Posts Global Market electricity prices 2706 11 January 2024

This trend was facilitated by the fall in the cost of gas, the decrease in demand and the growth of generation from renewable sources

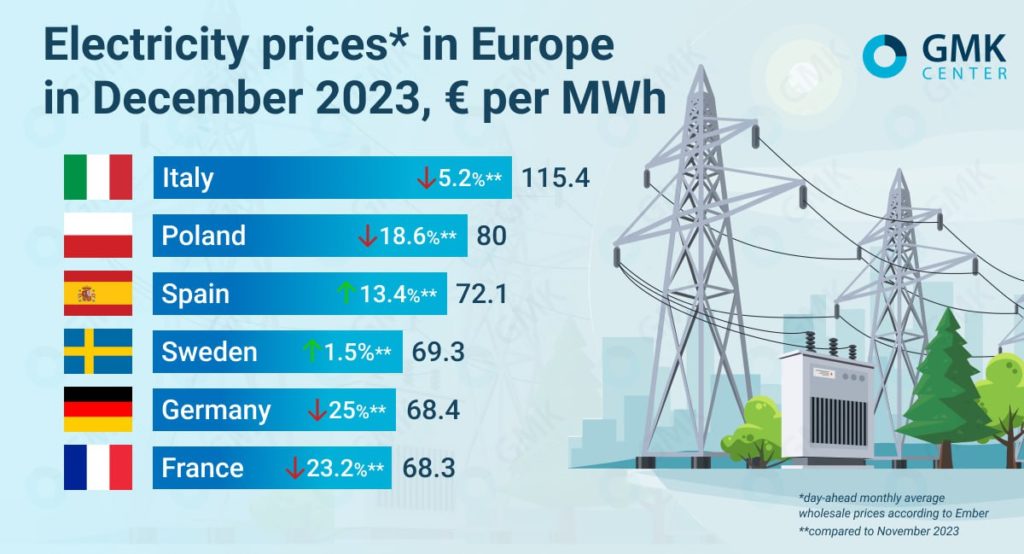

In the EU, average monthly wholesale prices for the day ahead in December 2023 compared to November decreased in most countries.

According to Ember, they were:

- Italy – €115.4/MWh (-5.2% m/m);

- France – €68.3/MWh (-23.2%);

- Germany – €68.4/MWh (-25%);

- Spain – €72.1/MWh (+13.4%);

- Poland – €80/MWh (-18.6%);

- Sweden – €69.3/MWh (+1.5%).

December electricity prices, GMK Center

In the first week of December, gas prices in Europe fell below €40/MWh, approaching the levels of early October 2023, AleaSoft Energy Forecasting notes. The cost of CO2 futures also decreased (on December 8, the lowest settlement price since October 2022, €68.63/t, was registered). These factors, coupled with increased wind power production and decreased demand, led to a drop in electricity prices in almost all markets. The same trend was observed in the middle of the month.

In the last week of 2023, demand for electricity was expected to decline due to the Christmas holidays. In Germany and France, increased solar power generation contributed to the price decline. In contrast, in Italy and the Iberian Peninsula, renewable energy generation fell, leading to higher prices.

In Ukraine, the weighted average price of electricity on the day-ahead market (DAM) in December 2023 decreased by 5.87% compared to the previous month – to UAH 4101.86/MWh (€98.1 at the exchange rate of UAH 41.8/EUR), according to Market Operator data.

Trends of 2023

According to AleaSoft, last year, average European electricity prices fell to the levels of 2021 (with the exception of Italy), and were mostly below €100/MWh. This was driven by lower gas prices and demand for electricity, as well as an increase in electricity production from renewable sources compared to 2022.

In 2023, the average price for TTF futures for the month ahead was €41.4/MWh (for comparison, the average in 2022 was €133.19/MWh, and in 2021 – €48.54/MWh).

