The main part of the products is sent to the USA

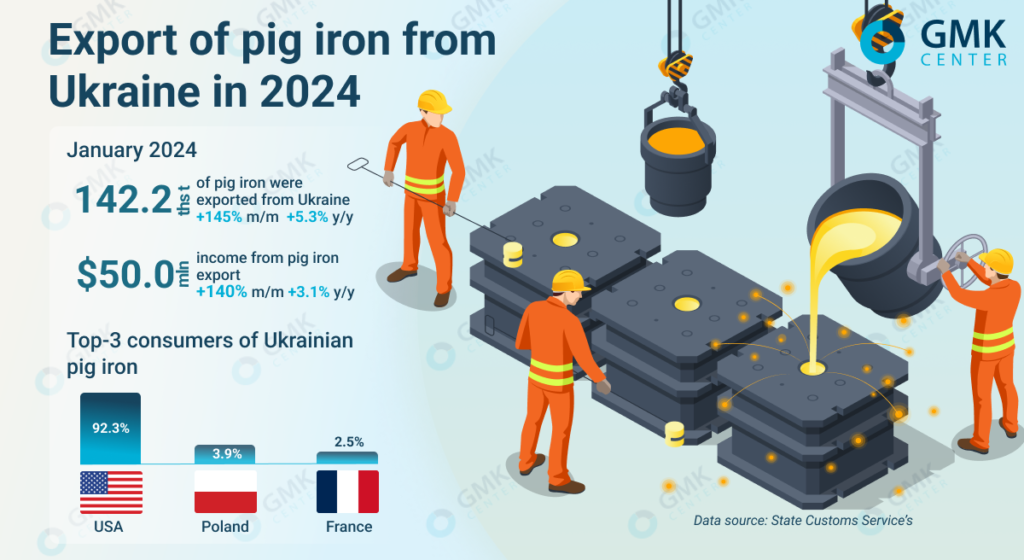

In January 2024, Ukrainian steelmaking companies increased pig iron exports by 2.4 times compared to the previous month, to 142.18 thousand tons. The figure increased by 5.3% compared to January 2023. This is evidenced by data from the State Customs Service.

Revenues of domestic steel enterprises from pig iron exports amounted to $50 million for the month, up 2.4 times compared to December 2023 and 3.1% compared to the same month last year.

The bulk of the products were exported to the United States – 92.3% in monetary terms. Another 4% of pig iron was exported to Poland and 2.5% to France. Thus, the United States returned to the top spot in terms of pig iron exports from Ukraine for the first time since the start of the full-scale invasion.

As GMK Center reported earlier, in 2023, Ukraine reduced pig iron exports by 5.8% compared to 2022, to 1.25 million tons. Compared to the pre-war year of 2021, pig iron shipments abroad decreased by 61.4%, or 1.99 million tons. Export revenues of domestic enterprises decreased by 26.2% y/y – to $471.5 million.

Poland was the largest consumer of Ukrainian pig iron in 2023, accounting for 51.9% in monetary terms. Spain accounted for 21.4% of export shipments and the United States for 13.1%.

Last year, Ukrainian steelmakers continued to operate amid limited logistics capabilities and unfavorable global market conditions. The main pig iron producers in Ukraine, Metinvest Group companies (Kametstal and Zaporizhstal) and ArcelorMittal Kryvyi Rih, operated at 65-75% and 20-30% capacity utilization, respectively.

Due to the inadequate operation of seaports, it is impossible to increase capacity utilization, but sales markets are gradually changing. Until recently, Ukrainian pig iron suppliers had to compete with Russian producers who offered discounts on their products in the EU market.

In the 12th package of sanctions, which was adopted at the end of 2023, the EU introduced new and expanded existing restrictions on Russian mining and metals products. In particular, the ban on imports of pig iron and mirror iron and direct reduced iron (DRI) from Russia was extended.

This decision was quite expected despite the resistance of steel lobbyists (consumers of Russian pig iron), the EU managed to approve the ban on pig iron imports on the fifth attempt. The new restrictions will ban imports of pig iron and DRI from January 1, 2026, and until then, quotas will be in place to reduce the volume of supplies.