Posts Global Market hot-rolled prices 3889 29 November 2024

The market does not accept producers' attempts to raise prices

In November 2024, the global hot-rolled coil market was marked by uncertainty. Despite a slight increase in prices in some regions, low demand and economic instability restrained activity. Producers are facing difficulties due to weak consumption in key sectors, excess inventories and competition from imported suppliers. The outlook remains uncertain, as production is expected to decline before the holiday season.

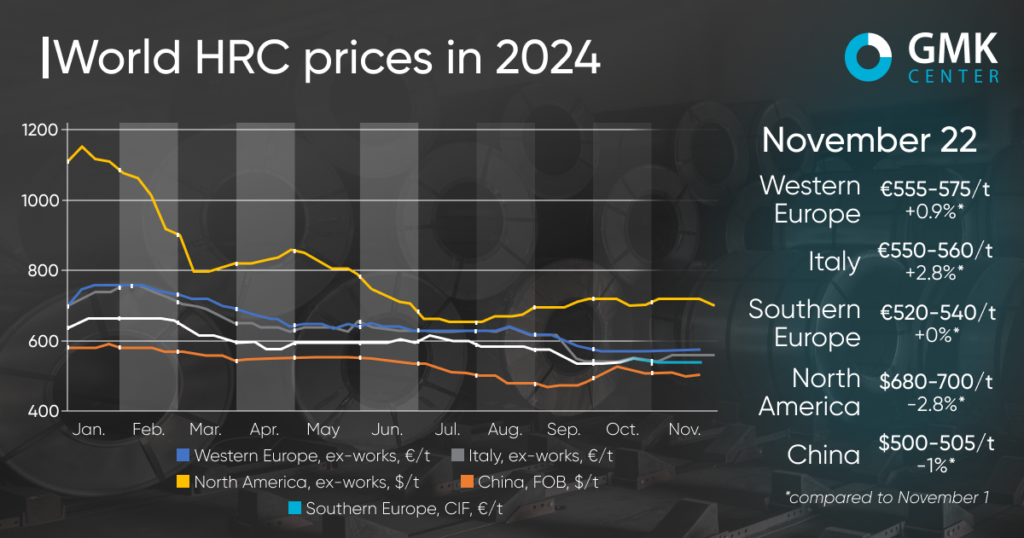

In November 2024, the European hot-rolled coil market showed relative stability with little price fluctuation. In Western Europe, prices increased by 0.9% – to €555-575/tonne Ex-works, in Southern Europe they remained stable at €520-540/tonne CIF, and in Italy they rose by 2.8% – to €550-560/tonne Ex-works. However, these changes took place against the backdrop of weak demand and low activity in all regions.

The main factors affecting the market were a decline in consumption in key sectors such as automotive and engineering, as well as limited activity due to the uncertain economic situation. In November, many service centers and re-rollers operated at minimal profitability or even incurred losses due to persistently low product prices.

The Italian market remained weak despite a moderate increase in prices. Demand was limited, and most producers planned to suspend production for the holiday season in December, which would reduce supply. Import prices remained competitive, but many buyers refrained from purchasing due to long delivery times and the risk of being subject to import tariffs.

Forecasts for the coming period remain uncertain. Before the production shutdown in December, buyers may increase purchases to replenish stocks, which could support prices in the short term. However, overall market conditions, including low margins and weak demand, suggest that the outlook for early 2025 remains challenging.

“The spread between ex-works coil prices in the EU and China is relatively small, which retains the potential to increase prices. There will be no pressure from imports before the start of the new quota period, so a price rebound looks quite possible,” said Andriy Glushchenko, GMK Center analyst.

In November, the US hot-rolled coil market experienced a noticeable decline in prices, despite attempts by leading producers to keep them at a higher level. The upper price limit decreased by 2.8% and the lower price limit by 4.2%, reaching $680-700 per short tonne Ex-works, reflecting weak demand and oversupply in the market.

At the beginning of the month, prices remained relatively stable in the range of $710-720/ton. Some producers, such as Nucor and Cleveland-Cliffs, tried to increase their offers to $750/mt, hoping for improved demand. However, real deals were made at a lower level, as buyers were actively bidding. The situation was complicated by sufficient stocks in service centers and low activity of buyers, who were in no hurry to place large orders due to expectations of further price declines.

The middle of the month was marked by a deepening recession. Despite manufacturers’ announcements of price increases, the market reacted differently, with transaction prices remaining stable or even gradually declining. In particular, by November 20, the HRC price range had widened to $690-720/t, and by the end of the month it had dropped to $680-700/t. The seasonal factor had a significant impact: many producers and consumers reduced operations ahead of the holiday season, which led to a decline in sales.

Distributors pointed out that real transactions often took place with significant discounts, especially for large order volumes. Some even reported prices in the region of $600/t, although this was not confirmed. Domestic producers continued to keep their price offers at $750/mt, but actual sales reflected more flexibility in pricing.

A significant factor was weak demand from key industries, such as automotive and machinery, which limited the ability of producers to maintain high prices. In addition, cheap imports remained scarce due to long delivery times, creating additional room for domestic deals.

At the end of November, the market was in a state of limbo. Many participants are preparing for the end of the financial year and the start of the new one, hoping for an improvement in demand in the first quarter of 2025. However, the outlook remains uncertain due to low demand, intense competition among producers and significant pressure from consumers to reduce prices.

The hot-rolled coil market in China was volatile in November after a two-month price increase, which ended with a slight decrease of 1% to $500-505/t FOB. The market dynamics were influenced by both domestic economic factors and international trade, which made it difficult to predict price trends.

At the beginning of the month, prices remained stable, awaiting the announcement of government incentives. However, futures contracts on the Shanghai Stock Exchange showed a moderate decline, reflecting traders’ cautious mood. The lack of significant export deals, particularly with Vietnam, also kept prices down.

The middle of the month was marked by a decline in prices due to unfavourable economic signals and a drop in futures prices. News of anti-dumping investigations by Australia, which could potentially limit Chinese HRC exports, also had an impact.

However, by the third week of November, prices had partially recovered amid higher consumption and lower stocks in the domestic market. The export segment saw an increase in activity, in particular, the conclusion of deals with Vietnam. Nevertheless, the last days of the month brought another decline, when the weakness of the stock market spread to futures contracts and spot transactions.

Overall, November was a month of continued uncertainty for the Chinese HRC market. Although government incentives and projected good demand in 2025 created some positive expectations, their impact on the market was limited. The main challenges remained the instability of export opportunities, domestic overcapacity and the risks of new trade barriers in key export markets.