Posts Global Market iron ore 2377 06 July 2022

Diversification of supplies is required due to expected export cut from Ukraine

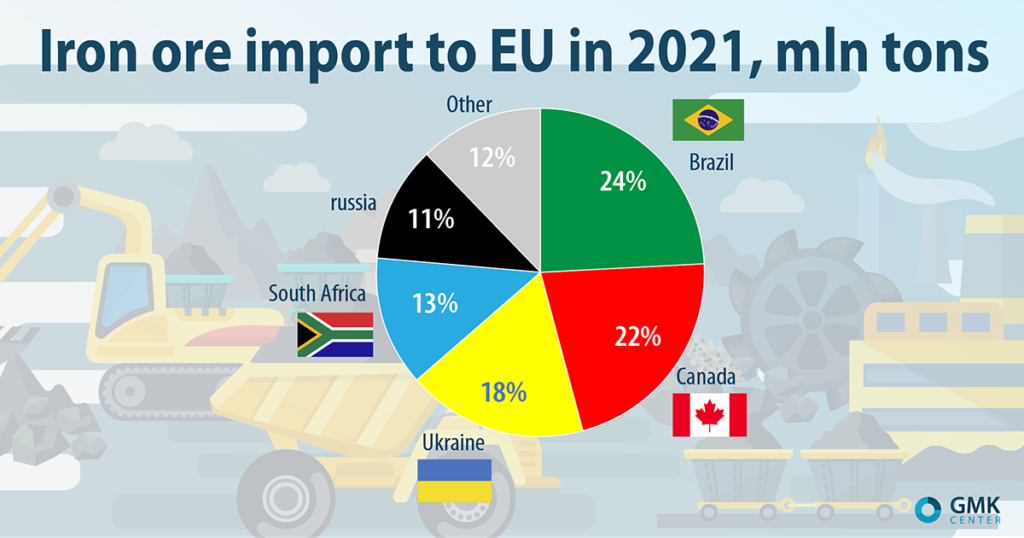

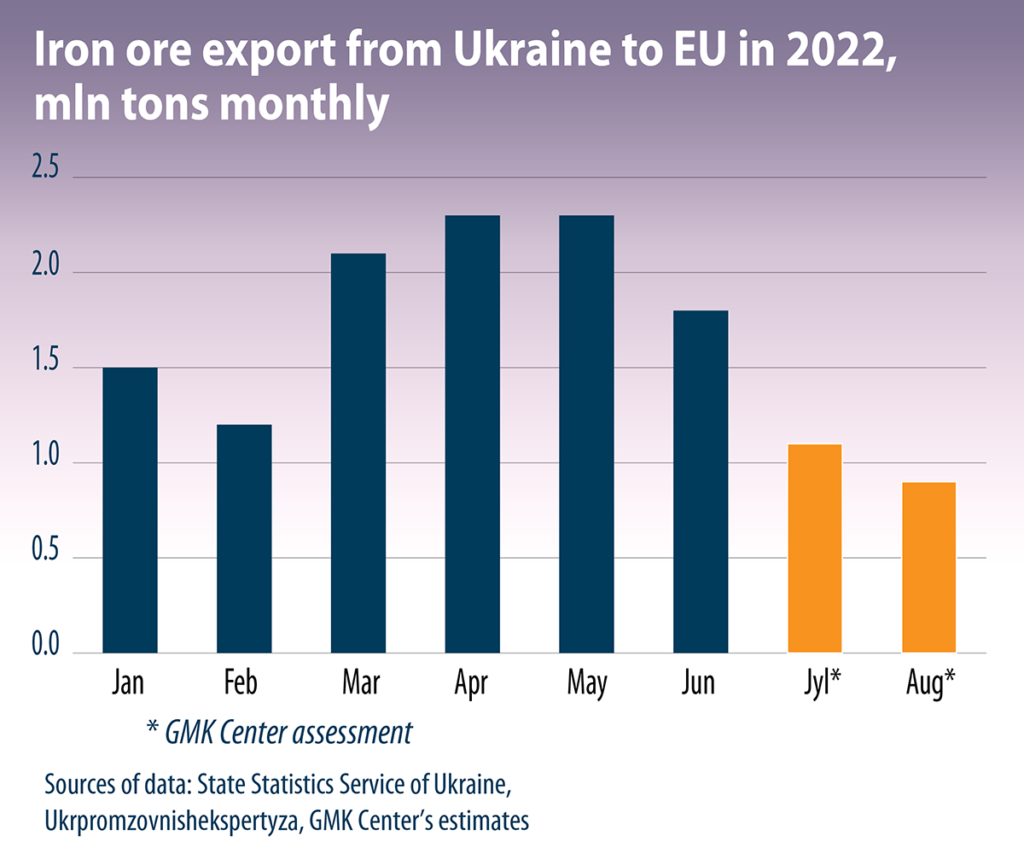

Ukraine became the largest supplier of iron ore to the EU in March, replacing the supply of Russian products. Traditional Ukrainian monthly sales to the EU on the level of 1.4-1.5 million tons increased to 2.1-2.3 million tons, and the share of Ukrainian companies on the European market reached 30%.

