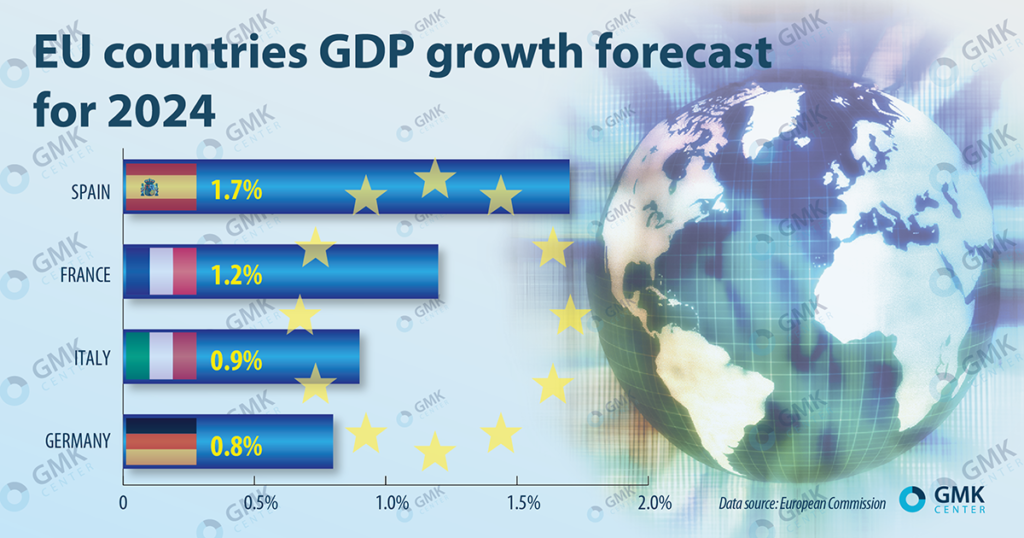

This situation led to the fact that at the end of last year the European Commission worsened the forecast of eurozone GDP growth in 2023 to 0.6% from 0.8%, and in 2024 – to 1.2% from 1.3%. The European Central Bank (ECB), which for a short time worsened its estimate of eurozone GDP growth in 2023 to 0.6% from 0.7%, and in 2024 – to 0.8% from 1%, is of the same opinion. The bulk of investment banks worse assess the prospects of the European economy in 2024 – expectations are on average in the range of 0.4-0.6%. Goldman Sachs has the most optimistic assessment – 0.9%, while “pessimists” from Citigroup expect a decline of 0.2%.

General estimates of the development of the European economy and its largest participants for 2024 are still in the positive zone. Although they underwent a downward correction in the fall.

One of the key problems for Europe remains inflation, the level of which in Europe, although it has decreased from its peak levels, remains relatively high. The European Commission expects the inflation rate in the eurozone (HICP index) to amount to 5.4% in 2023 and 2.7% in 2024. Until inflation in the eurozone reaches the target level of 2%, there will be no significant reduction in interest rates. At present, the ECB is not even discussing such a reduction.

“The EU is already experiencing deflation and a sharp slowdown in industrial production. The ECB is taking a tough stance, expecting a possible acceleration in inflation and believes the economy is strong. But we are seeing strong inertia. And the effect of high rates only started to affect industrial production a year after the rate hike cycle began. Similarly, the positive effect of easing credit policy will be seen with a certain lag. It is important to safely exit the current cycle of high rates without creating risks for a deeper recession. As of December, we see a surge of positive expectations in the eurozone, which may suggest that the economic and output slowdown will be short-lived and mild,” Andriy Tarasenko, chief analyst at GMK Center, says.

In addition, the energy balance remains very vulnerable. Currently, the energy situation in Europe is stable, but geopolitical tensions will constantly create new hotbeds of conflict and risk factors. It is possible that the energy factor will not put pressure on the European economy again in the future.

Asian factor

Developed countries have not been driving the global economy for a long time. The IMF estimates that developed economies will grow by 1.5% in 2023 and 1.4% in 2024, while developing countries will grow by 4% in both years.

Asian countries are expected to show high rates of development in 2024. Thus, the Asian Development Bank improved the forecast of economic growth in the emerging economies of the Asia-Pacific region in 2023 to 4.9% from 4.7%, in 2024 – left at 4.8%.

Analysts do not expect a rapid recovery of growth in the Chinese economy, its growth will slow down amid problems in the real estate sector and the fall in global demand. This will have consequences for the global economy and the entire region. At the same time, the PRC economy has the potential to recover after the removal of anticovoidal restrictions.

