News Global Market iron ore prices 1127 03 March 2023

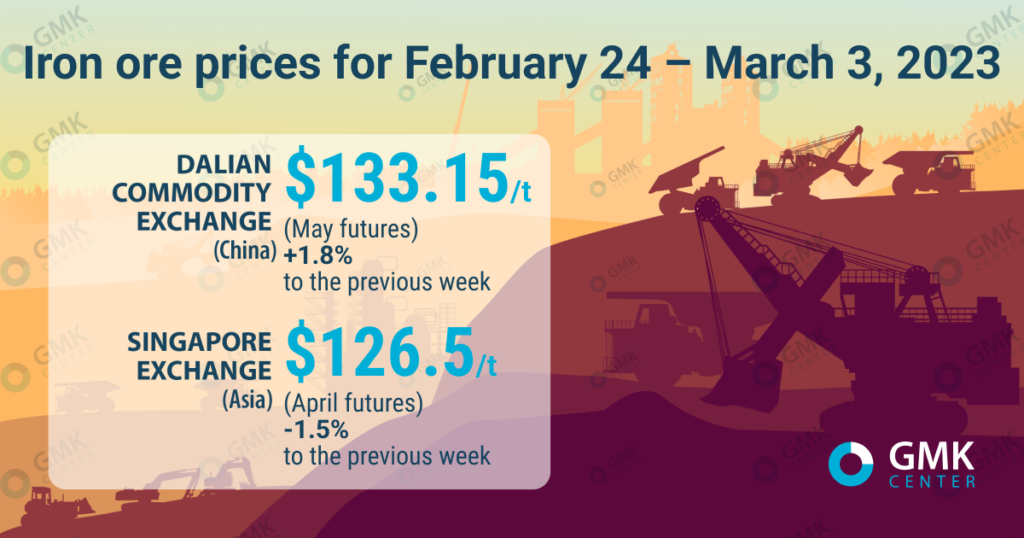

Iron ore futures on the Dalian Commodity Exchange for the week of February 24 – March 3, 2023, increased by 1.8% compared to the previous week

The most traded May iron ore futures on Dalian Commodity Exchange, for the week of February 24 – March 3, 2023, increased by 1.8% compared to the previous week – up to 919 yuan/t ($133.15/t). Thus, iron ore quotations reached an 8-month high. This is evidenced by Nasdaq.

Iron ore prices in March 2023

On the Singapore Exchange April futures as of March 3, 2023, decreased by 1.5% compared to February 24, 2023, – to $126.5/t.

Earlier last week, iron ore prices were lower in China as local regulators tried to restrain the market from a sharp rise in prices amid an expected increase in demand for the commodity.

The positive expectations of the market are confirmed by the statements of the main producers of iron ore, in particular BHP Group BHP.AX and Rio Tinto RIO.AX, RIO.L. The world’s biggest mining companies reported signs of recovery in demand for raw materials in China after the lifting of coronavirus restrictions and the introduction of support measures for the real estate sector.

The favorable outlook for China lifted iron ore prices in Dalian and Singapore out of the $120-130/t trading range they have been in for the past few weeks.

However, prices began to fall after some steel mills in Tangshan and Handan suspended production due to severe air pollution. The duration of the restrictions was not specified, but they are connected to the opening of the annual meeting of the Chinese Parliament on March 5, 2023. Normally, Beijing makes significant efforts to ensure clean air ahead of the annual meeting.

The market was also weighed down by an increase in iron ore inventories at the country’s ports, which increased by 1.2% early last week to the highest level since September 2022.

At the same time, the expected increase in demand for steel supports the prices of iron ore at a sufficiently high level. Already at the end of last week, there was a jump in quotations, as China released data on industrial production activity for February 2023. The official producing PMI for the month reached its highest record since April 2012, which was positive for the iron ore market and expectations for a recovery in demand.

The rapid lifting of restrictions on production in Tangshan and Handan also contributed to the increase in quotations. As early as March 2, China’s leading steelmaking centers resumed work again as air quality improved.

“The lifting of restrictions partially contributed to the increase in iron ore prices. In addition, raw material stocks at steel plants fluctuate at a relatively low level, which supports prices,” Haitong Futures analysts commented.

In the near term, iron ore prices will remain close to $130/t, as steelmakers cannot afford to buy iron ore at higher prices. Quotations of iron ore are rising faster than steel prices, and because of this, it is difficult for companies to make profits. In addition, the projected increase in steel production will hinder the increase in steel mills’ margins.

As GMK Center reported earlier, China’s iron ore market will face oversupply in 2023 as overall iron ore supply increases and demand from steel producers is likely to decrease. China’s domestic supply of ferrous metals, including production at local mines and imports, is expected to grow by 23 million tons y/y in 2023 – up to 1.41 billion tons. At the same time, the total demand in the current year is forecast at the level of 1.39 billion tons, which is 3.6 million tons less than the figure in 2022.