Infographics China 5754 18 December 2024

Cheap Chinese steel is actively flooding the global market, creating challenges for local producers

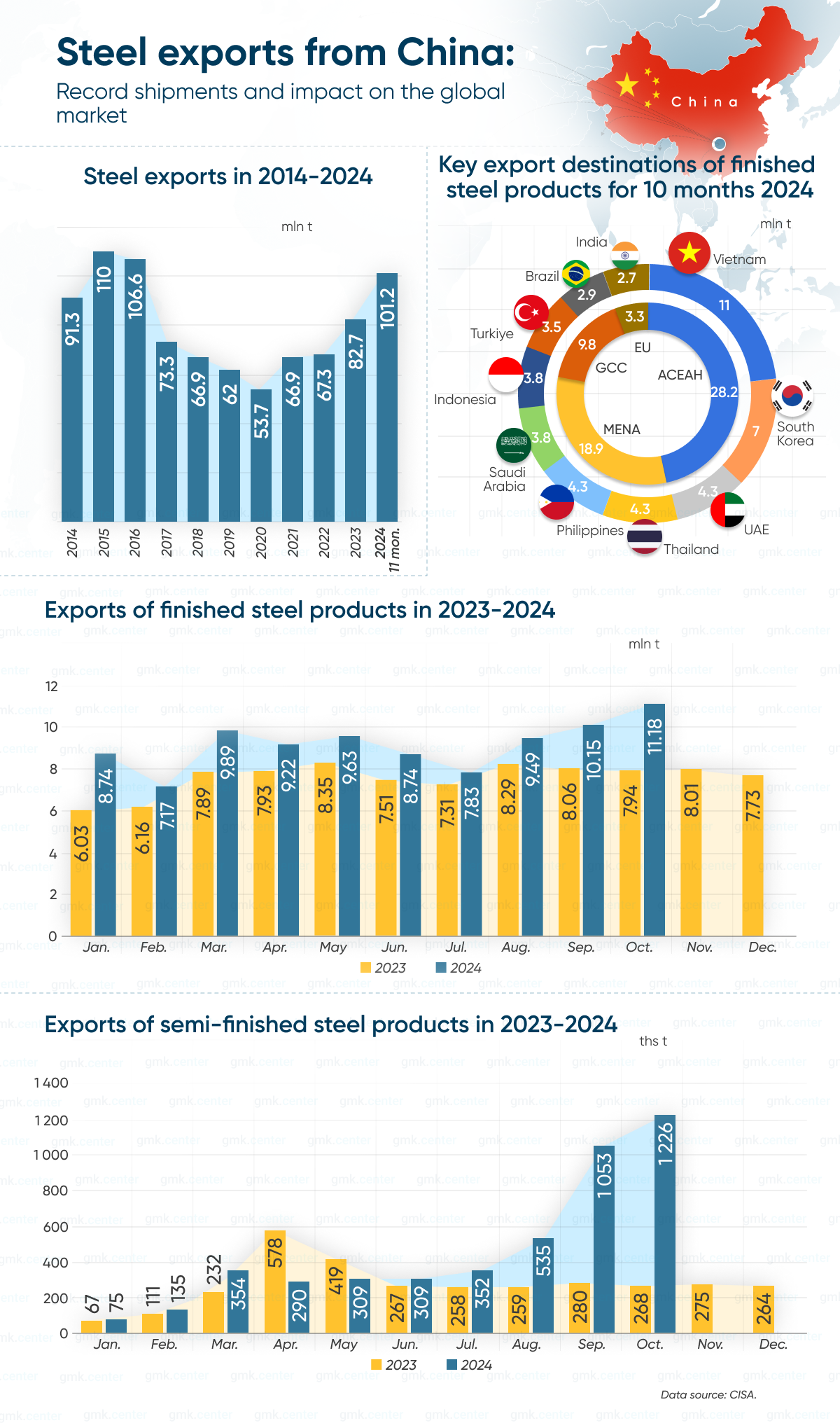

China’s steel exports are likely to surpass the 2015 record of 110 million tons in 2024, reaching over 111 million tons (+23% y/y). In January-November, shipments already amounted to 101.2 million tons, which is 12% higher than the total 90.3 million tons in 2023. The surge in Chinese steel exports occurred in 2023-2024, while in 2021-2022, volumes stabilized at 66-67 million tons.

The sharp increase in exports is due to a weakening domestic market, mainly because of economic difficulties and weakness in the construction sector. Despite numerous stimulus measures from the government, construction in China continues to decline, forcing steelmakers to sell surplus products to foreign markets at prices that are unattainable for competitors.

Chinese producers are rapidly gaining global market by taking advantage of large-scale production and relatively cheap labor. According to analysts, Chinese steel is 10-20% cheaper than products from competitors in the US, EU or other Asian countries. This allows Chinese exporters to displace local producers, especially in developing countries where the industry is less protected from price dumping.

In 10m 2024, China’s exports of finished steel reached 92.06 million tons (+22% y/y), and semi-finished products – 4.64 million tons (+69.3% y/y). The growth in shipments has been particularly noticeable since the beginning of the third quarter, with exports of semi-finished products increasing to 1.05 million tons in September and 1.23 million tons in October, while at the beginning of the year these volumes were estimated at 70-300 thousand tons.

The largest volumes of steel finished products in the first 10 months of 2024 were shipped to Vietnam, South Korea, the UAE, Thailand and the Philippines. These countries accounted for more than 33% of total exports for the period. The main consumers of semi-finished products include Italy, Taiwan, Djibouti, Saudi Arabia, and Indonesia.

Countries facing an uncontrolled influx of Chinese steel are taking active measures to protect domestic producers. The European Union, for example, has repeatedly imposed anti-dumping duties on Chinese steel and is considering new restrictions on the import of certain categories of products. The United States also maintains a tough tariff policy, in particular, it maintains duties of up to 25% on steel imports from China. The gradual tightening of such measures is forcing Chinese producers to ship as much product as possible before the restrictions come into effect, reflecting the significant increase in exports over the past two months.

In addition to customs barriers, some countries are trying to invest in the modernization of their steel mills to increase their efficiency and competitiveness.

The continued growth of steel exports from China poses systemic challenges for local producers around the world. The global market, which is already experiencing an oversupply, may face a decline in steel prices to their lowest levels in the last 10 years.

“The systemic challenge for steel producers in the EU and other countries is finding and developing their own sources of competitiveness. Competition can not be won only through trade barriers or technical restrictions – these instruments may only postpone the problem. One way or another, it will be necessary to improve efficiency and reduce production costs. We shouldn’t hope that the problem will disappear if China reduces steel production and increases domestic consumption – in this case competitiveness of European steelmakers will not rise automatically”, comments Stanislav Zinchenko, CEO of GMK Center.