Posts Global Market rebar 141 09 July 2025

In Turkey and Italy, prices fell to their lowest levels in 2025, while in the US, growth was recorded

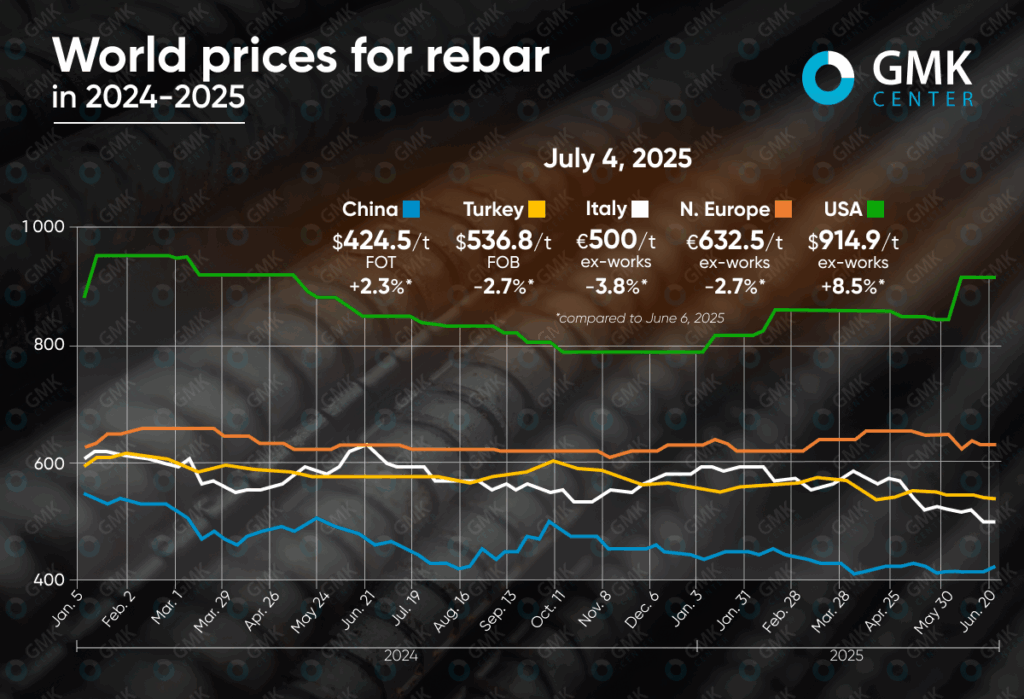

At the beginning of July, the global rebar market is showing mixed dynamics. Turkey recorded its lowest prices since the beginning of the year due to weak demand and export problems. Europe is experiencing a seasonal lull. In contrast, the US is seeing price growth due to new trade barriers, while the Chinese market is fluctuating between expectations of production restrictions and low demand.

Turkey

Reinforcing steel prices in Turkey stabilized in early July, with a slight downward adjustment. As of July 4, 2025, offers stood at $536.8/t FOB, down 0.5% from the previous week and 1.5% from early June prices. Turkish rebar is currently being offered at its lowest prices since the beginning of the year, and prices are expected to decline further this week.

Throughout June and early July, the market was pressured by weak demand, seasonal factors, and the exhaustion of export quotas to the EU. After the holiday period, activity in the domestic market remained low due to high interest rates and financial difficulties among traders. Although the euro exchange rate strengthened the position of Turkish products in Europe, demand there remained subdued, and since July 1, exports to the EU have been subject to duties due to exceeding quotas.

At the same time, Turkey faced fierce competition from China in foreign markets, especially in Latin America. The African market virtually froze, and purchasing activity in the Balkans and the Middle East was limited. Despite the rise in energy prices, particularly gas, factories were forced to lower domestic prices to $525-540/t ex-works.

Given the weak demand dynamics and high cost of raw materials (scrap remained at $335-340/t CFR), most market participants believe that prices are close to bottoming out. However, short-term growth is unlikely without changes in the macroeconomic situation, a reduction in interest rates, or stabilization of the situation in export markets. Further pressure on prices is expected in July, especially if no new export channels are opened.

EU

In the EU, rebar prices were stable at the beginning of the month – €632.5/t ex-works in Northern Europe and €500/t ex-works in Italy – which is in line with the previous week’s level. At the same time, compared to the beginning of June, offers lost 2.7% and 3.8%, respectively. Italian producers lowered their prices to the lowest level this year.

Prices in June-July were influenced by weakening demand, seasonal factors, and competition from cheaper imports. In France and Germany, buyers reduced their purchases due to uncertainty and low margins. In Italy, activity remained only in public infrastructure projects, while private construction almost came to a standstill. Additional pressure came from lower scrap prices and excess inventories built up in the spring.

In July, market activity is expected to decline due to the holiday season, especially in France and Germany. Despite isolated attempts by producers to raise prices, the market remains weak, and no significant changes are expected by the end of August.

United States

Rebar prices in the US rose by 8.5% compared to June, to $914.9/t ex-works. At the same time, prices remained stable compared to the previous week.

The price increase in June was caused by several factors. Leading producers – Nucor, Steel Dynamics, Gerdau, and CMC – almost simultaneously announced an increase in base prices by $60/t, and some additionally increased the cost of 20-foot bars by another $40. These changes took place against the backdrop of the Trump administration’s decision to double import duties on steel to 50%, which significantly weakened the position of foreign suppliers. In addition, importers from Vietnam, Algeria, Bulgaria, and Egypt are currently subject to anti-dumping and countervailing investigations, creating additional uncertainty in the market.

Despite limited competition from imports, demand for rebar in the US remains subdued. Commercial and residential construction are particularly weak, while infrastructure projects are relatively stable. The market is expected to pick up in the medium term thanks to large government investments, but price dynamics will remain cautious in July due to low economic activity and high borrowing costs.

China

The Chinese rebar market saw a 2.1% increase in early July compared to the previous week, reaching $424.5/t FOT. Compared to early June, prices rose by 2.3%.

The price increase was supported by news of possible production restrictions and expectations of new policy decisions after the Politburo meeting. However, the market remained volatile: despite stable blast furnace output, demand remained weak due to the seasonal slowdown, rains in the south of the country, and heat in the north. Manufacturers are increasingly stopping rebar production, switching to more profitable billets or special steels. At the same time, activity in export markets is declining: the lack of new deals and pressure from dumping prices are reducing profitability.

Despite short-term growth, the market remains under the influence of weak fundamentals. A slight price pullback is possible in the coming weeks if the expected production restrictions are not implemented and demand continues to decline.