Posts Global Market electricity prices 5275 05 March 2025

In Ukraine, the weighted average price on the DAM last month was €139.3/MWh

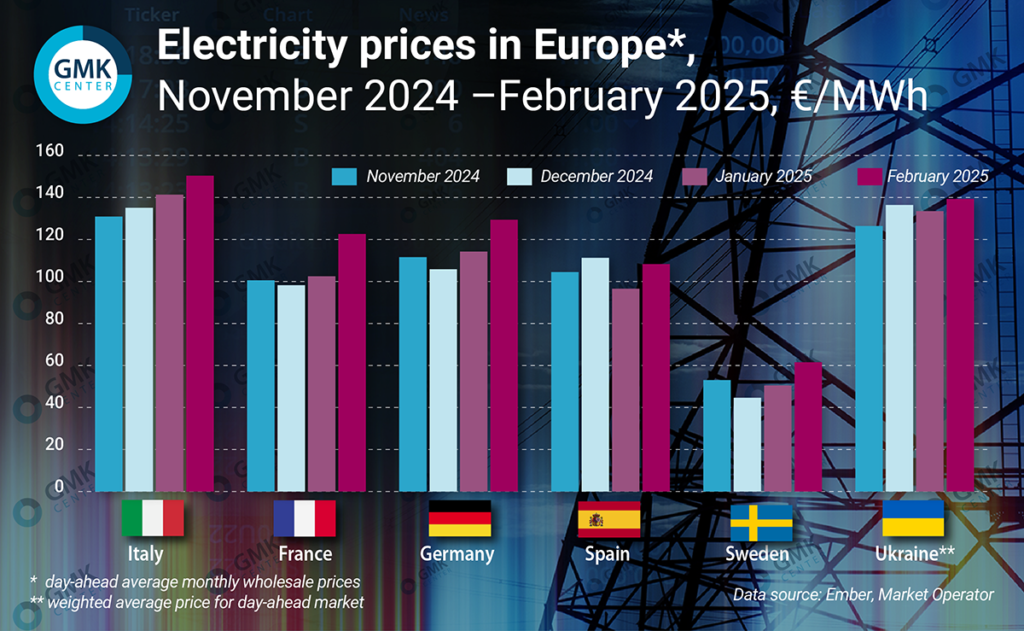

In February, electricity prices in Europe increased in most markets.

According to Ember, they were as follows:

- Italy – €150.36/MWh (+6.4 m/m);

- France – €122.64/MWh (+19.7%);

- Germany – €129.39/MWh (+13.3%);

- Spain – €108.28/MWh (+12%);

- Sweden – €61.54/MWh (+22).

According to AleaSoft, until mid-February, prices on European markets were rising due to a significant rise in gas prices and a decrease in wind generation. In the first week of the month, most weekly averages exceeded €120/MWh, and in the second week – €140/MWh.

In the last week of February, weekly prices in most major European electricity markets were still above €100/MWh (except for Spain and Portugal), with demand mostly declining as average temperatures rose. Gas futures and CO2 emission prices reached their lowest estimated values since December 2024 during this period.

EU decision

On February 26, the European Commission (EC) presented the Clean Industry Agreement, a business plan to support the competitiveness and future of manufacturing industries in Europe. The document positions decarbonization as a powerful driver for industrial growth and focuses on two closely related areas – energy-intensive industries and clean technologies.

One of the components of the Agreement was the Action Plan on Affordable Energy published by the European Commission. The EU’s energy measures include proposals to speed up the issuance of permits for renewable energy projects, change the way energy tariffs are set, as well as increase state aid for environmentally friendly industries and more flexible electricity production.

According to the European Commission, the plan will bring relief not only to households but also to industries struggling with high production costs. The greatest benefit is expected to come from the faster development of renewable energy and improved energy efficiency, which will curb countries’ demand for oil and gas with an estimated total savings in fossil fuel costs of €45 billion in 2025. By 2030, annual savings should increase to €130 billion.

The plan recognizes that high gas prices are affecting the competitiveness of European industry. To ensure fair competition, the Commission promises to strengthen control over EU gas markets through its bodies and national regulators. The EC also intends to work with reliable LNG suppliers to identify additional competitive imports and proposes to aggregate the demand for LNG for EU companies, including by investing in infrastructure abroad.

