Posts Industry ferroalloys 3462 28 November 2023

The ferroalloy industry has significant potential and needs investment

Ferroalloys are used to improve the characteristics of steel (tensile strength, corrosion resistance, etc.). In particular, they are important for the production of stainless steel, which is used in construction, automotive, energy and other industries. Ukraine has a vertically integrated complex – from iron ore mining and processing to ferroalloys production. However, the Russian Federation’s full-scale aggression has hit Ukraine’s ferroalloy industry hard – as of November, all enterprises in the industry have stopped working for various reasons.

Global market

The world’s largest producers of ferroalloys are China, Kazakhstan, Bharat, South Africa and Russia. China is the largest producer and consumer of ferroalloys – their production in China is about 36 million tons per year, which is more than 78% of the world output (46-47 million tons). In January-October, the output of ferroalloys in China increased by 1.7% year-on-year – up to 28.8 million tons.

The most important region for the global ferroalloys market is Asia-Pacific, which accounts for more than 60% of global demand. Apart from China, which accounts for more than 35% of global demand, other major markets in this region include Bharat, Indonesia, Malaysia, Japan, and others.

European ferroalloys

The EU is not a world leader in ferroalloys production, its production capacity is only 1.8 million tons. Last year, the European ferroalloy industry was hit very hard by high energy prices – the cost of electricity accounted for up to 40% of production costs. In particular, in September-2022, due to rising electricity prices in the EU, 479 thousand tons of ferroalloys production capacity, or 27% of the projected volumes, was shut down.

In addition, the industry is under pressure from CO2 emission costs. According to the ERCST study, the economic viability of the industry will be threatened if the price of carbon allowances is above €86/t (€75.2/t as of November 27, 2023). The study, which took into account lower energy costs, found that industry costs could reach unmanageable levels by 2030.

Given the energy intensity of production, the specialized European association Euroalliages advocates limiting taxes and additional charges on electricity and gas, as well as increasing state funding for energy-intensive industries.

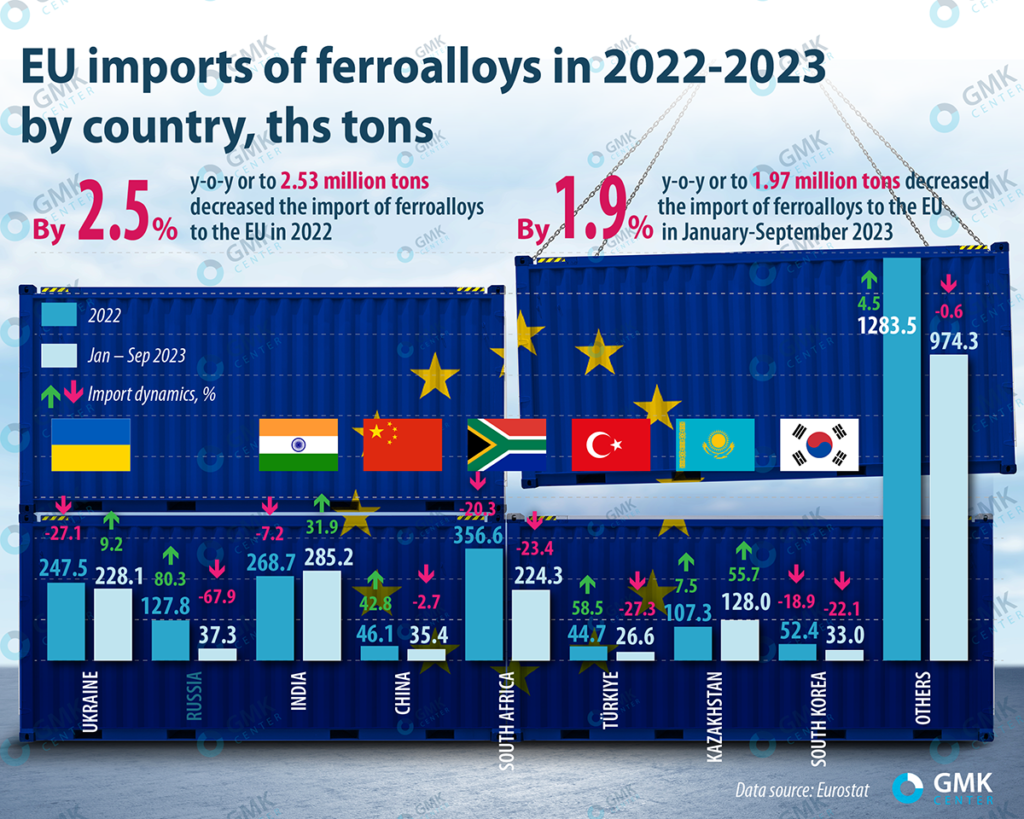

The war in Ukraine did not affect the dynamics of ferroalloy supplies to the EU and only slightly changed the country structure. Kazakhstan, India and others were able to increase their supplies to the EU in 2022-2023. Although the European sanctions against Russian steel industry did not affect ferroalloys, the share of supplies from Russia decreased from 5% last year to 1.9% in the first nine months of 2023. Over the same period, India’s share grew from 10.6% to 14.5%. The share of imports of ferroalloys from Ukraine increased from 9.8% in 2022 – to 11.6% in January-September 2023.

