Posts Industry titanium industry 9452 02 February 2023

The situation on the market of Ukrainian titanium assets is unstable and attracts increased attention

The military aggression of the Russian Federation against Ukraine also affected the titanium industry, in particular, the mining of titanium ores and the production of titanium products. Last year, the export volume of titanium ores decreased by more than 40%. In addition, the sanctions policy and the return to state ownership of titanium assets can lead to a redistribution of the market.

Titanfall

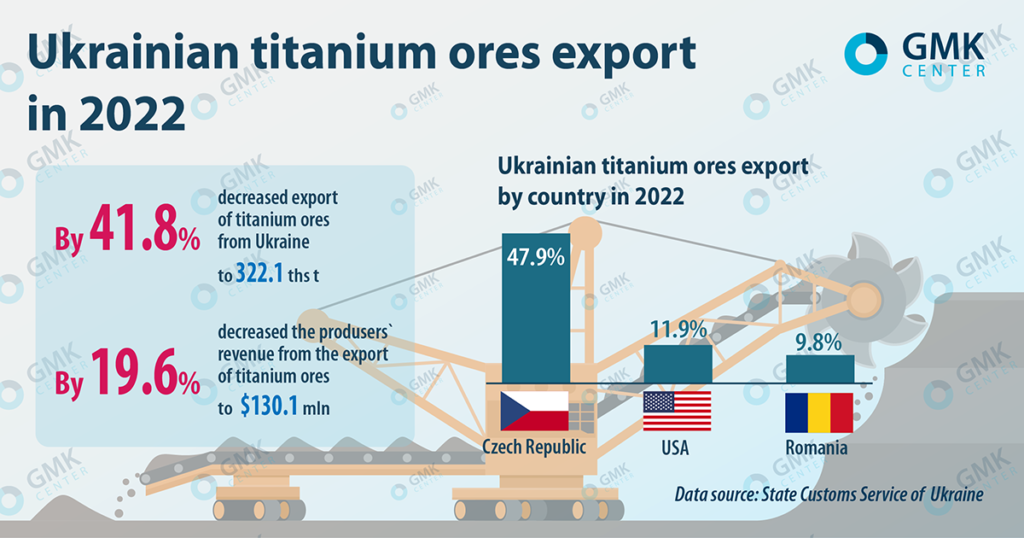

In 2022, the export of titanium ores from Ukraine decreased by 41.8% y/y in 2022 – to 322.1 thousand tons. At the same time, the revenue of exporters decreased by 19.6% y/y – to $130.1 million. In 2021, Ukraine increased exports by 3% y/y – up to 553,000 tons worth $161.9 million (+17% y/y).

According to the US Geological Survey, in 2021, Ukrainian ilmenite accounted for about 5% of the world production of ores used for the production of titanium.

Export of titanium ores from Ukraine in 2022

The main export destinations were the Czech Republic (47.9% of deliveries in monetary terms), the USA (11.9%) and Romania (9.7%). The distribution of exports by country differs significantly from 2021, when export deliveries of titanium ores were made to Mexico (21.2%), China (18.2%) and the Czech Republic (14.1%).

Market under conditions of war

The main producers on the titanium market of Ukraine remain:

- Zaporizhzhia Titanium-Magnesium Plant (ZTMK; produces titanium sponge);

- Sumikhimprom (produces titanium dioxide);

- Velta (stopped the construction of a titanium plant in Novomoskovsk, Dnipropetrovsk regions and worked on the relocation of its facilities to a safer place).

Titanium ores in Ukraine are mined by:

- United Mining and Chemical Company (UMCC; Vilnohorsk and Irshansky Minings);

- Mizhrichensky Mining;

- Valky-Ilmenit LLC;

- Velta.

Some of the industry’s enterprises were affected by hostilities, but the nature of the damage is not reported, and enterprises do not share information about their activity during hostilities.

The war significantly affected the work of enterprises in the titanium industry. At the same time, companies are in no hurry to disclose their production figures, but according to market estimates, they have significantly decreased.

