Posts Global Market electricity prices 14810 10 February 2023

Governments and companies are still forced to act in the face of energy price volatility

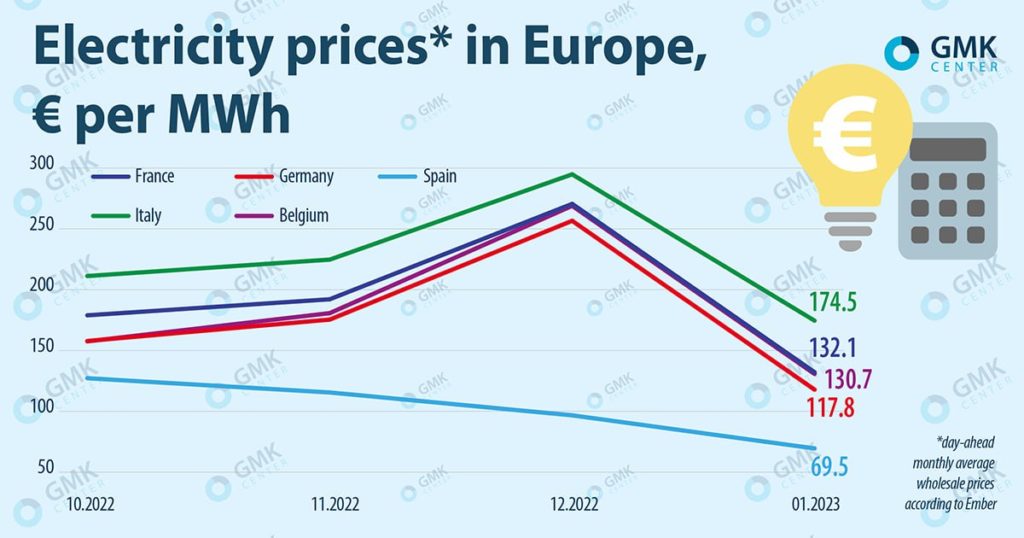

Prices. In January 2023, the average monthly day-ahead price of electricity in most European markets was below €135 MWh (excluding Italy and the UK). Spanish AleaSoft Energy Forecasting informs about it.

In the EU the average monthly wholesale prices per day in January were as follows:

- Italy – €174.5/MWh;

- France – €132.1/MWh;

- Germany – €117.8/MWh;

- Spain – €69.5/MWh;

- Belgium – €130.7/MWh.

According to Nordpool, in the UK the average monthly spot price per day in December was €149.7/MWh.

Compared to December 2022, prices have halved.

Electricity prices in Europe, October 2022-January 2023, GMK Center

In the energy markets of Germany, Belgium and France, the average January price was the lowest since August 2021, in Italy – the lowest since September 2021. Relatively mild weather, falling gas prices, an overall increase in solar and wind energy production, and falling CO2 emissions prices contributed to lower prices in European electricity markets, despite rising demand.

The UK. Amid news that the UK government is offering a £300m ($371m) support package to British Steel and Tata Steel UK to transition steelmakers from blast furnaces to electric arc furnaces, a debate is unfolding over reforming the country’s energy sector, Forbes writes about it.

Rising energy prices in the United Kingdom over the last couple of years have significantly increased the costs of the industry, and especially the steel industry, which must also take into account the cost of carbon emissions.

The UK produces about 40% of its electricity with natural gas, so installing electric arc furnaces will not necessarily solve the problem. For example, in January, Liberty Steel UK of commodity magnate Sanjeev Gupta, which uses EAF, announced its intention to reduce production and concentrate on high-margin products due to high energy costs and cheaper imports. In particular, production cuts are planned at the Rotherham plant to mitigate the impact of non-competitive costs on electricity.

Some politicians, especially in Wales, are also talking about the need for further state support for the creation of environmentally friendly energy sources for steel electric arc furnaces. In particular, there is a proposal for a wind farm in the Celtic Sea.

France. According to the French National Institute of Statistics and Economic Research’s (INSEE) data, in 2023, selling prices for electricity for businesses could increase by an average of 84% compared to 2022 without state assistance. The expected increase will be the largest in the industrial and agricultural sectors – by 92%, excluding government measures. This is largely due to the fact that companies have contracts for electricity, which are changing in accordance with the sharp increase in market prices over the past year.

The report is based on a survey of electricity suppliers in December 2022 and on an analysis of market indices. However, it does not attempt to predict actual price increases for businesses, given contract renegotiations or planned government interventions to dampen the hit this year.

From February 1, 2023, the regulated electricity tariff (TRV) in France has been raised to 15%. The country also extended until 2024 the reduction of the tax on final consumption of electricity (TICFE) – to € 1 ($ 1.09) per MWh for all enterprises.

The French Ministry of Economy also announced that companies with high electricity consumption can apply for assistance of €4 million, €50 million or up to €150 million (in sectors with a higher risk of carbon emissions).

In January 2023, according to Euractiv, France resumed its position as the largest electricity exporter in the EU (44 out of 56 reactors were in operation), but since mid-January, German electricity exports to the country began to increase. This coincided with strikes by French workers protesting plans to raise the retirement age. France imported €330 million worth of electricity to meet domestic demand in January, while its exports to Germany totaled just €96 million during that period.

Germany. Germany probably won’t need all the €200bn earmarked to protect households and businesses from the impact of a sharp rise in energy prices. This was announced in mid-January by the Minister of Finance of the country, Christian Lindner. Germany’s spending on capping gas and electricity prices could be lower than expected due to falling energy prices in futures markets, he said. It will also reduce the revenue from the excess profit tax of the energy companies.

However, according to Reuters, the ministry of economy said it was not possible to directly assess how falling gas prices would affect the overall volume of the aid package, as consumer prices depend on individual contracts with energy suppliers. Industrial consumers are faced with even greater uncertainty. Therefore, the department believes that it is necessary to talk cautiously about reducing plans for funding needs. The actual data should be available in the coming months.

Gas. Due to mild winters and weak industrial demand, EU gas storage capacity remains high. According to AGSI platform, as of February 9, 2023, in the EU this figure was 68.1%. On January 26, TTF futures hit their lowest settlement price since the first half of September 2021 – €54.82/MWh.

According to the revised forecast of the international financial group ING, published at the end of January, European gas storages, in the absence of prolonged cold weather, will complete the heating season with more than 50% occupancy. This is well above the 26% at the end of the 2021/2022 season and above the five-year average of 34%.

The financial group expects the average TTF to be €60-65/MWh in the first half of 2023 and increase to €75-80/MWh in the second half. The previous forecast by ING analysts was about the European benchmark of €125/MWh on average for the current year. A more comfortable storage situation is expected to put Europe in a better position for the 2023/2024 heating season, and prices should not be as high. The risks that ING calls the key to the revision of the forecast are the halt of the residual flows of Russian gas to the EU and the demand for LNG from China.

Trends. Fluctuations in European energy prices and forecasts for further developments in the situation continue to affect energy-intensive industries, in particular the steel industry. Governments, in turn, are forced to reconsider the scale of support.

Companies are still considering the worst-case scenarios and are faced with the choice of whether to restore production, which they stopped due to a price spike in 2022. Although the energy crisis in the EU and its impact on the steel industry has eased somewhat, there is still a risk of an outflow of investment from Europe’s energy-intensive industries. In addition, EU steelmakers are concerned about other issues, such as the issue of competitiveness against the backdrop of US environmental subsidies for industry, provided for by the law to reduce inflation. The EU is already preparing its own response to support investment in green industry.