Such cooperation was extremely important for both sides. In this way the EU market kept itself in balance, after the loss of Russian iron ore. At the same time, Europe has become the only possible direction for Ukrainian producers when the Black Sea ports are blocked.

The Ukrainian iron ore sector achieved utilization of 50% due to the growth of shipments to EU. It seemed that the first months of the war had passed, and the main difficulties gone with them. Suddenly, logistical problems and the market factor came to the fore. The volume of iron ore export decreased by 23% in June. But it was only the beginning. A number of iron ore facilities in Ukraine have announced a suspension of their operations. And the EU market has lost it`s largest supplier.

What happened and why

Last week, Metinvest Group announced the suspension of operations at three of it`s iron ore plants due to congestion in the railway infrastructure, rising transportation costs, hike in energy prices and falling prices on the global markets. The stopped South and Inguletsky Mining and Processing Plants supplied iron ore concentrate to the EU, and the Northern Mining and Processing Plant – iron ore pellets. Other local producers have not yet announced their plans for the summer. But it is obvious that everyone will reduce output and export volumes.

Indeed, the global iron ore market showed a sharp reversal in June. If at the beginning of June prices in China reached $145 per ton, then at the end of the month – $116. Among the reasons for the decline are the slowdown in the Chinese economy and the impending recession in developed countries. Fitch forecasts an average iron ore price in China this year at $130 per tonne. The average price in the first half of the year was just over $140. In other words, the second half of the year will not be as successful, with an average price of $120.

This price level that became critical for Ukrainian producers, who were moved to the tail of the cost curve by the war, local regulatory policies and a strong hryvnia. Other sources give similar estimates. Goldman Sachs assessed the average price in the second half of 2022 at $110, Department of Industry, Innovation and Science of Australia – $114.

This situation appears to be long term. Fitch forecasts global iron ore supply growth at 2.7% in 2022-2026, outpacing steel output growth. It will be a factor of long-term pressure on iron ore prices given the advancement of EAF technology.

Difficulties in logistics were key in the decision to reduce iron ore output. Transport problems have been discussed for a long time, but only in recent months have they fully manifested themselves and posed a threat to grain exports. Significant volumes of cargos turned towards the EU, for which neither Ukrainian nor European infrastructure was ready. About 42,000 wagons lined up at the border. The national Ukrainian railway operator released direct ban on the export of certain types of goods through certain border crossings.

Later it became known that the tariffs for freight rail transportation in Ukraine raised by 70% from July 1st. This will prevent the restoration of supply even if the market situation improves. Therefore, GMK Center assess possible iron ore exports volumes to the EU to 0.9-1.0 million tons in recent months. These volumes are two times lower than this spring and 50% lower than traditional volumes. Now European steel producers face the issue of replacing the lost Ukrainian iron ore.

Challenges for the EU market

The decline in iron ore supplies from Ukraine means the need to adapt supply chains for European companies, as it could be a long-term trend. We are talking about more than a million tons per month, or about 10% of the market. Who can give such a volume today? Fitch points to the possibility of an increase in supplies from Brazil, where an annual increase in deliveries of around 10 million tons is expected. Goldman Sachs estimated that there is 35 million tons surplus of iron ore supply on the global market due to the slowdown in demand in China. But it is worth contracting the missing volumes right now, since delivery times from Brazil to Europe can reach two months, while from Ukraine before the war – 8-14 days. However, these calculations are irrespective of the types of products.

Ukraine has been a reliable supplier of EU steel plants for decades. Some European facilities were built for Ukrainian iron ore. For example, iron and steel plants in Romania, Slovakia, the Czech Republic, Poland use Ukrainian sintering ore for their sinter plants. Deteriorating market conditions and expensive logistics will primarily hit the supply of sintering ore, as a low value-added product. For example, the price of sinter ore in Europe reaches $70-80 per ton, while concentrate is $20-30 expensive. Also, all plants that exported iron ore concentrate were stopped. It will be extremely difficult to find a source of similar quality products.

The supply of pellets will also be reduced. Positions will be retained only by products with an iron content above Fe65%. For a long time, Ukrainian manufacturers have relied on high-quality products. However, everything will depend on the price situation.

It`s likely that iron ore will now be more expensive for European steelmakers. Firstly, due to more expensive logistics, and secondly, possibly cheaper sintering ore will have to be replaced with concentrate on sinter plants or higher share of pellets in BF feed. It is unlikely that the increase in costs will be passed on to the buyer in the current conditions of falling demand on the market. This will reduce the margins of European steelmakers, that are under pressure from high energy prices.