The Cabinet of Ministers has already started implementing tax changes that have a negative impact on business

The government adopted the Budget Declaration for 2025-2027 and thus resumed medium-term budget planning. In a time of war and high uncertainty, this is more of a procedural gesture to formally fulfill IMF requirements. The document provides only general directions in which the state’s budget and fiscal policy will move in the coming years.

Businesses should only prepare themselves for increased tax pressure and stricter tax administration procedures in the coming years, which is to varying degrees envisaged in various binding documents signed by the authorities.

The return of planning

On June 28, the Cabinet of Ministers approved the Budget Declaration for 2025-2027 by its Resolution No. 751. Its goal is to ensure transparency, consistency and predictability of budget and fiscal policy. It is worth reminding that the first time the Parliament adopted the Budget Declaration was on July 21, 2021, when it was designed for 2022-2024. Obviously, it quickly became irrelevant during the war.

The document aims to restore medium-term budget planning, i.e., the preparation of a budget forecast for three years. In addition, the resumption of state and local budget planning is enshrined in the memorandum with the IMF and the Ukraine Facility program. The budget declaration is yet to be approved by the Verkhovna Rada. In addition, a draft law that would restore medium-term planning for local budgets is currently before the Parliament.

Basic numbers

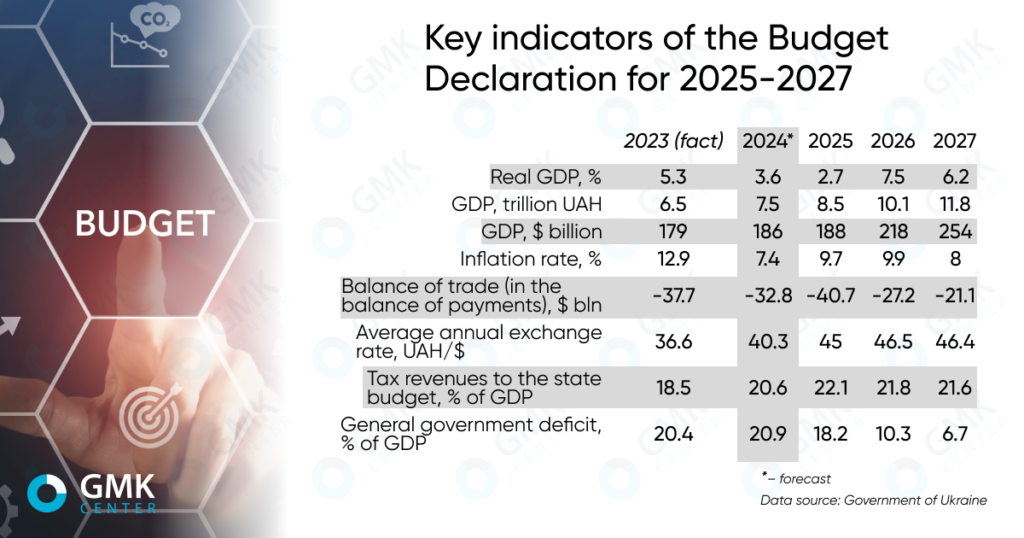

The forecasted macroeconomic indicators for 2025-2027 are subject to high uncertainty caused by constant changes in internal and external factors. The forecast in the Budget Declaration is based on the assumption that active hostilities will continue at least throughout 2025.

Key figures of the document:

- Real GDP growth is expected to reach 2.7% in 2025, 7.5% and 6.2% in 2026-2027.

- Consumer prices are expected to grow by 9.7% in 2025, 9.9% and 8% in 2026-2027, respectively.

- The average annual hryvnia exchange rate against the dollar is expected to reach UAH 45 in 2025, UAH 46.5 and UAH 46.4 in 2026-2027.

- Next year, state budget revenues are expected to increase by 36.6% compared to 2024, and by 14.2% and 13.6% in 2026-2027.

- The total level of expenditures in 2025 will increase to almost UAH 4 trillion from UAH 3.3 trillion planned for 2024 and will remain at this level in 2026-2027. The defense and security sector remains a priority (50% of all expenditures on average in 2025-2027).

