Posts Global Market electricity prices 7227 11 March 2024

In most markets, they reached their lowest levels since the first half of 2021

In the EU, average monthly wholesale day-ahead prices in February 2024 fell across major European markets, with most of them reaching their lowest levels since the first half of 2021.

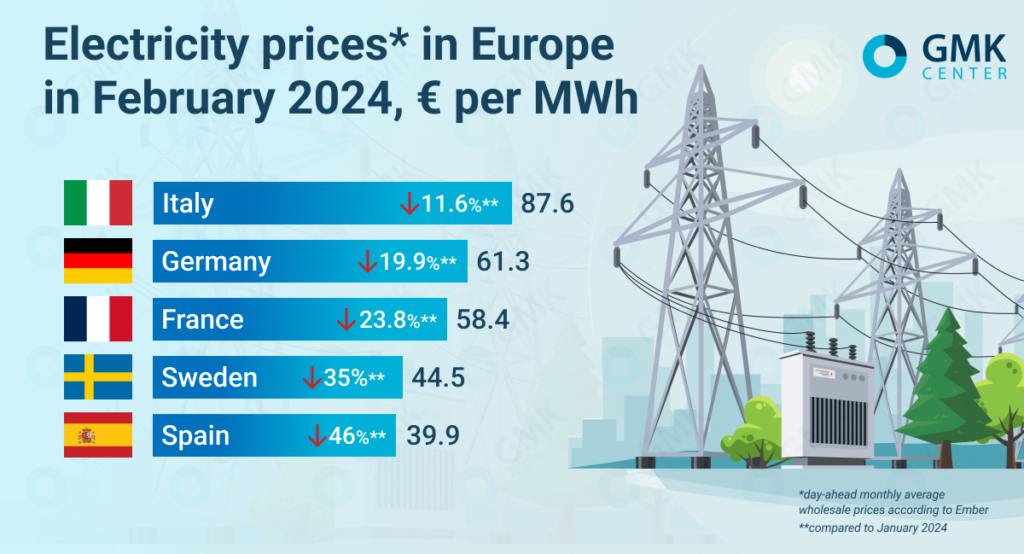

According to Ember, they amounted to:

- Italy – €87.6/MWh (-11.6% m/m);

- France – €58.4/MWh (-23.8%);

- Germany – €61.36/MWh (-19.9%);

- Spain – €39.9/MWh (-35%);

- Sweden – €44.4/MWh (-45%).

In Ukraine, the weighted average price of electricity on the day-ahead market (DAM) in February 2024 decreased by 15.3% compared to the previous month – to UAH 3268.6/MWh (€78.6 at the rate of UAH 41.59/EUR), according to Market Operator data. Demand for DAM in the specified period decreased by 13.16% m/m.

According to The European Energy Exchange (EEX), the Central European exchange for electricity and related products, the basic settlement price of electricity futures on the German market in March 2024 will be €61.27/MWh, on the French market – €58.81/MWh, on the Spanish market – €19.83/MWh, on the Italian market – €84.73/MWh.

Electricity prices in February, GMK Center

February trends

According to AleaSoft Energy Forecasting, the decline in electricity prices in February in Europe was driven by falling demand, average gas prices, and CO2 emissions compared to the previous month. In addition, as is typical for the season, solar energy production increased (in Spain and Portugal, it reached historical records for February). Wind generation also increased in most of the markets analyzed.

In February 2024, the average price of TTF futures for the month ahead was €25.76/MWh, the lowest since May 2021. The average price of CO2 futures fell by 15% compared to the previous month and by 42% y/y – to €57.6/t. Last month’s average was the lowest since July 2021.

Calls from the industry

The European industrial sector continues to focus on electricity prices and access to green energy. In February, EU industry leaders representing nearly 20 different sectors signed the Antwerp Declaration on the European Industrial Agreement. One of its points was a call to make Europe a globally competitive energy supplier.

«Energy costs in Europe are too high to compete and are driven not only by commodity prices but also by regulatory fees,» the declaration says.

According to the signatories, the next European Commission needs to prioritize new projects for the abundance and availability of low-carbon renewable and nuclear energy. They also believe that a genuine EU Energy Strategy is needed with concrete actions that will, in particular, enable cross-border electricity transmission.

Renewable energy

Despite the fact that renewable energy generation has a significant impact on prices, and the EU is seeking to expand its share, the situation in the sector is tense.

