Interviews rolled steel with coating 6240 06 March 2023

The CEO of the Metipol company — about the situation on the Ukrainian market of rolled products with a polymer coating and its prospects

The Ukrainian market of painted rolled steel largely depends on business activity in the construction sector, which has decreased sharply due to the war. As a result, the volume of these products consumption fell by more than 50% last year. Although Ukrainian companies were able to increase their market presence to 18%, production decreased by almost 40%. At the same time, due to convenient logistics, the largest market share was given to European, not Chinese rolled steel. Denys Rysukhin, CEO of the Metipol company, informs GMK Center about it in an interview.

What was the situation on the Ukrainian market of rolled products with a polymer coating last year?

– The military aggression of the Russian Federation against Ukraine and its consequences strongly affected our market – due to the temporary stoppage of most commercial projects and residential construction, the demand for products fell sharply. The closure of ports led to the need to look for new logistics solutions, which in the first half of 2022 significantly increased in price, reducing the export competitiveness of Ukrainian products. There was also a significant increase in the cost of energy resources, and restrictions on the supply of electricity at the end of the year forced production to stop.

Due to the influence of the above factors, the volume of visible consumption of painted rolled steel in Ukraine in 2022 fell by 55.4% y/y – to 152.5 thousand tons compared to 342 thousand tons in 2021. The last time such a level of demand was recorded was in 2010.

What were the indicators of domestic production in 2022?

– The production of painted rolled products by national producers decreased by 38% y/y – to 37.5 thousand tons compared to 61 thousand tons in 2021. The dynamics of production of individual companies in 2022 was as follows:

- Heavy Metal – decrease by 10.5% y/y, to 15.8 thousand tons;

- Modul-Ukraine – decrease of 66.8% y/y, to 11.7 thousand tons;

- ROM LTD (estimated) – growth by 25% y/y, up to 10.1 thousand tons.

Production at the Heavy Metal plant declined as much due to a low comparative base in 2021. Logistical problems and proximity to the war zone also affected the results. The average capacity utilization of the plant last year was 30%.

Due to the peculiarities of production, the capacities of Modul-Ukraine are largely dependent on energy prices, the rise of which deprives products of competitiveness. In December, the enterprise stopped completely due to problems with the supply of electricity. The average loading of the enterprise in 2022 was only 17%.

Despite everything, Ukrainian producers were able to increase their market presence from 11% in 2021 to 18% in 2022. The share of Heavy Metal in the domestic market increased from 5% in 2021 to 8% in 2022, ROM LTD – from 2% to 5%. The specific gravity of Modul-Ukraine remained at the level of 6%.

Due to the decrease in the volume of production and the drop in the level of demand, deliveries of domestic producers products to the domestic market in 2022 mainly decreased:

- Heavy Metal – decrease by 0.9% y/y, to 12.4 thousand tons;

- Modul-Ukraine – a decrease of 56% y/y, to 9 thousand tons;

- ROM LTD (estimated) – growth by 6.3% y/y, up to 8.5 thousand tons.

What was the volume of painted rolled products exports last year?

– First of all, it is necessary to say about the big problems with logistics in the first half of 2022, which, in addition to the rest of the problems caused by the war, significantly complicated exports. Last year, the total export volume of rolled products with a polymer coating decreased by 44% y/y – to 11.1 thousand tons compared to 20 thousand tons in 2021. Heavy Metal indicators decreased by 23.2 y/y – to 4.1 thousand tons, and Modul-Ukraine – by 62.7 y/y, to 5.5 thousand tons. The volume of ROM LTD exports last year was estimated to be more than 1.5 thousand tons.

How did the war affect the structure of the domestic market?