- Financing of the state budget (borrowings and grants) in 2025-2026 will amount to UAH 1.5 trillion and UAH 1.04 trillion, and in 2027 – UAH 788.5 billion.

- The road fund revenues are supposed to be transferred to the general fund of the state budget with its gradual restoration: 25% (UAH 44 billion) in 2025, 50% (UAH 124 billion) in 2026, and 75% (UAH 234 billion) in 2027.

- Freezing of minimum social standards for 2025-2027 – the subsistence minimum (UAH 8 thousand) and the minimum wage (UAH 2.9 thousand) remain at the level of 2024.

At the same time, experts have doubts about the validity of some of the figures in the declaration.

“The first thing that catches your eye is the significant discrepancies in the forecast for 2025 in the Budget Declaration and the latest forecasts of the IMF, the NBU, and think tanks. In particular, the Budget Declaration lowers the real GDP growth for 2025 to 2.7%, which is primarily due to the consequences of the destruction of energy infrastructure. While the IMF estimates real GDP growth for 2025 at 5.5%, the NBU estimates it at 5.3%. I would like to hear more arguments from the government about such a deterioration in the short-term economic outlook,” said Danylo Hetmantsev, Chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy.

Tax innovations

First of all, businesses are interested in what tax changes the government is planning. The declaration does not indicate any possible changes in key tax rates. It is planned to increase the military tax – the accrual base and the rate, but no specific figures are given. At the same time, the VAT rate in the declaration remains unchanged at 20% until 2027. In addition, the government declares the gradual approximation of excise tax rates on tobacco products and fuel to the EU level, initiatives to combat the use of schemes with individual entrepreneurs and in the circulation of tobacco and alcohol, and plans to introduce an excise tax on sugary carbonated drinks.

Although the document declares that the main tax rates will remain unchanged, their growth cannot be ruled out. The declaration indicates “a package of additional measures for 2025-2027” as revenues to the state budget, which provides for about UAH 340 billion annually.

“The Declaration is based on the assumption that all tax rates (income tax, personal income tax, VAT, rent payments), except for excise taxes on tobacco products and fuel, remain unchanged. It could not be otherwise, as the draft law on additional sources of state budget revenues for 2024 has not been approved by the government itself. However, the Declaration explicitly points to the need for such a package of measures to finance the defense needs for 2025-2027, which is estimated at UAH 340 billion annually. The adoption of such a draft law is not excluded, but it may not necessarily lead to the need to change the rates of basic taxes,” explains Danylo Getmantsev.

The realization of these intentions will lead to a reduction in the state budget deficit from the actual 20.6% of GDP in 2023 to 6.7% in 2027. At the same time, the share of tax revenues to the state budget will increase from 18.5% of GDP last year to 21-22% in 2025-2027.

It is important to note that tax innovations are also “sewn up” in other documents, which means that the Budget Declaration does not include all possible fiscal changes in the coming years. In addition, the war is not over, and the Cabinet of Ministers may need additional sources of domestic revenue.

“The updated Memorandum with the IMF dated 17.06.2024 provides for an increase in excise rates, expansion of the list of excisable goods (+sweet carbonated beverages), and, somewhat remotely, an increase in rent payments, environmental tax, taxation of crypto assets, and the emergence of higher (>18%) personal income tax rates. There will also be a tax on medical cannabis and advance payment of income tax by gas stations. Over the next three years, taxpayers will pay more than UAH 1 trillion to the budget on an emergency basis,” said Vyacheslav Cherkashyn, Senior Tax Policy Analyst at the Institute for Social and Economic Transformation.

Thus, on the one hand, the plans laid down in the declaration do not quite correspond to the plans specified in the memorandum with the IMF. On the other hand, according to economic expert Danylo Monin, the plans include a strong tax increase first “for the war” and then “let it be.”