According to Eurostat, imports of ferroalloys in the EU in 2022 decreased by 2.5% y/y – to 2.53 million tons, for January-September 2023 – by another 1.9% y/y, to 1.97 million tons. In the first nine months of 2023, ferroalloys supplies to the European market increased:

- Kazakhstan – by 55.7%, to 128 thousand tons;

- India – by 31.9%, to 285.2 thousand tons;

- Ukraine – by 9.2%, to 228.1 thousand tons.

In January-September 2023, they reduced their supplies of ferroalloys to Europe:

- Russia – by 67.9%, to 37.3 thousand tons;

- Türkiye – by 27.3%, to 26.6 thousand tons;

- South Africa – by 23.4%, to 224.3 thousand tons;

- South Korea – by 22.1%, to 33 thousand tons;

- China – by 2.7%, to 35.4 thousand tons.

Ukrainian ferroalloys

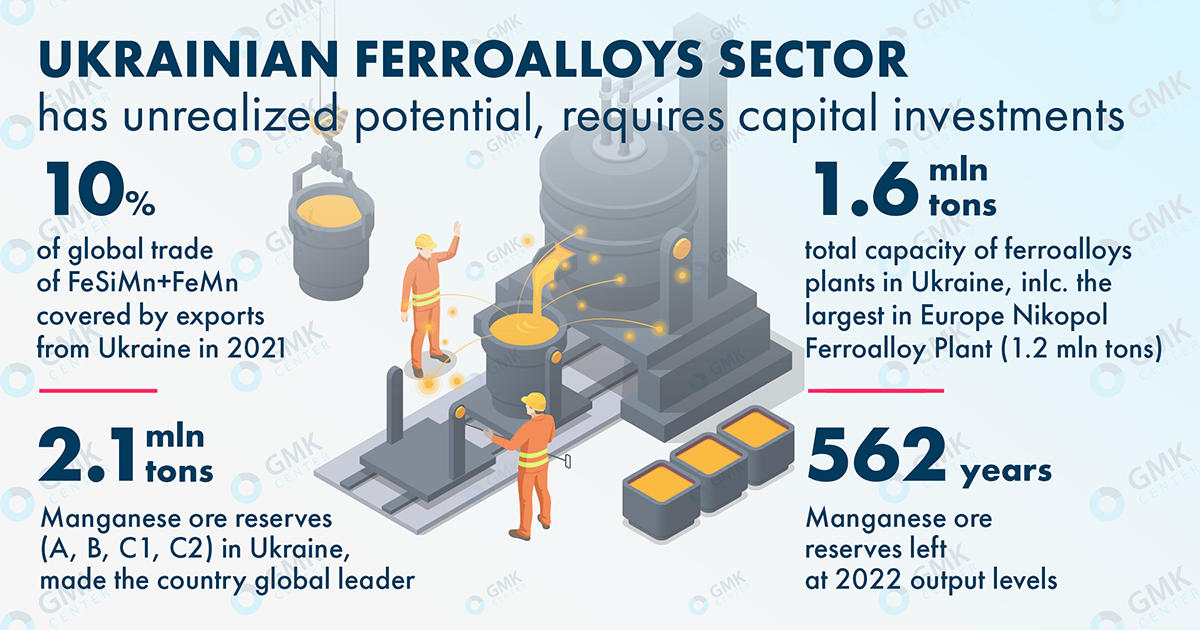

The Ukrainian ferroalloy industry is represented by quite powerful enterprises:

- Nikopol Ferroalloy Plant (NFP, the largest in Europe) – with a capacity of 1.2 million tons of products per year;

- Zaporizhzhia Ferroalloy Plant (ZFP) – up to 400 thousand tons of products per year;

- Pobuzhsky Ferronickel Plant (PFP) – up to 100 thousand tons of ferronickel and 7-20 thousand tons of nickel per year;

- Pokrovsk Mining and Processing Plant (PGOK) – processing up to 9.3 million tons of manganese ore per year;

- Marganets Mining and Processing Plant (MGOK) – processing up to 7 million tons of manganese ore per year.