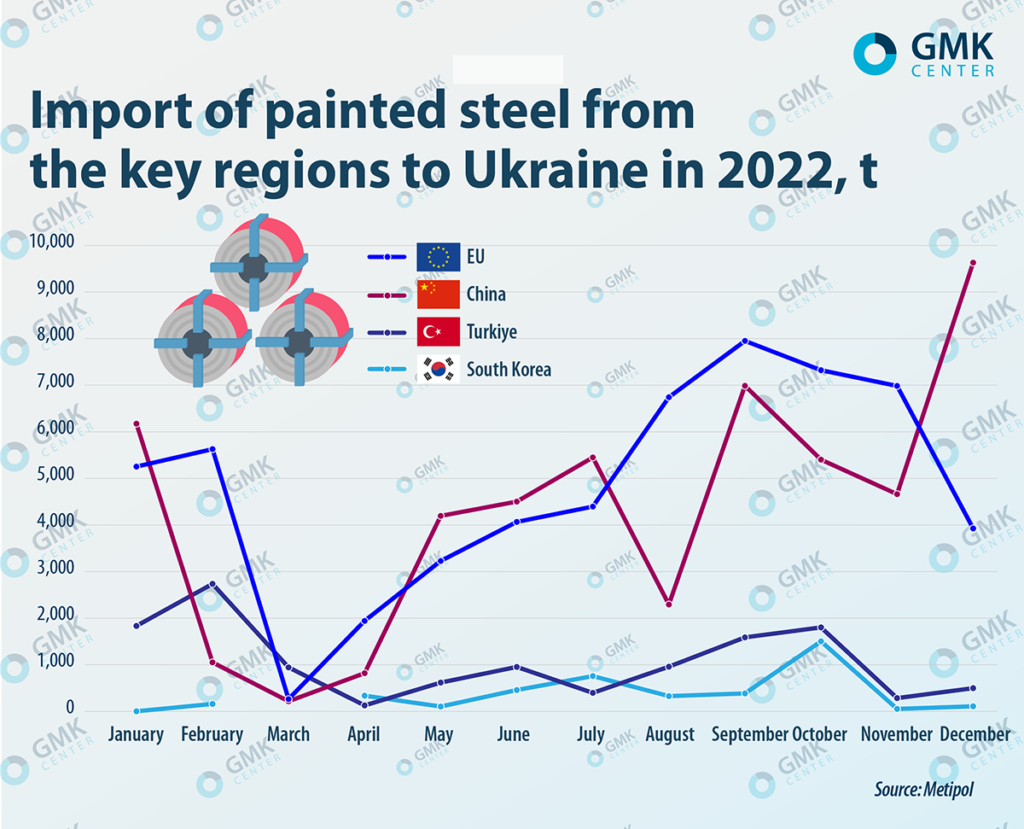

– In 2022, the structure of the domestic market of painted rolled products has changed significantly. The market leader was European rolled steel, the specific weight of which increased from 26% in 2021 to 37% in 2022. European producers delivered to Ukraine 57.7 thousand tons of rolled steel with a polymer coating, which is 35% less compared to 2021. The leadership of the European steel is due to the presence of the shortest logistics arm and the falling rate of the euro against the dollar.

Import of painted rolled products to Ukraine in 2022

The key sources of rolled products imports with a polymer coating to Ukraine in 2022 were:

- ArcelorMittal Poland – 43.7% (25.2 thousand tons);

- US Steel Kosice – 24.8% (14.3 thousand tons);

- Arvedi – 14.1% (8.1 thousand tons).

The share of rolled steel from China in the Ukrainian market decreased from 51% to 33% in 2022. In absolute terms, the drop was 73% – to 51.4 thousand tons. This is due to the blockade of Ukrainian seaports and the long-term redirection of container deliveries from China to European ports. This situation is a temporary phenomenon, by the end of the year the logistics with China were more or less fixed. In December 2022, the volume of imports from China already exceeded the import of rolled products with a polymer coating from Europe by 2.5 times – 9.6 thousand tons against 4 thousand tons. At the same time, the lion’s share of Chinese products does not meet the declared characteristics of the density of zinc coating application.

Thanks to convenient logistics, the share of Turkish products increased its share in the Ukrainian market from 5% in 2021 to 8% in 2022. The volume of deliveries was 12.7 thousand tons (-25% by 2021). However, this applies mainly to non-standard items – these are products made of structural grades of steel, rolled products with special widths, etc.

What was the price situation in the market in 2022?

– The dynamics of prices for painted rolled products corresponded to global trends: high prices in the first half of the year, which were replaced by a sharp drop of 27% by the end of the year. This became an additional negative factor in our market.

The customs value of painted rolled steel import to Ukraine in 2022

Short logistics and a low exchange rate of the euro made European rolled steel prices very attractive to consumers. In the second half of the year, the price decreased from $1,900/t to $1,450/t.

Chinese rolled steel has suffered due to complex and expensive logistics. By the end of the year, its price dropped below $1,200/ton. The usual price difference between segments of 25-30% in certain time periods of 2022 ranged from 6% to 32% and leveled off only at the end of the year. This was facilitated, in particular, by a significant decrease in the cost of container transportation.

In December, the decline in the prices of painted rolled steel stopped, and then at the beginning of the current year, they began to rise.

In 2022, the opening of several plants for the production of painted rolled products was announced. It was expected that you would open one of them at the site in Bila Tserkva. However, none of this happened. What is the current situation with your and other projects?

– Earlier it was planned that two steel painting lines would be launched by the end of 2022. Our line, which we planned to install by the end of last year, was not imported to the territory of Ukraine. We are waiting for better times to decide on its further use.

As far as I know, the second line, which was supposed to be operational near Kharkiv, has been taken to a safe region, and now the issue of its launch is being resolved.

How have the logistics of Turkish rolled steel delivery, which you use in production, and the export of your products changed?

– Today, the Black Sea seaports work exclusively for grain. River ports on the Danube got a new life. Through them, we can receive steel from Turkiye, but we have to wait in huge queues among priority grain producers.

Containers today can be obtained in several ways:

- Through the port of Constanța (Romania) – then by car via the ferry from Romania.

- Through Poland – by motor vehicle across the western border or by rail (this is how they work more and more often).

What are the results of the Interdepartmental Commission on International Trade anti-dumping investigation against Chinese painted rolled products?

– In the conditions of martial law, this anti-dumping investigation was practically not conducted. As other similar investigations were not conducted. Interdepartmental Commission on International Trade met, but our issue was not considered. Currently, it is impossible to name any deadlines for its completion.

How do you see the Ukrainian painted rolled market in 2023?

– We expect to increase the production of rolled steel at our enterprises this year. The planned production rate for Heavy Metal for 2023 is set at 32 thousand tons, for Modul-Ukraine – 18 thousand tons.

Overall, our key expectations for the market in 2023 are as follows:

- the return of Chinese products dominance thanks to the low price;

- the increase in the price of products as the warehouses of profiling companies are replenished;

- the impossibility of forecasting the level of demand due to hostilities;

- the problem of the impossibility of replacing employees due to mobilization;

- the consequences of the earthquakes in Turkiye will not globally affect the state of the market, only the timeliness of the execution of some orders.