Posts Global Market hot-rolled prices 6532 26 March 2024

European distributors refrain from new purchases

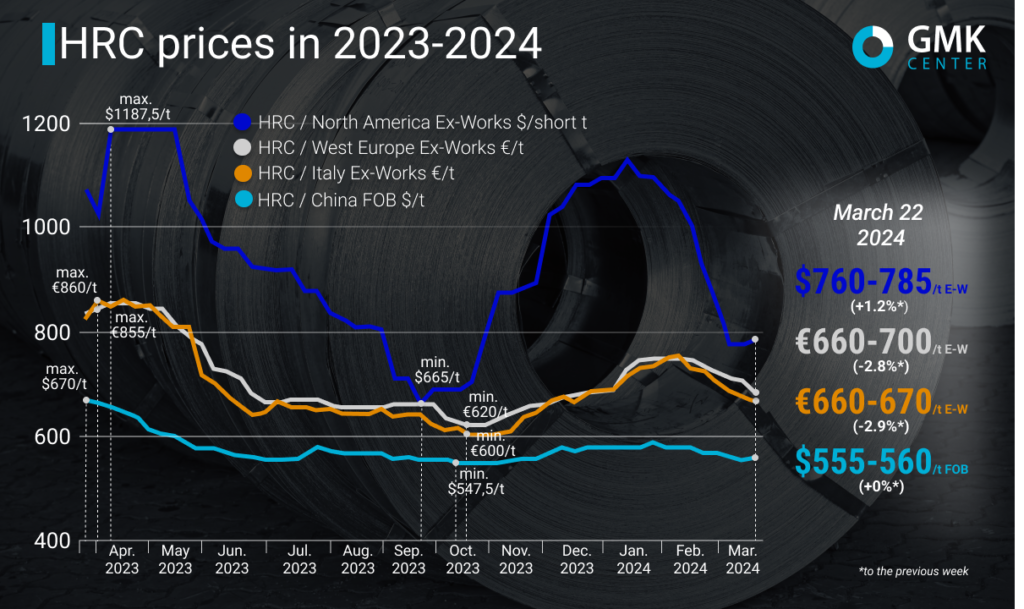

Global hot-rolled steel prices are adjusting after a sharp rise in late 2023 and early 2024. The slowdown in demand for products has kept the downward price trend in major global markets for about 2 months. The North American market suffered the biggest losses. Since the beginning of the year, prices for hot-rolled sheets in the region have fallen by 27%, or $300/ton. At the same time, the Chinese market seems to have hit rock bottom in mid-March.

Hot rolled steel prices in Western Europe for the period March 15-22, 2024, decreased by 2.8% compared to the previous week – to €660-700/t Ex-Works. Since the beginning of March, product quotations have fallen by €30/t, or 4.1%, and remained at the same level compared to the beginning of the year, although in January the peak price for hot-rolled plates in this region reached €760/t.

The situation in the Italian market is similar. During March 15-22, prices for hot-rolled sheets fell by €20/t, or 2.9%, compared to the previous week – to €660-670/t. Since the beginning of March, prices have fallen by €40/t, or 5.6%, and since the beginning of the year they have remained at the same level. At the same time, prices also peaked in January at €760/t.

In January, prices for hot-rolled steel in the EU were supported by a low supply of locally produced products and the exhaustion of import quotas. As demand increased and production capacity was limited, some producers were able to raise their target price levels, including ArcelorMittal, but this trend could not be sustained over the long term, so prices gradually declined in early February. Real demand did not support the mills’ intentions to raise prices to €800/t.

In February, hot-rolled coil prices in the EU continued to be under pressure from weak demand. Steel distributors reported that they were unable to pass on the January price increase to the end consumer, so they will refrain from purchasing new shipments.

With no prospects for a recovery in demand, consumers of hot-rolled sheets are buying only small quantities of products. In addition, disappointing expectations are contributing to increased interest in imported products despite long delivery times, as rolled products from India, Taiwan and Japan are offered at €600-610/t for delivery in June.

There is currently no driving force in Europe that would stimulate demand for hot-rolled sheets, so prices are expected to continue to decline. The working price level is estimated at less than €650/t for April delivery. At the same time, import suppliers are ready to reduce prices to €580-600/t with a view to €550-560/t.

Currently, re-rollers are the only buyers of products, particularly in the import market. Service centers continue to reduce inventories and buy only limited tonnages of hot-rolled steel.

In the North American region, prices for hot rolled coils increased by $10/t, or 1.2%, over the period March 15-22, 2024, to $760-810/t Ex-Works. At the same time, since the beginning of March, prices have fallen by $90/t, or 10%, and since the beginning of the year – by $300/t, or 27%.

North American rolled steel prices also showed a slight increase at the beginning of the year, supporting the trend of the end of 2023, but prices have been gradually falling since the second decade of January. Consumers refrained from purchasing amid a lack of demand prospects and expected prices to bottom out. Prices adjusted after reaching high levels in December.

Last week, HRC prices did rise after a long decline, which means that the bottom has been reached. This was mainly due to the setting of minimum price targets by some steelmakers, including Cleveland-Cliffs and Nucor. The mills are trying to convince market participants that there will be no lower levels and that further refraining from purchases will not work. At the same time, the market conditions remained the same as before, and it became more difficult to conclude deals.

In the short term, US rolled steel prices are likely to stabilize in anticipation of a recovery in demand. In addition, mills may resort to production cuts to reduce supply and revive consumer interest in replenishing stocks as soon as possible.

In China, prices for hot-rolled plates remained unchanged last week at $555-560/ton FOB. Since the beginning of March, they have fallen by $10/t, or 1.7%, and since the beginning of the year – by $20/t, or 3.4%.

In January, hot rolled coil prices in China were rising amid improving global steel demand and domestic macroeconomic stimulus, but they began to stagnate as the holiday season approached in February. Trade deteriorated in early February due to unfavorable weather conditions that forced many consumers to start their New Year’s holidays early. Export demand also slowed. Market activity did not recover after the Chinese New Year holidays.

The slow recovery in demand, coupled with negative conditions in export markets, continued to put pressure on HRC prices in China. Buyers adopted a wait-and-see attitude to assess the market’s future prospects.

In March, prices for hot-rolled steel in China stabilized somewhat as supply decreased due to maintenance at some steel mills. At the same time, market participants predict that demand may soon recover amid improving weather conditions, which is likely to boost construction. Inventories are currently declining, but weakness in export markets continues to weigh on HRC prices in China.

«The fall in raw material prices caused by the state of the Chinese economy is the main driver of the decline in prices for finished products. It directly depends on China’s actions when the decline will end and at what level prices will stabilize,» said Andriy Glushchenko, GMK Center analyst.