The WindEurope industry group said that last year’s renewed investment in the wind energy sector gives hope that the bloc will be able to achieve its clean energy goals.

According to Euractiv, the group said that in 2023, investments in European offshore wind turbines rose to €30 billion, up from €0.4 billion in 2022. EU countries also installed a record 16.2 GW of new wind capacity in 2023.

WindEurope expects Europe to install an average of 29 GW of wind capacity per year in 2024-2030, reaching a total wind capacity of 393 GW in 2030. This is close to the bloc’s goal of 425 GW of renewable energy by that time. One of the biggest risks to the expansion of European wind power, the group says, is slow investment in modernizing the grid to handle renewable energy.

However, representatives of the European wind energy sector believe that it will suffer the same fate as the solar industry if the authorities do not block market access for cheaper Chinese equipment. At least, this opinion was expressed by Siemens Energy CEO Christian Bruch. According to him, the company will support «a combination of either quotas or quality criteria» to push the wind energy industry in the EU and make it harder for China to compete.

Solar crisis

At the same time, European solar panel manufacturers warned in early February that they were ready to close production lines if the EU did not take emergency measures to save the sector, such as buying back their stocks that had accumulated in recent years due to the influx of cheaper products from China.

In particular, in February, the Swiss company Meyer Burger, the country’s largest solar panel manufacturer in Germany, announced that in March it would begin preparations to close its plant in Freiberg and focus on its sites in the United States.

However, the European Commission does not want to impose trade measures against Chinese solar panels. Instead, it calls on EU member states to subsidize domestic production. The bloc needs Chinese products to expand its renewable energy capacity, so it should leave the door open for imports, according to European officials.

Fullness of gas storage facilities

According to the AGSI platform, as of March 1, 2024, the occupancy rate of gas storage facilities in the EU as a whole was 62.25%.

In early March, EU energy ministers considered further steps to reduce the bloc’s dependence on gas from Russia.

According to the data provided by European Commissioner for Energy Kadri Simson, Interfax-Ukraine reports that in 2023, Russian gas supplies accounted for 15% of total EU imports, compared to 24% in 2022 and 45% before 2022. Overall, gas imports from Russia have decreased by 71% since 2021. Last year, European companies also imported 18 bcm of LNG from Russia.

Simson noted that gas prices in the block have now fallen and are quite stable. By the end of the heating season, the block is likely to approach the end of the heating season with a gas reserve level of 45-55%. The main suppliers of gas to the EU are currently Norway and the United States.

The European Commissioner reminded that the transit agreement between Gazprom and Naftogaz of Ukraine expires on December 31, 2024. Last year, 14 billion cubic meters of Russian gas were transported through this route, mostly to the central and southeastern countries of the bloc. EU member states have considered what the consequences of the absence of this transit route would be for them and have concluded that after two years of REPowerEU, the bloc has a diversified network of alternative transportation infrastructure.

Simson added that the EU is not interested in extending the trilateral agreement with Russia. The focus should now be on supporting Ukraine and how best to utilize its gas infrastructure and storage facilities in the future, as well as on further integrating the country into the EU energy market.

However, Politico notes that as the deadline for completing the deal approaches, EU countries are beginning to make contingency plans, particularly Austria and Slovakia.

Reduced demand

At the same time, the European Council announced that it had reached a political agreement to continue coordinated gas demand reduction in the bloc.

According to the institution, from August 2022 to January 2023, gas demand was reduced by 19% (41.5 billion cubic meters).

According to the communiqué, the situation with gas supplies to the EU has improved significantly since 2022. This was made possible, in particular, by the reduction in demand, which the member states of the bloc resorted to on the basis of the relevant regulation. The latter was adopted as an emergency instrument in 2022 in response to the energy crisis caused by Russia’s full-scale invasion of Ukraine. Last spring, the regulation was extended until the end of March 2024 to ensure security of supply and curb price volatility.

However, the document notes that despite the overall improvement in the situation, according to the latest reports from the European Commission, the situation on global gas markets remains tense. Therefore, the bloc states want to be prepared for any possible disruptions. For this purpose, the EU’s collective storage facilities must remain at a sufficiently high level throughout the winter.

According to the agreement reached at the European Council, EU countries are recommended to continue reducing gas consumption by at least 15% by March 31, 2025, compared to the average consumption between April 1, 2017, and March 31, 2022. The agreement is to be formally approved by the European Council, with the recommendation expected to be adopted in March 2024.