Posts Global Market hot-rolled prices 2898 27 October 2023

This will be facilitated by a limited supply amid capacity reductions by some producers

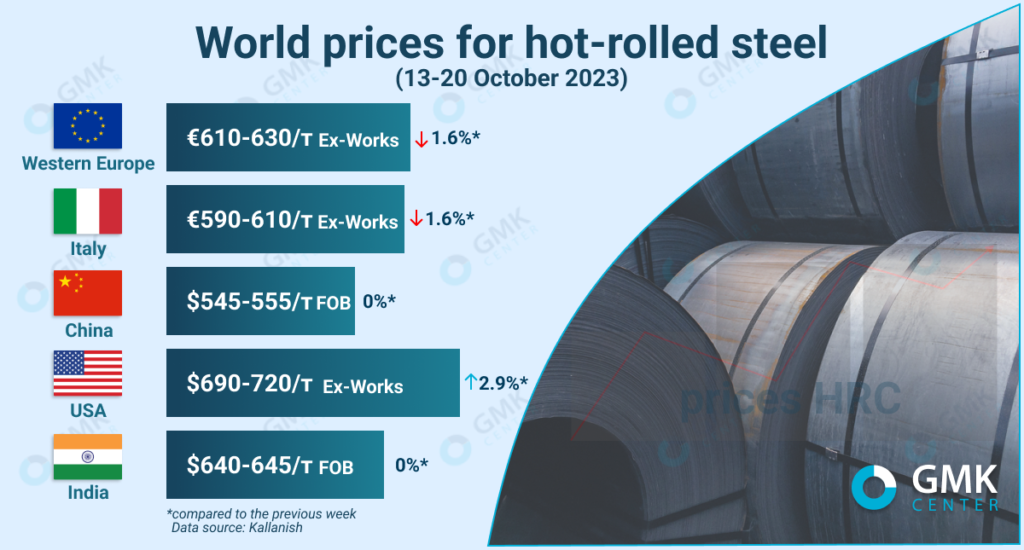

World prices for hot-rolled coil during October show mixed trends by region. In the EU market, product quotations are falling under the pressure of cheap imports and overcapacity. In the US, on the contrary, prices are rising due to a reduction in supply and an increase in the order fulfillment period, and in India – prices are stable amid stable domestic demand.

Europe

In Western Europe hot rolled coil prices for the period October 13-20, 2023 fell by €10/t compared to the previous week – to €610-630/t Ex-Works. The drop in prices for products has been observed since the beginning of October, in particular, since September 29, quotations of rolled steel in Western Europe have fallen by €50/t, or 7.3%. During August-September, prices were mostly stable.

On the market of Italy the situation is similar, in particular, as of October 20, the hot rolled coil is traded at €590-610/t, which is €10/t less compared to the previous week, and €20/t compared to the price at the end of September.

In October, the divergence between the trends in Western and Southern Europe narrowed to a minimum amid the general deterioration of the market. Price dynamics are currently under the influence of cheap imports. In addition, the pricing policy is determined by distributors and service centers who are interested in liquidity, not supply and demand (producers).

The sales of service centers and distributors has reached a critically low level due to a slowdown in consumer demand. According to market participants, approximately 60% of the total sales of rolled steel in the EU are provided by distributors, and 40% are sold directly by producers. It is currently difficult to identify exactly who started the price dumping in October.

Some steel companies, including ArcelorMittal, are considering suspending or have already shut down some capacity to balance supply and demand and limit the fall in prices.

The market continues to be pressured by a large volume of imports from Asian countries and India. Import quotas for the fourth quarter were exhausted in the first days of the quota period, but it is expected that a significant part of the products will also arrive in the first quarter of 2024.

The automotive sector in Europe, which is one of the largest consumers of rolled steel, is significantly reducing purchases. The depression of the industry has been observed since July 2023.

Despite the weak state of the market, European steelmakers are preparing for a moderate increase in HRC prices by reducing capacity. The market may soon face an undersupply, which will keep prices up. In view of exhausted import quotas, European suppliers will become the main source of products on the market in November-December.

«European consumers imported products from those Asian countries that could offer attractive prices that were lower than the prices of local producers. But the available import quotas do not allow to fully meet the needs of the market through imports at favorable prices. Consumers will not be able to hold off on purchases for long given the low inventories. According to our estimates, purchases will intensify in November, thus supporting the growth of prices,» commented the GMK Center analyst Andriy Glushchenko.

USA

On USA market HRC prices for the week of October 13-20, 2023 rose to $690-720/t (N America Ex-Works) compared to $680-700/t a week earlier. At the same time, the forecast price for October 27 is $750-830/ton. Here, the situation is the opposite – since September, prices for HRC have been falling, but since October, the trend has changed for the better, and prices have rebounded to the end of August.

Currently, the market does not have enough certainty, so there is a wide spread of prices among suppliers. Steel companies are resorting to production cuts to push prices up, but demand for products also falls seasonally. Limited supply is allowing major producers to raise their target prices, with order fulfillment times scheduled for early to mid-December. Some of them have stopped booking volumes by December.

The ongoing strike by the United Auto Workers (UAW) union against Ford, General Motors (GM) and Stellantis has expanded to the larger automakers’ plants, but it has not impacted significantly on steel demand.

India

In India quotations of rolled steel have remained stable since the beginning of October – at $640-650/t FOB. At the same time, compared to September, prices increased by $10-15/t.

Amid lethargy in Southeast Asia and the European steel market, Indian rolled steel producers have been focusing their products mainly on the domestic market for the past 2-3 months and refraining from exports. Price stability reflects stable domestic demand for rental.

Domestic steel consumption is supported by the fact that mills in Vietnam and China are yet to receive the extension of the Bureau of Indian Standards (BIS) certificate to export steel to India, which means lower imports from these countries and increased interest in the domestic market. However, the arrival of previously booked cargoes may increase the supply in the domestic market, and producers will still have to ship some volumes for export.

Currently, India is shipping products to the domestic market at a premium of $100-200/t compared to export offers. This will continue until imports resume.

India’s domestic HRC trade is expected to continue until around the end of October as the first import cargoes arrive in the country in November. In addition, the festival period will begin in India, which will further limit demand, forcing some volumes to be shipped for export, mainly to the EU, as India still has a significant amount of quota to supply to European consumers.

China

On the Chinese market, the prices for HRC were stable during October 13-20 – at $545-555/t FOB – although since the beginning of October, the levels still fell by $5/t, or 0.9%.

Price stability was supported, in particular, by weak domestic demand and the holidays at the beginning of October. The country’s steelmakers are still exporting, but competition is becoming more difficult as rising raw material costs drive up production costs and current levels of finished goods prices lead to unprofitability. In addition, overall sentiment in the global market is dampening demand for steel.

The government’s delay in implementing steel production restrictions in 2023 is likely to lead to an increase in steel inventories at steelmakers. At the same time, weak domestic demand and a drop in exports will trigger an even greater drop in prices.