In the first half of 2022, the titanium business enterprises of Group DF (which includes Mizhrichensky Mining, Valky-Ilmenit LLC and Motronivskyi Mining) mined 1.07 million cubic meters of ilmenite ore (-25% compared to the same period in 2021) and produced 62 thousand tons of ilmenite concentrate (-5.7%).

UMCC reduced production during the war and changed logistics – the company arranged for the shipment of ilmenite ore through ports in Romania and Poland.

Velta company was operating at only 50% of its capacity due to a decrease in the volume of electricity supplies.

Market segmentation

Redistribution of ownership is possible in the Ukrainian titanium market. Last year in May, the court confirmed the return of ZTMK to state ownership. ZTMK and UMCC even under martial law can be exhibited for sale as part of the great privatization. However, it is doubtful that such privatization auctions will be effective before the end of hostilities. It is obvious that the state is not determined to create its own vertically integrated closed cycle of titanium production, which was actively discussed before the war.

Ukraine confiscated 100% of the authorized capital of VSMPO Titan Ukraine LLC (produces titanium pipes), whose corporate rights were transferred to ATMA.

At the same time, the court did not allow the Ministry of Justice to confiscate Demurinsk Mining. On the eve of Russia’s invasion of Ukraine, Russian titanium producer VSMPO-Avisma sold its shares in Demurinsk Mining. The fate of these assets has not yet been determined.

The fate of the Velta company, which was put up for sale last year due to bank loan debts, is still unclear. However, the auction on August 1, 2022, did not take place due to the lack of participants.

Reserves of titanium ores

According to Ukrainian legislation, information on titanium ore reserves is a state secret. At the same time, the State Geological Survey of the USA estimates them at 8.4 million tons: ilmenite – 5.9 million tons, rutile – 2.5 million tons. This is 1.12% of world reserves. Instead, UMCC noted, that Ukraine has about 20% of the recorded global reserves of titanium ores. According to the company, the total volume of balance reserves of titanium ores as of January 1, 2022, was 40.2 million cubic meters. The volume of conditionally on-balance sheet and off-balance sheet reserves of titanium ores was 81.15 million cubic meters.

According to the EY company’s report, 78 deposits of various levels of study were discovered in Ukraine. However, in fact, the mineral and raw material base of titanium in Ukraine is represented by approximately 40 deposits, including one unique, 13 large and 10 medium deposits. Currently, titanium ores are mined in Ukraine only from placer deposits, which make up about 10% of all explored reserves.

“The main resources of titanium ores are concentrated in native deposits. They can be enough for a long period of time of titanium ore mining enterprises’ operation. But there is a problem in the shortage of ores with fresh ilmenite, the reserves of which in Ukraine are mostly associated with the large Stremyhorodsky and the smaller Fedorivsky native deposits. The main problem with the development of these deposits is that their exploitation requires the involvement of significant capital investments: for the construction of new mines and processing plants,” the EY report emphasizes.

Titanium attractiveness

The military aggression of the Russian Federation against Ukraine changed the situation on the world titanium market as well. Russia, in the person of VSMPO-Avisma, lost two of the largest consumers of titanium products – Airbus and Boeing.

Airbus is trying to find alternative suppliers and will stop supplying titanium from Russia for several months. Boeing suspended the purchase of titanium from the Russian Federation at the beginning of the war. Previously, the American corporation covered up to a third of its needs at the expense of Russian titanium. At the same time, the European Union recently excluded VSMPO-Avisma from the seventh package of sanctions.

UMCC said, that the USA can invest in the development of our titanium industry, and Ukrainian products can be a replacement for Russian products that have fallen out. UMCC has already concluded a direct agreement on the supply of 80,000 tons of ilmenite concentrate from the American company The Chemours. In turn, Velta received a license to export ilmenite concentrate to the USA in the summer 2022.

The war forced a postponement strategic plans development of the Ukrainian titanium industry until the best times. However, despite the hostilities, Ukrainian titanium assets remain attractive for investment. Ukraine is one of the seven countries that produce titanium sponge, the basis of metallic titanium. Also, Ukraine occupies a leading position in the world in the production and reserves of ilmenite ores.