International institutional organizations have recently lowered their forecasts on the growth of the Chinese economy for 2024. Thus, the World Bank expects growth of 4.4%, rather than the previously announced 4.8%, the IMF – 4.2% (4.5%), the OECD – 4.7% (5.1%). Investment banks estimate the prospects for the PRC economy in 2024 in the average range of 4.4-4.8%. In 2022 the Chinese economy grew by 3%, although it had a growth target of 5-5.5%, which remains valid for 2024.

An important factor in assessing the nature and dynamics of the PRC economy is the policy of stimulating the economy by the Chinese authorities. Deflation in China also contributes to the growth of stimulation. Consumer prices have been falling since September, production prices – since August. For example, in November the consumer price index amounted to -0.5% y/y, the producer price index – -3% y/y.

In conditions of deflation in China there is room for active stimulation of the economy, but they are slowing down for some reason, apparently, so that their policy does not go in dissonance with the policies of other central banks. That is, the Chinese, unlike the rest of the world, now have the opportunity to introduce various stimulus programs,” Andriy Tarasenko notes.

At the moment, the Chinese authorities intend to prioritize the development of industry over the stimulation of domestic demand in their economic policy for 2024. However, the Chinese authorities also want to develop consumption, namely such areas as «smart homes», recreation, tourism and sporting events. In any case, the country’s economy will continue to be pressured by problems in the real estate segment.

World expectations

The current year promises to be little better than the previous one. The number of negative factors and global challenges is growing literally every month. Their emergence is almost impossible to predict, and the consequences of even regional events can have global implications.

The key risks and challenges for the global economy in 2024 include the following:

- Growing geopolitical tension and the number of armed conflicts (China – USA, China – Taiwan, Ukraine – Russia, Middle East).

- Possible slowdown in economic growth in China.

- Election campaign and results of the US presidential elections in November 2024.

- High discount rates and cost of loans (with the prospect of reduction).

- Maintaining a relatively high level of inflation.

- High debt burden in many countries of the world.

- Increasing division of the world economy into blocs.

- Declining business and consumer confidence in developed countries.

Among the specific risks of 2024, which became evident already at the end of 2023, we can name the blockage of shipping through the Suez Canal (through which about 12% of cargoes of all world trade passes) due to the threat of missile and UAV attacks on merchant ships by Yemeni Houthis. As a consequence, the world’s largest transportation companies MSC, Maersk, CMA CGM, etc. have already refused to pass through the Bab-el-Mandeb Strait (the southern entrance to the Red Sea) and are sending their ships around Africa. This will inevitably affect the cost of goods by increasing logistics costs and delivery time (additional 10-14 days). It will also hit Egypt’s economy hard due to a drop in revenues from ship passage by the Suez Canal. Certain hopes are pinned on measures to protect shipping, which can be taken by the US Navy and allied countries, but this may lead to deterioration of the situation in the region and direct armed clashes.

Analysts do not exclude that factors and hotbeds of tension may emerge in the world, which are not visible yet, but will manifest themselves later. The IMF believes that the most effective measure to improve global economic prospects is to stop the Russian Federation’s war against Ukraine.

As is usually the case with forecasts, closer to the beginning of the forecast period conservative assessments improve, and overly negative ones – improve, if, of course, there are grounds for this. Toward the end of last year, Fitch improved its forecast for global GDP growth in 2024 to 2.1% from 1.9%, while the European Commission worsened it to 2.9% from 3.2%. Analysts of investment banks on average estimate the prospects of the world economy in 2024 in the range of 2.4-2.8%. Citigroup has the most pessimistic assessment – growth of 1.9%.

In addition to Asian countries, the US will also help to support the growth of the global economy. Fitch has improved its forecast for US GDP growth to 1.2% from 0.3%. By the end of 2023, the US labor and housing markets have improved, even despite high interest rates, although inflation is still high.

For their part, Goldman Sachs analysts expect the global economy to beat expectations in 2024 – just as it did in 2023. At the beginning of 2023, analysts expected global economic growth in 2023 to be in the range of 1.4-2.7%. Refined forecasts at the end of the year show expectations for global GDP growth averaging between 2.9-3.1%.

Apart from geopolitics, the most key influence on the global economy will continue to be the monetary policy of central banks. At the end of 2023, global interest rates were still at high levels. The US Federal Reserve kept its key interest rate at 5.25-5.5%, while the ECB kept its benchmark lending rate at 4.5% and deposit rate at 4%. On the other hand, the long struggle of the central banks of Western countries with inflation should bear fruit. According to IMF estimates, in 2024 the world is waiting for a slowdown in global inflation to 5.8% from 6.9% in 2023. The Fed and the ECB want to bring inflation down to 2%.

