Opinions Industry exchange rate 343 17 September 2019

The stronger the hryvnia gets, the higher losses Ukraine’s steel industry suffers

According to authoritative consulting agencies that make production cost curves, the cost of rolled steel production by key global producers does not drastically differ. This indicates a high level of competition between them. Besides, global demand for steel is weakening. Specifically, according to the World Steel Association, the global demand is expected to increase by only 1.3% in 2019 and by 1% in 2020.

Expectations for the main Ukrainian sales markets are even worse. The Association says that the EU markets will grow by only 0.3% in 2019, while those of the Middle East countries will shrink by 2.6%. In this situation, steel companies will seek any opportunity to cut primary cost and maintain the market share. Devaluation of national currencies of competing countries may be one of these opportunities.

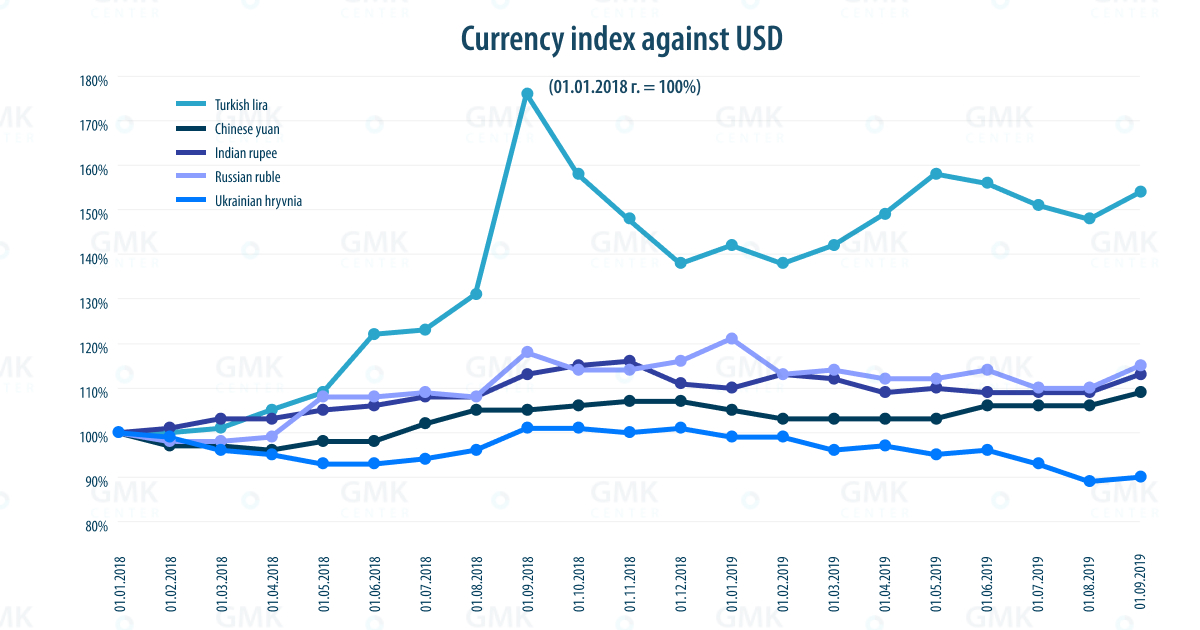

The extent of devaluation in competing countries

gmk.center

The Turkish lira devalued most strongly (by 9% since the beginning of 2019 and by 54.4% since the beginning of 2018). This is no surprise, because Turkey is facing an economic crisis. Steel production and domestic demand for steel products are steadily falling. In this situation, export sales are especially attractive for Turkish steel companies, and Turkey is Ukraine’s competitor in the markets of the Middle East and North Africa.

Conversely, the Russian ruble strengthened by 4.3% since the beginning of 2019 and dropped by 15.4% since the beginning of 2018. Ukrainian steelmakers compete with Russian producers in the same sales markets. And the devaluation of the ruble, though unstable, allows Russian companies to be more competitive.

The Chinese yuan dropped by 3.5% since the beginning of the year. The Indian rupee fell 2.8% over the same period. Chinese and Indian steel products are mainly represented in the Asian region, which is not among the key sales markets for Ukrainian steelmakers. However, being the key market players, China and India are price setters. Hence, the devaluation of the Chinese yuan and the Indian rupee is a global factor, which keeps pressure on world prices for steel products on the one hand, and weakens the market positions of competing countries on the other.

Implications for steel companies

The devaluation of national currencies gives advantages to exporting countries. And in case of revaluation of the hryvnia, our competitors get these advantages. First of all, devaluation gives exporters an additional inflow of local currency. This is important for steelmakers, since they pay their costs partly in the national currency. Consequently, they spend less in dollar terms. At the same time, financial results of companies are improving and additional resources for investment are being released.

In Turkey, devaluation helps neutralize a hike in producer prices: they rose by 7%, while the lira declined by 4.7% over the first seven months of 2019. Conversely, deflation in Russia (2% over the first seven months of 2019) partially offset the effect of revaluation (8.7%). In China, devaluation and deflation are going on in parallel (0.3% within January–July 2019), which reduces production costs on both sides.

In India, revaluation amounted to 1.5% in the seven months of 2019 and was accompanied by a 1.9 rise in producer prices (the similar situation was observed in Ukraine). Yet, by late August, the rupee rate weakened and as a result, devaluation is expected to exceed the inflation rate.

What about Ukraine?

In Ukraine, a rise in producer prices (by 2.4% within January–July 2019) has been accompanied by steady revaluation since February. This trend against the background of competing countries is very painful for Ukrainian steelmakers.

As a result of revaluation, coupled with an increase in domestic prices, expenses of Ukrainian companies are growing in dollar terms and thus the companies have less available cash. This complicates the servicing of debt obligations and the implementation of investment projects that are important for maintaining long-term competitiveness.

Furthermore, imports of steel products are increasing amid revaluation. Imports in 2018 increased by 9.2% in physical terms compared to the previous year. In the seven months of 2019, the volume of imports remained the same as in the previous year, but nevertheless was higher than two years ago. Moreover, imports consist of products that can be produced in Ukraine: rebar, wire rod and cold-rolled sheets. Needless to say, a growth in imports cannot be caused solely by the strengthening of the hryvnia. On the other hand, there is no denying that revaluation facilitates access of imported products to the domestic market.

Conclusions

Unfortunately, the Ukrainian domestic market cannot completely consume steel products of local producers. In this situation, it is especially important to remain competitive in export sales. Revaluation of the hryvnia however does not help increase exports, but impedes it through worsening the competitiveness of Ukrainian producers. The stronger the hryvnia gets, the higher losses Ukraine’s steel industry suffers.