Posts Global Market electricity prices 3280 16 October 2023

Gas prices also rose due to reduced supply

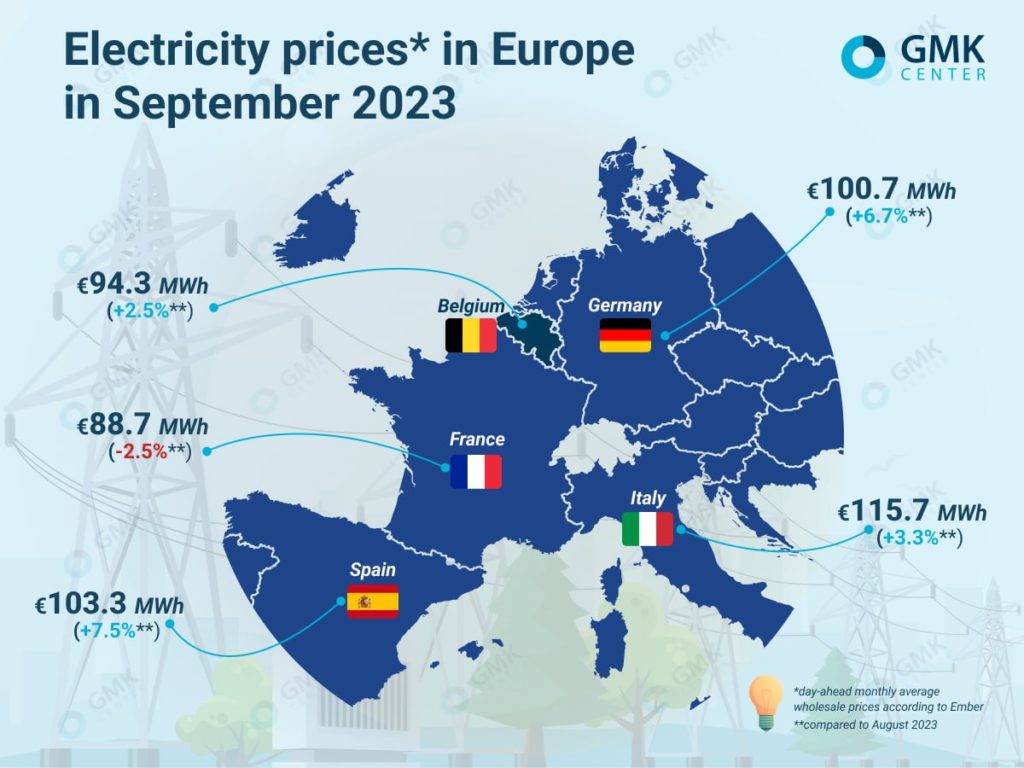

In the EU, average monthly wholesale prices for the day ahead in September increased compared to August, with the exception of France last month.

According to Ember, the prices were:

- Italy – €115.7/MWh (+3.3% m/m);

- France – €88.7/MWh (-2.5%);

- Germany – €100.7/MWh (+6.7%);

- Spain – €103.3/MWh (+7.5%);

- Belgium – €94.3/MWh (+2.5%).

In the UK, according to Nordpool, the average monthly day-ahead spot price in September of this year was €95.9/MWh, which is almost the same as in August.

Electricity prices in September, GMK Center

September trends

At the beginning of September, electricity prices fell in most European countries despite the growth in demand – the Iberian Peninsula was an exception. According to AleaSoft Energy Forecasting, this was facilitated by a decrease in the average price of gas and the price of carbon emissions, as well as an increase in the production of solar energy.

In the last week of September, the average weekly price in most European markets exceeded €100/MWh. In addition, hourly prices of more than €200/MWh were recorded in some places (for example, on September 26-28, such levels were observed in Germany and the Netherlands). However, on certain days and hours, negative values were also recorded. The increase in the cost of electricity at the end of the month was caused by the increase in gas prices, a drop in the volume of wind generation and an increase in demand.

