Posts Infrastructure electricity 5682 13 September 2024

The situation in the energy sector largely depends on new missile attacks, weather and the dynamics of restoration of damaged energy facilities

For almost six months now, a new series of targeted Russian missile-drone attacks against Ukrainian energy facilities has been underway. During this time, the frequency, scale and objects of attacks changed – in spring it was HPP and TPP, and now – substations. All this creates a huge number of problems for the state, the population and business.

What is the current situation in the energy system and what awaits Ukrainian consumers in the future, GMK Center analyzed.

Pre-season situation

Between October 2022 and September 2024, Russia carried out more than 1 thousand attacks against Ukrainian energy infrastructure. The new large-scale wave of strikes that occurred in March-June resulted in the loss of more than 9 GW of manoeuvring capacity (TPP and HPP) and, as a result, electricity shortages and large-scale outages.

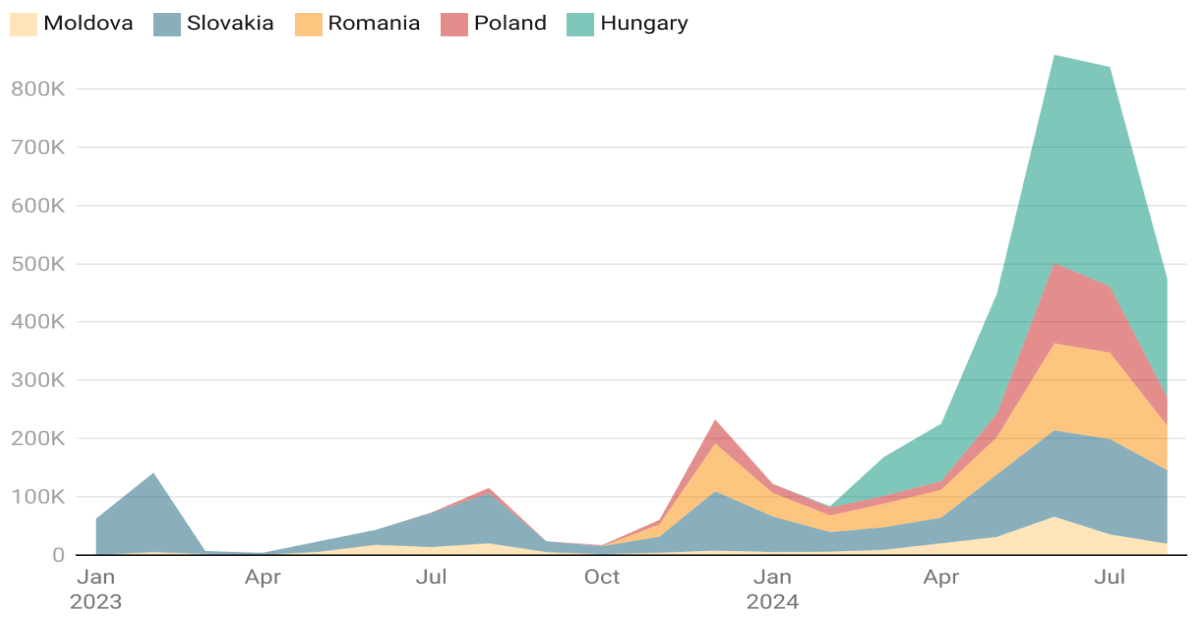

The shortage of own capacity had to be covered by an increase in electricity imports to 1.7 GW of capacity at individual hours, which, however, has already decreased after its peak in June. According to ExPro Electricity, in July, Ukraine reduced its electricity imports by 2% compared with June – to 837.8 thousand MWh. In August – already 43% m/m, up to 474 thousand MWh. Ukraine is in dialogue with European partners on the expansion of electricity imports from 1.7 to 2.2 GW.

Electricity imports to Ukraine in 2023-2024, MWh

Source: ExPro Electricity

The situation in the energy system was stabilized only at the end of July as the heat subsided and several nuclear power units were taken out of repairs. This allowed Ukrenergo to say that the most difficult period in the energy system was behind us and that consumers could go through September-October with minimal restrictions. Due to the surplus of power in the energy system, Ukraine even planned to resume electricity exports to Europe from August 25, which had not been carried out since mid-May.

However, already on August 26, a missile attack negated some of the efforts to stabilize the operation of the energy system. During the attack, missiles with a cluster warhead were used against substations that provide power output from the nuclear power plant, which increased the area of destruction. As a result, four nuclear power plant units were disconnected from the grid. As we can see, from “victory” to “betrayal” – just a day and several missiles.

Industrial energy

The sharp increase in the electricity deficit quickly affected economic activity. According to a survey by the Institute for Economic Research and Policy Consulting (IER), 52% of industrial enterprises in Ukraine suspended operations in May due to power shortages. In June-July, power outages took first place among obstacles for industrial business, exceeding the importance of war risks and rising prices for raw materials and goods.

The power shortage is affecting the production plans of enterprises, as manufacturers are afraid to take on new orders simply because of doubts about the ability to produce products. According to the IER, in July, Ukrainian companies worsened their half-year expectations and sharply slowed the pace of recovery amid problems with electricity.

The problem for enterprises that are not critically important sectors of the economy is that they themselves must take care of the stability of their power supply. Workers are left with only two options:

- Import of at least 80% of electricity from the total consumption to guarantee power supply without outages. The purchase of expensive imported electricity increases the overall energy costs of enterprises, which makes the products of Ukrainian manufacturers less competitive.

- Launch of own generation. This will require significant investments in the purchase and installation of gas generating units and, on average, six months for launch.