Competitive energy prices are a topic that steel industry associations have been raising in dialogues with the EU executive. They are indeed a problem for the industry. Last month, for example, ArcelorMittal Hunedoara, a Romanian steelmaker, temporarily suspended operations from February 14 to March 31. The main reason for this decision was high electricity prices and the need to cut costs. The plant, which specializes in the production of steel sections, billets and long products, operates an electric arc furnace and is not the first to face challenges related to energy costs.

The situation in Ukraine

In Ukraine, the weighted average price for the purchase and sale of electricity on the DAM in February 2025, according to the Market Operator, increased by 3.8% month-on-month to UAH 6,042.08/MWh (€139.3/MWh at the average monthly exchange rate of UAH to EUR).

The demand side of the DAM increased by 13.78% compared to January, while the supply side increased by 1.45%.

In February, according to ExPro Electricity monitoring, Ukraine increased electricity imports by almost 30% compared to the previous month and 2.9 times y/y – to 244 thousand MWh. Hungary (35% of the total) and Slovakia (30%) accounted for the largest share of imports in the period under review.

On February 10, NPC Ukrenergo began to introduce power restrictions for industry and business of various durations. The company cited damage to power facilities during previous Russian missile and drone attacks as the reason. At the same time, no restrictions were imposed on household consumers (except for emergency outages).

Fullness of gas storage facilities

According to the AGSI platform, European gas storage facilities were 38.24% full as of March 1, 2025 (compared to 62.2% as of the same date in 2024). This winter, European countries were forced to actively use their reserves amid low temperatures, many windless days, and the resumption of industrial activity.

Last month, the European gas market faced a significant price increase. On February 10, the price of futures at the TTF hub in the Netherlands exceeded €58/MWh (approximately $635 per thousand cubic meters). This was the highest level in the last two years. However, at the end of the month, it fell sharply (to €44.3/MWh as of February 28) due to forecasts of higher temperatures in Europe, weak demand for LNG in Asia, and signals from the European Commission that it is likely to ease gas storage rules.

Going forward, the European gas market is likely to face further volatility. Europe is entering the season of replenishment of reserves amid a decline in global liquefied natural gas supplies. It is worth noting that in February of this year, the supply of LNG from European LNG terminals to the region’s gas transmission network was the highest since December 2023. During the month, 8.262 million tons of liquefied natural gas were used (+11% y/y).

Achieving the EU’s storage targets by the beginning of next winter will require much higher gas supplies than in the previous two years. Therefore, the region will increase its interest in global LNG markets, which will put pressure on the market.

The upcoming maintenance in Norway may limit supplies during the replenishment period. In addition, gas imports may become more expensive due to US tariffs and possible retaliation.

According to ExPro, Ukraine increased gas imports in February to a 1.5-year high of almost 512 million cubic meters. Compared to the previous month, these volumes increased 12 times. The company imported 401 million cubic meters to the customs warehouse of Ukrainian UGS facilities (188.1 million cubic meters via short-haul service), and 110.8 million cubic meters directly to the Ukrainian gas transmission system.

In February, gas stocks in Ukrainian UGS facilities were at a record low. According to the Association of European Underground Gas Storage Operators (GSE), the storage capacity was only 8.9% as of February 12.

As GMK Center reported earlier, the gas shortage was caused by a number of factors, such as Naftogaz’s market strategy flaws and inability to foresee risks, and rising gas prices in Europe. An additional reason for the increased deficit and the need for imports was the frequent rocket attacks on gas production facilities. In particular, such an attack took place on the night of February 11 by the Russian Federation, when both Naftogaz and DTEK (the country’s largest private investor in the energy sector) reported damage to their facilities. Another strike was also carried out on February 20.

In preparation for the next winter, experts believe that Ukraine will have to significantly increase gas imports. For example, the former head of Ukraine’s GTS Operator, Serhiy Makohon, believes that a new gas reserve of at least 14 billion cubic meters should be created by November, and that Ukraine’s own production will not be enough, so it will need to import 2-3 billion cubic meters.

According to DTEK, this year Ukraine will have to buy 1 to 2 billion cubic meters to prepare for the next heating season. This estimate was made by DTEK CEO Maxim Timchenko. He noted that the exact volume of imports will depend on the restoration of gas infrastructure, production and weather conditions.

DTEK expects to announce a deal to import liquefied natural gas within the next two months. The company is negotiating with several sellers, mainly from the US, for a two-year supply contract. Last December, DTEK received its first LNG cargo from the United States (a shipment of about 100 million cubic meters) through an import terminal in Greece. The country does not have its own facilities, so the company used swaps to pump gas from the European system.