Last year, gas prices were significantly affected by supply disruptions from Norway, labor disputes at Australian LNG export facilities, and instability in the Middle East. However, high levels of European stocks and excessive LNG supplies led to a decline in the average annual price of TTF gas futures.

Renewable energy

The past year clearly reflected Europe’s efforts to switch to green energy. For example, Luxembourg, which took first place in the EU ranking, generated 89% of its electricity from renewable sources. Austria was ranked second (87%), and Lithuania was ranked third (81%).

All major European electricity markets registered an increase in installed solar capacity compared to 2022. The Netherlands became the leader, adding 7679 MW to the system (+51% y/y). However, in Germany and Italy, solar power capacity increased by less than 10% y/y in 2023.

According to Reuters, in the last quarter of 2023, European power producers generated more electricity from wind than from coal for the first time, a key milestone for the bloc’s environmental efforts. According to Ember, in October-December, these volumes amounted to a record 193 TWh, compared to 184 TWh at coal-fired power plants. Wind energy production during the fourth quarter of 2023 increased by about 20% year-on-year despite a significant decline in the wind turbine sector due to high labor, material and financing costs.

New policy support agreed by European lawmakers at the end of 2023, including funding for turbine producers and shorter permitting times, should help to further develop regional wind power in 2024.

In addition, at the UN Climate Change Conference COP28 held in early December, 118 governments pledged to triple global renewable energy capacity and double the annual rate of energy efficiency improvement by 2030. European Commission President Ursula von der Leyen later hailed the agreement as the dawn of a new world without the need for coal or oil.

More than 20 governments also supported the COP28 declaration to triple nuclear power capacity by 2050, including Ukraine.

«Nuclear power is making a comeback,» French President Emmanuel Macron commented on this step. However, some European politicians criticize the promise of nuclear energy development and consider this bet to be a mistake.

In 2022, Macron placed nuclear power at the center of his country’s drive to become carbon neutral by 2050, announcing the construction of six new European pressurized reactors and research into eight more. Already in early 2024, the country’s Energy Minister Agnès Pagnier-Runache noted that France needs more than the six new nuclear power plants currently planned, and that it also needs to increase the structure of renewable energy sources.

Fullness of gas storages

According to the AGSI platform, the EU average gas storage capacity utilization rate was 86.25% as of January 1, 2023, and 84.27% as of January 8.

The Financial Times notes that the use of Ukrainian gas storage facilities helps Europe avoid further energy crises. European companies began withdrawing gas in November 2023 and accelerated the process in early 2024 due to increased demand for heating in the winter months. Earlier, despite the war, they turned to the country to preserve their reserves.

According to analysts, this decision helped energy groups and traders to get only relatively small withdrawals from EU storage facilities, keeping gas prices low and making it easier to replenish next year.

«This winter, Ukraine will play a key role in ensuring the security of gas supplies to Central and Eastern Europe,» Natasha Fielding, head of gas pricing in Europe at Argus Media, said.

Ukraine has more gas storage capacity than any other country in the EU, as it has played a critical transit country for Russian pipeline gas. The bloc’s storage facilities reached almost maximum capacity in mid-October. The country also offered some incentives, such as cheap storage tariffs.

Overall, analysts are positive about Europe’s prospects for this heating season. According to Bloomberg columnist Javier Blas, despite the cold weather in Europe, winter is over for European gas traders. The region is almost halfway through the heating season, and the mild weather has so far left stocks ample. Even if the cold stays for a long time, Europe will still consume much less gas than in a normal winter. Due to lower demand from both heating and industrial consumers, European gas storage facilities are not being depleted as quickly, which is leading to lower prices – they have fallen by 45% compared to last year.

On current trends, Blas notes, Europe will meet spring with half-full underground gas storage facilities, while the decade-long average is only 35%. However, while European gas prices have fallen significantly from the record highs of the past two winters, they remain well above the 2010-2020 average of €20.1 per MWh.