News Industry long products 1143 20 April 2023

Ukrainian consumers' spending on imported long products decreased by 12.7% m/m

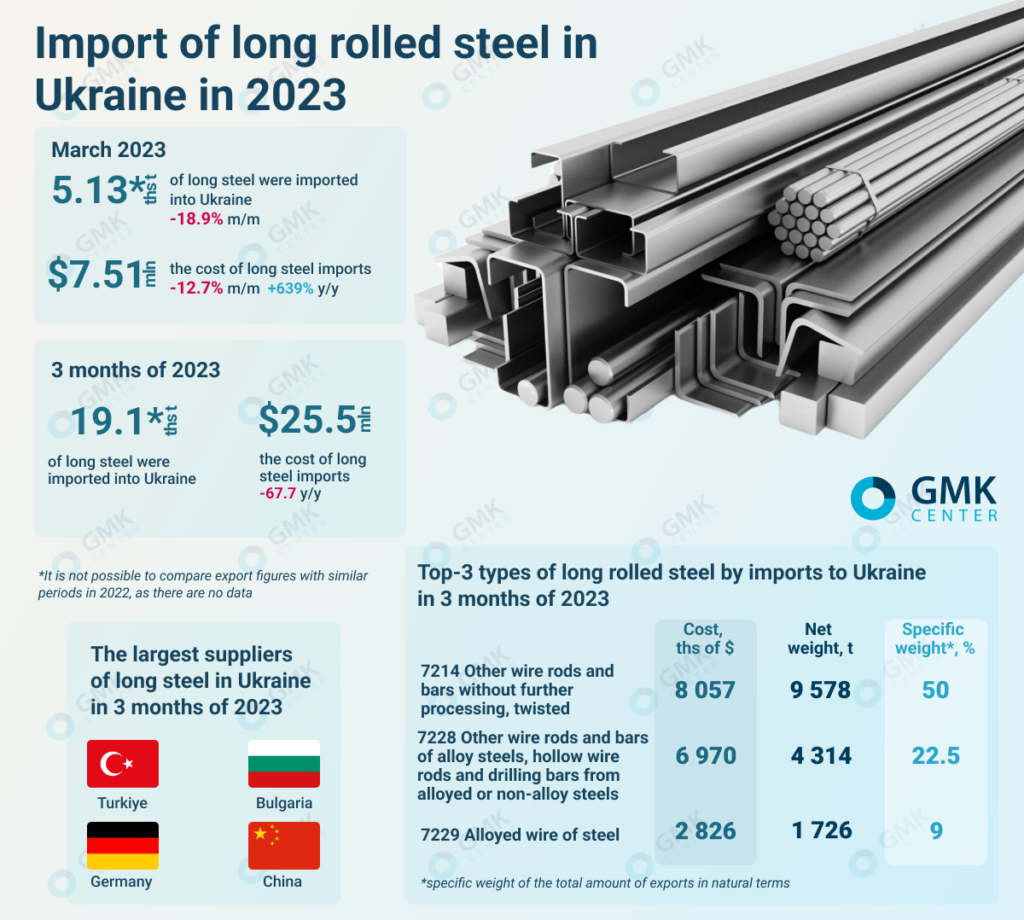

In March 2023, Ukraine reduced imports of long rolled steel products by 18.9% compared to February 2023 – to 5.13 thousand tons. Import costs for the month decreased by 12.7% m/m – to $7.51 million. This is evidenced by State Customs Service’s data.

Compared to March 2022, in March 2023, Ukraine increased the cost of importing long products by 7.4 times. It is impossible to calculate the difference in the volume of imports in physical volume due to the lack of data.

In January-March 2023, Ukraine consumed 19.14 thousand tons of imported long products worth $25.51 million. The cost of importing foreign products decreased by 42.6% compared to the same period last year.

Most of all, in January-March 2023, other twisted bars without further processing (Nomenclature 7214) were imported to Ukraine – 9.58 thousand tons for $8.06 million. In March, 1.78 thousand tons were delivered (-36.3% m/m) for $1.61 million (-30.5% m/m) Also, 4.31 thousand tons of other rods and bars from alloyed steels, hollow rods and bars for drilling from alloyed or non-alloyed steels (Nomenclature 7228) for $6.97 million were imported, in March – 1.78 thousand tons (+29.6% m/m) for $2.56 million (+0.7% m/m).

The third place in terms of supplies to Ukraine among the types of long products in the first quarter of this year was occupied by alloy steel wire (Nomenclature 7229) – 1.73 thousand tons for $ 2.83 million. In March, supplies of such products to Ukraine fell by 4.9% compared to the previous month – to 527 thousand tons, and in monetary terms – decreased by 7.6% m/m, to $874 thousand.

Import of long products to Ukraine in 2023

The largest suppliers of other rods and twisted bars without further processing are Turkiye and Bulgaria – 76.82% and 12.81%, respectively, in monetary terms. Germany (65.52%) and Turkiye (16.09%) shipped over 80% of other alloy steel bars and rods, alloyed or non-alloy steel hollow bars and rods for drilling. The main wire suppliers are Germany and China – 50.32% and 27% respectively.

As a result of the Russian invasion of Ukraine, several steel enterprises remained in the temporarily occupied territory, including the largest steel plants Azovstal and Ilyich Iron and Steel Works. Enterprises located in the territory under control are operating at minimum capacity due to problems with logistics, the unfavorable situation on the global steel markets, and interruptions in energy supply due to the shelling of the Ukrainian energy infrastructure by Russian forces, but now the situation has stabilized.

As GMK Center reported earlier, in 2022 Ukraine reduced imports of long products by 70.5% compared to 2021 – to 96.06 thousand tons. Import costs for the year decreased by 60.6% y/y – to $113.65 million.

Export of long rolled steel from Ukraine in 2022 amounted to 748.95 thousand tons, which is 59.7% less than in 2021. In monetary terms, deliveries of such products fell by 54.3% m/m – to $23.84 million.