News Global Market scrap prices 1028 27 June 2023

Stagnation of the Turkish market due to macroeconomic problems continues

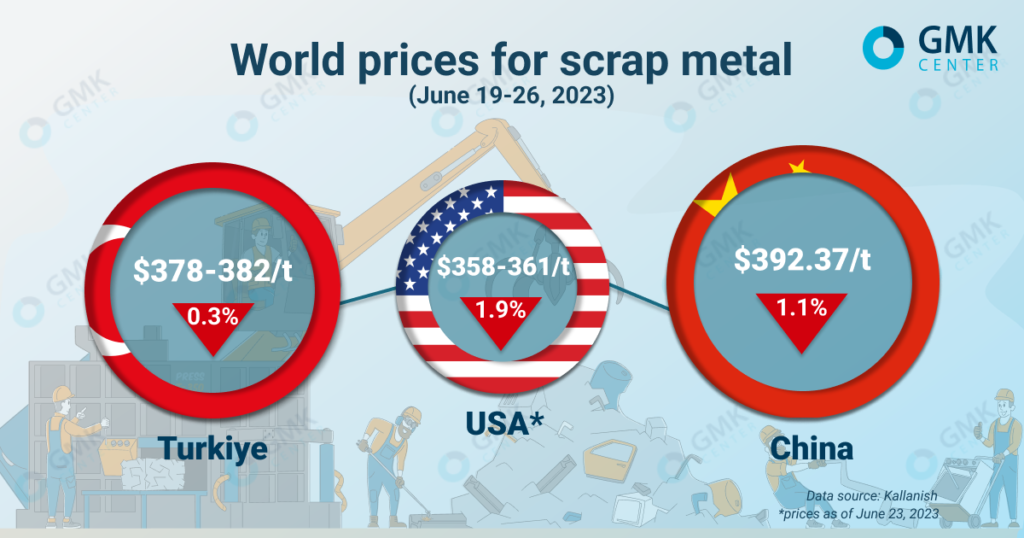

World prices for scrap decreased in most world markets last week. In Turkiye, market activity is limited due to macroeconomic issues that are putting pressure on finished steel sales and scrap demand, in the US scrap prices are falling due to weakened steel demand, and the Chinese market is flooded with raw materials due to the approaching public holiday.

Prices for scrap in Turkiye for the week of June 19-26, 2023, fell by $1/t, compared to the previous week – to $378-382/t. At the same time, scrap quotations fell to $380/t during the week, but slightly recovered at the June 26 auction. Thus, scrap prices remained almost unchanged compared to the previous week.

The Turkish market does not show significant changes due to limited activity. Raw material purchases are affected by uncertainty in the steel market and economic problems, in particular, an increase in interest rates, which did not reduce inflation as expected. On the contrary, the Turkish lira depreciated to historical lows. These factors increase the concern of the mills about the deterioration of their ability to finance their own needs.

Macroeconomic factors affect domestic and international demand for Turkish steel, which, in turn, increases pressure on raw material prices. According to market participants, if the government does not contribute to overcoming inflation, then the scrap may fall even to $340-350/t. At the same time, even at such levels, raw materials will not be in demand, since steelmakers have no idea about the future prospects of the steel market.

Currently, every steel plant has a problem with financing and crediting. The devaluation of the lira reduces the purchasing power of steel producers, and loans become unprofitable and scarce. Enterprises cannot transfer interest rate increases to buyers in conditions of non-competitiveness in export markets and lack of demand in the country. Thus, the situation may lead to unprofitability of steelmakers in the near future.

Until the end of June, activity in the Turkish market will be low as the public holiday of Eid al-Fitr begins in Turkiye, so commodity prices are likely to remain stable. Domestic steel trade is expected to resume after the holidays, so scrap prices may increase slightly. It is possible that the Central Bank will introduce additional interest rate hikes to contain the devaluation of the lira.

On the USA market for the week of June 16-23, 2023, prices for scrap fell by $7/t, or 1.9% compared to the previous week – to $358-361/t. At the same time, the forecast price for June 30 is $356-360/ton.

Quotations of American scrap still have not reached the bottom, according to market participants. Prices for low-grade commodities are expected to continue to decline through the end of the month and into the July auction amid ample supply. At the same time, forecasts are better for grades of higher-quality scrap – price stability is expected.

The US scrap market is currently being held back by subdued steel activity and uncertainty in export markets, particularly in Turkiye. Since the export volumes in June were not fully sold, the obsolete grades (from household items that were used) will be sold at about $20/t cheaper at the July auction.

At the same time, some US steel mills have recently announced their intention to raise quotations on HRC in order to prevent a further drop in steel prices. The prospects of such steps are still unknown.

Scrap prices in China for the week of June 19-26, 2023, suspended a three-week growth, and fell by 1.1% compared to the previous week – to $392.37/t. Such dynamics are connected with the fact that traders increased the supply of scrap to the market before public holidays.

During the week of June 14-21, 2023, the capacity utilization level of factories operating on electric arc furnaces increased by 2 percentage points compared to a week earlier – up to 52%. Average daily scrap deliveries to all steel enterprises of the country increased by 4.1% – up to 466.7 thousand tons, and average daily consumption increased by 3.5% – up to 488.6 thousand tons.

Confidence among scrap market participants is gradually declining amid seasonal drop in demand for steel in the summer. It is expected that steel mills will soon reduce their scrap stocks and increase the frequency of small purchases in order to flexibly respond to market changes.

Raw material imports were slow last week as overseas prices are higher than local prices.

As GMK Center reported earlier, Ukraine in January-May 2023 increased the export of scrap 3.1 times per year – up to 77.5 thousand tons. Scrap production decreased by 33.5% y/y – to 444.3 thousand tons. Scrap supplies to Ukrainian steel plants decreased by 44.3% y/y – to 345.7 thousand tons.