And although in the short term regulators do not see the grounds for lowering rates, but by the middle of 2024, there may be prerequisites for easing monetary policy. Fitch analysts expect central banks to cut rates by 75 basis points (b. p.) by the end of 2024: the upper limit of the range of the Fed rate will fall to 4.75% per annum, the prime rate on ECB loans – to 3.75%. In turn, J.P. Morgan forecasts that the Fed will start cutting the rate by 25 bps starting from June-2024, and the ECB – from September (-25 bps).

Steel forecast

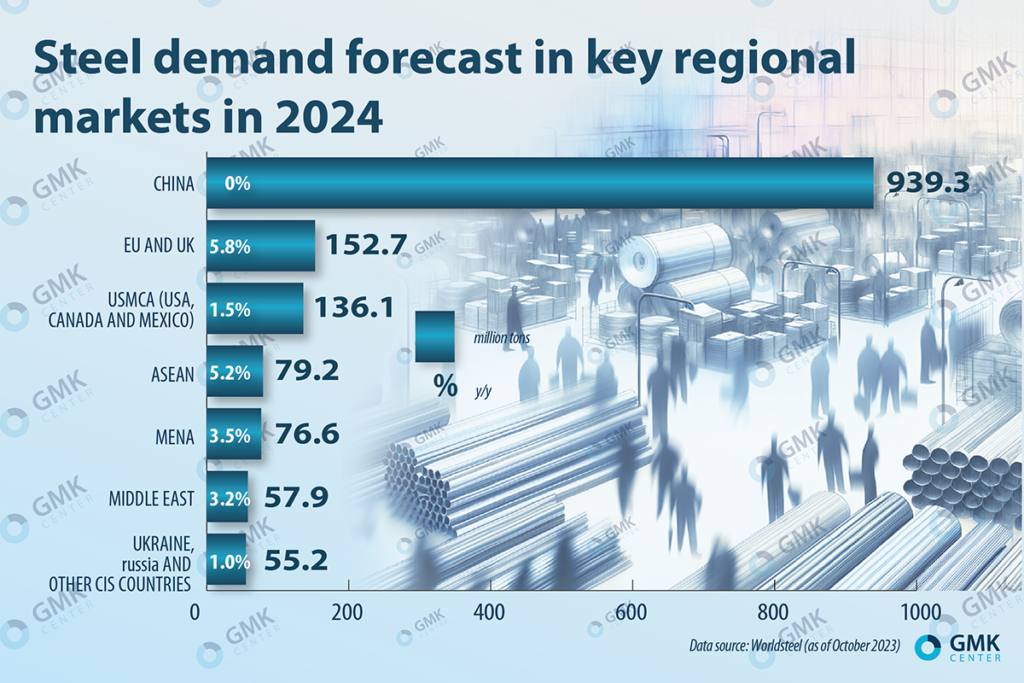

Global steel demand is highly dependent on business expectations and current business activity, which in turn is strongly influenced by high inflation and rising interest rates. The Worldsteel Association expects steel demand growth in 2024 to be low in developed countries and higher in emerging economies, especially in Asia, due to the effects of tight monetary policy. Fitch forecasts low single-digit steel demand growth in most regions, with the exception of China, where production and consumption are expected to decline modestly.

Global steel demand is expected to grow slightly this year. Worldsteel (as of October-2023) estimates that global steel demand will increase 1.9% to 1.849 billion tons in 2024, which in tons is slightly worse than April expectations that called for a 1.7% increase to 1.854 billion tons. In any case, that’s more than the association expects for 2023 – an increase of 1.8% to 1.814 billion tons.

For its part, the European steel association EUROFER expects visible steel consumption in the European Union to grow by 7.6% in 2024, although the previous forecast was for 6.2%. This will be supported by rising demand in the automotive, manufacturing and infrastructure construction sectors on the back of lower inflation and energy prices. However, demand dynamics will largely depend on the geopolitical situation and economic factors.

Global steel demand drivers in 2024 are expected to be manufacturing, automotive and infrastructure, especially related to the energy transition. At the same time, growth in construction will be restrained by high interest rates.

SteelMint estimates that we can expect these trends in the global steel industry in 2024:

- The upward trend in prices observed in December 2023 will continue in the first half of 2024, supported by lower production in China and rising domestic demand.

- Demand will remain stable in key sectors such as construction and infrastructure, although other areas may see some weakening due to the global economic slowdown.

- Global trade flows will remain volatile due to ongoing geopolitical tensions and protectionist policies.

According to Fitch, the main risks for the global metals industry include prolonged high interest rates if inflation persists in developed markets, high energy prices and a slowing Chinese economy.