To stimulate the second direction, the Cabinet of Ministers exempted energy equipment from import duties and VAT, launched preferential lending programs for the development of distributed generation, and also adopted a rule that industrial consumers using at least 80% of their own electricity will not have their power supply disconnected.

In general, the situation with the functioning of businesses in the conditions of power outages does not look very optimistic. According to a survey by Advanter Group (July 2024), only 17% of enterprises are ready for power supply restrictions, and another 40% are preparing. At the same time, by the end of the year, it will be possible to launch no more than a quarter of the planned volume of up to 1 GW of distributed capacities, the construction plan of which was announced by President Volodymyr Zelenskyy. However, already in 2025, a sharp increase in the launch of gas-generating capacities can be expected.

Steel readiness

Companies in the iron and steel complex of Ukraine have already accumulated sufficient experience of working in the most difficult military conditions, including during power outages. Therefore, preparation for winter is already planned, not emergency.

«We understand all the risks of possible blackouts and are taking a number of measures to mitigate this threat. For example, like a year or two ago, the process of creating reserves of semi-finished products – steel blanks for the operation of capacities for the production of pipes and railway products – began in the summer,» says Vasyl Goncharuk, Director of Dneprostal-Energo, which is part of the Interpipe Group.

Enterprises in the industry use two existing options for ensuring a stable power supply for production processes.

- Electricity import. Since June, enterprises have been forced to switch to imported electricity, although they are significantly overpaying both for the cost of electricity and for the crossing fee.

- Construction of own generation. Metinvest has contracted more than 30 MW of gas turbine stations for a total cost of $36 million, which should be installed at enterprises in November. Also, 50 MW of generation has already been installed for emergency cases – to stop the capacity in the event of a sudden cessation of power supply.

At the same time, creating your own generation is a rather long and expensive option. For example, Metinvest enterprises consume more than 550 MW, which will require an investment of more than $500 million. Therefore, the option of building distributed generation is rather additional, the main bet is still on centralized energy supply.

At the same time, companies in the industry are taking measures to reduce energy consumption and improve energy efficiency. Thus, Interpipe is carrying out the following internal activities:

- Interpipe Steel uses such operating modes of the arc furnace that allow saving electricity consumption per hour;

- at all enterprises, the schedule of scheduled repairs has been adjusted so that they are carried out during peak hours, when electricity is the most expensive;

- at all enterprises, modified operating schedules are used for the most energy-intensive production areas.

Situation forecast

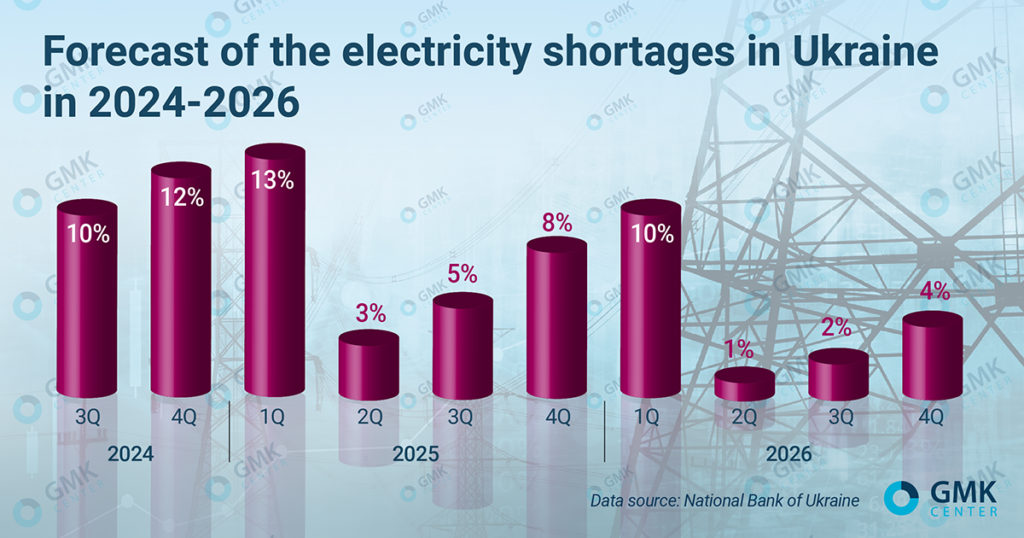

After the shelling of shunting generation, the National Bank worsened the forecast for the electricity deficit for 2024-2026. In particular, the deficit estimate in the third quarter of 2024 has been worsened from 6.5% to 10%, in the fourth quarter – from 7% to 12%, in the first quarter of 2025 – from 7% to 13%.

The situation with energy supply and the size of the power deficit in the energy system in the autumn-winter period of 2024-2025 depend on new missile attacks and possible damage to the energy infrastructure, weather and the dynamics of restoration of previously damaged energy facilities. Given the high risks of repeated shelling, no one can predict with high accuracy what the situation will be in winter.

Power engineers built a repair campaign so that all 9 nuclear power units would operate during the autumn-winter period, so that about 7.5 GW of capacity would be in operation. In turn, DTEK planned to return 60-70% of thermal generation to operation by October, which was before the start of massive shelling in March. The main condition is the absence of new shelling.

In industry, the stability of energy supply will depend not only on the above factors, but also on the willingness of businesses to overpay for imported electricity and/or invest in their own generating capacities.

In any case, the current heating season is unlikely to be significantly easier than the winter of 2022-2023, when there was the first wave of attacks on energy infrastructure and power outages. Even if the electricity deficit in the Ukrainian energy system is small in the fall, it will increase in the winter.