“The Ministry of Finance has presented a plan to raise taxes by 4% of GDP, expecting that the war will last the whole next year, and inflated its own expenses for 2025 compared to the basic budget for 2024 from UAH 1.6-1.7 trillion to UAH 2.226 trillion,” he adds.

It is also important that the declaration envisages the implementation of measures to reform the tax administration policy envisaged by the National Revenue Strategy until 2023, which was adopted at the end of last year. These measures include improving tax administration, reviewing investment incentives to eliminate corporate profit tax exemptions, and building up relevant tools (information exchange, strengthening control over transfer prices). At the same time, many economists are extremely negative about this strategy, and businesses are demanding its revision.

After the adoption of the Budget Declaration, concrete measures to implement fiscal changes began. In mid-July, the Cabinet of Ministers prepared a draft law to increase taxes by UAH 140 billion. This will mostly affect individuals and individual entrepreneurs, with a key innovation for business: legal entities will also have to pay the military tax of 1% of any income. Earlier, the Cabinet of Ministers was working on a draft law to increase the military fee (from 1.5% to 5%) and VAT (by 2-3%), as well as to increase the fiscal burden on individual entrepreneurs.

These planned innovations have already caused a negative reaction from economists and parliamentarians.

“It’s just a shame. Not only that, but some of the items are unclear where they came from, they are random ideas that are not connected by logic or necessity. Then, for PR purposes, they called this whole mix the word “military fee” and submitted it to the Rada without any explanation, shouting “we urgently need money.” Why such changes? What are the calculations for them? How can we be sure that this will not increase the shadow? Why make things too complicated and create additional administration where it could be avoided? How will some things work in practice? It’s obvious that this was written in a hurry, because there are a lot of mistakes in the text. I’m not even talking about zero communication or any explanations,” says Yaroslav Zheleznyak, MP, First Deputy Chairman of the Parliamentary Committee on Finance, Taxation and Customs Policy.

Declarative consequences

The budget declaration is initially declarative in nature, but in the current environment, its formal significance is only increasing. Currently, the Cabinet of Ministers is “stamping out” dozens of different strategies and action programs that are practically irrelevant in a time of war. However, the adoption of these strategies is part of the obligations under various important agreements with the EU and the IMF.

Under conditions of high uncertainty, the indicators planned for the next 3 years are initially poorly related to reality due to the unpredictability of the processes taking place. For example, the document assumes that the war will continue until the end of 2025. In the declaration, defense and security spending in 2026-2027 is reduced by about a third of the level of 2025. However, if the war continues, spending may increase significantly.

“Under the current conditions of uncertainty and volatility of many factors, it is impossible to rely on these figures and plan anything based on them. A common problem today is that the planned and actual figures do not coincide. Such documents are realistic in countries with a stable political and economic situation and inflation, but not in our case,” emphasizes Dmytro Boyarchuk, Executive Director of CASE Ukraine.

The declaration itself names the following main risks that will put pressure on financial stability in 2025-2027

- uncertainty about the duration and intensity of military operations in Ukraine;

- trade blockade by neighboring countries;

- the situation with maritime exports – the operation of ports and the nature of the destruction of port infrastructure;

- difficult demographic situation and outflow of labor resources abroad;

reduction of the harvest; - acceleration of inflationary processes and reduced demand for domestic debt instruments.

For business, the main issue is the predictability of the government’s tax policy and other actions. For example, recent government decisions on energy tariffs were made without prior discussion with industrial consumers directly affected by them and without assessing the impact on the country and business. This situation is fraught with numerous negative consequences, which together can finish off an economy that is already struggling in the face of war.

In any case, Ukrainian business expects an increase in tax pressure, just like during the pandemic. The declaration states that in 2025-2027, the state will refrain from introducing any tax and administrative measures that may adversely affect the tax revenue base (no new incentives and preferences for business).

“Ukraine will face an excessively tight fiscal policy, which, along with the war, will be the main reason for the unsatisfactory pace of economic recovery, aggregate demand will remain depressed, and living standards will deteriorate,” summarizes Vyacheslav Cherkashyn.