In general, in the third quarter of 2023, the average quarterly price for electricity remained below €100/MWh in almost all European markets, with the exception of Italy (€113.2/MWh) and the Nordic Nord Pool market (€27.77 / MWh).

Average prices in July-September were significantly lower compared to the same period in 2022. The smallest year-on-year decline was demonstrated by the Portuguese and Spanish markets (33% and 34%, respectively). The largest decrease in the cost of electricity compared to the third quarter of 2022 was observed in the Scandinavian market (84%), in France prices decreased by 80% year-on-year, in the UK – by 74%.

Gas prices

Gas prices in Europe in September, which largely affect the cost of electricity, remained volatile. In the first week of the month, TTF settlement futures remained below €35/MWh.

At the end of September, European and Asian prices began to rise due to reduced supply in Europe and increased demand in Asia. Thus, on September 25, TTF gas futures on the ICE market one month ahead reached a weekly maximum settlement price of €44.44/MWh, which is 29% higher than the previous Monday, and this value became the highest since the beginning of April 2023.

The price of gas continued to rise in October. Thus, on October 11, the price of November TTF futures was already €48/MWh. At the close of trading on October 12, according to Platts, the TTF front-month benchmark gas price rose to €52.95/MWh – the highest in nearly eight months. Geopolitical risks (fighting in the Middle East, sabotage of the Balticconnector pipeline) prevailed over fundamental supply and demand factors.

However, the market is currently in better shape than at the same time last year. Gas reserves are high, industrial demand is lower, and some capacity has been added. In addition, according to some forecasts, this year’s winter in Europe will be relatively warm.

European measures

In mid-September, the European Parliament adopted a proposal to reform the bloc’s electricity market, giving the green light to the start of negotiations on this issue with the European Council.

A key element of the proposed reform is bilateral CfDs (contracts for difference). They should help the EU mitigate price volatility and are aimed at supporting investments in renewable energy projects.

However, national governments continue to argue over CfD, informs Montel. France, which has 56 nuclear reactors, leads a group of EU countries that want less EC control over how these state-backed bilateral contracts are used and how their potential revenues are redistributed. In particular, the country wants development subsidies from CfD to also apply to existing nuclear capacity.

The French are opposed by Germany, which calls for strict controls and monitoring to ensure that countries do not give their companies an unfair competitive advantage that would distort the EU’s internal energy market. A meeting of European energy ministers is scheduled to take place on October 17, during which they are trying to find a compromise on these issues.

Fullness of gas storages

According to Gas Infrastructure Europe, as of the beginning of October, gas reserves in the EU reached 1,091 TWh (103 billion cubic meters), which corresponds to a level of occupancy of 95.99%. This indicator exceeded the peak of 2022, reached on November 13 (95.68%), writes S&P Global.

The task of restocking this year was made easier by the previous warm winter. Thanks to this, at the end of March, EU gas storage facilities remained more than half full. For comparison, at the end of the 2021/2022 winter period, stocks fell to 25.6%.

This year, the EU reached its gas storage target of 90% already in mid-August, about 11 weeks ahead of the set deadline (November 1). During the summer, the unit quickly replenished its reserves – this process was slowed down only by repairs in Norway. So traders turned to the services of Ukrainian surplus warehouses. According to the forecast of the Minister of Economy of Ukraine Herman Galushchenko, voiced on October 6, by winter, the gas volume of foreign European companies in the country’s storage facilities will increase to 3 billion cubic meters.

However, experts warn that the likely risk is a prolonged cold winter that could lead to dangerously low supplies, especially due to significantly lower supplies of Russian pipeline gas.

In addition, European governments introduced energy-saving measures for large consumers last year, and this year is likely to be no different, writes OilPrice. In particular, Germany recently voted for energy saving initiatives, including mandatory ones. In addition, there is also lower energy consumption by industry, which may be positive for gas reserve levels, but negative in terms of economic growth.