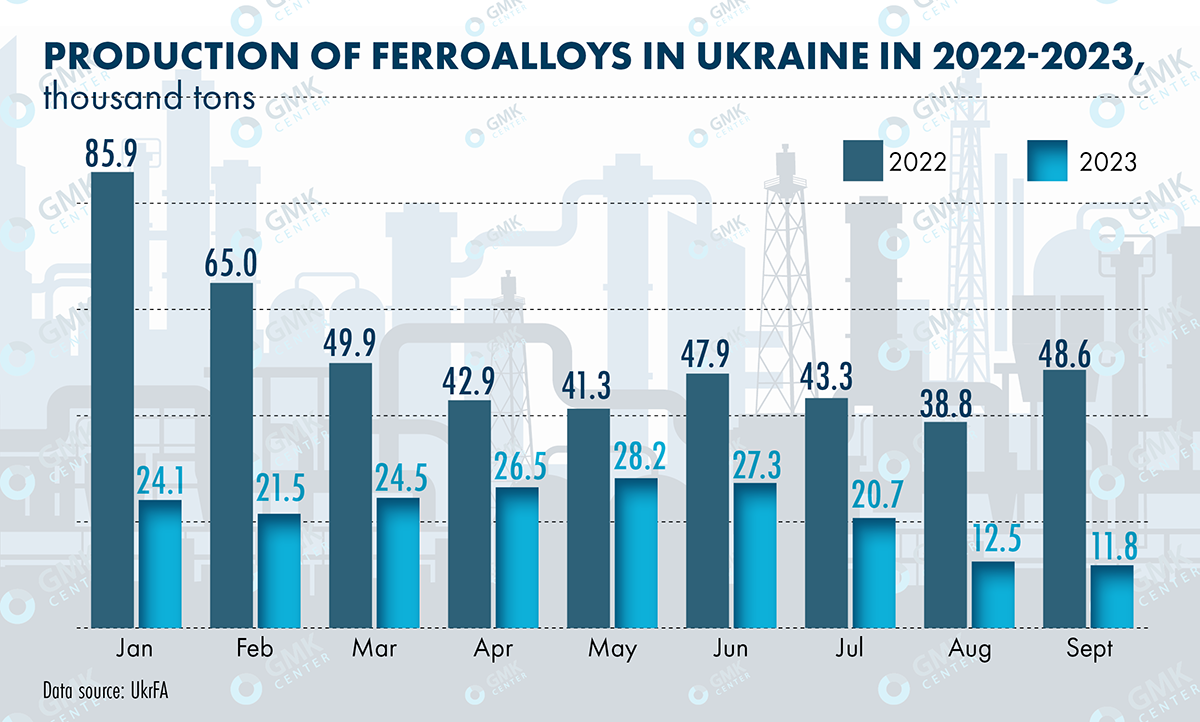

However, the war led to a significant drop in production in the industry. In January-September 2023, the output of ferroalloys in Ukraine compared to the same period last year collapsed by 57.5% – to 197.1 thousand tons. In pre-war 2021 ferroalloy enterprises of Ukraine increased output by 15% compared to 2020 – up to 858.7 thousand tons.

The situation in the industry has deteriorated significantly over the past few months. Thus, in August and September 2023, compared to the same months last year, the output of ferroalloys collapsed by 67.8%, to 12.5 thousand tons, and by 75.7%, to 11.8 thousand tons. While the average utilization of the industry’s enterprises was at the level of 30% in 2022, in September 2023 it was only 9%.

Full stop

By early November 2023, the entire vertically integrated ferroalloy complex of Ukraine actually stopped working. In October, PGOK and MGOK suspended mining and processing of manganese ore. Since the beginning of November, the production block – NFP and ZFP – has also stopped.

The formal reasons for the shutdown of ferroalloy capacities were:

- Lack of guarantees of constant energy and water supply in winter.

- The need for repair work.

- Problems with product sales and logistics.

“In order to ensure stable operation of the enterprise, electricity and water supply must be guaranteed. Taking into account the experience of the previous winter period in conditions of power supply limitations, the need to provide heat to the residents of the region, to reduce the load on the power grid of the region and Ukraine, as well as the presence of ferroalloys inventories in the warehouses of the enterprise, it was decided to stop the furnace units for repair work. This is done in order to prepare the equipment for stable operation at the end of the heating season. The decision was made taking into account the orders of domestic customers for this period, which will be supplied with available ferroalloys residuess,” ZZF emphasizes.

Ferroalloy enterprises have worked with reduced capacity utilization and interruption of production processes before. In the summer of this year, NFP reduced output due to the need to reduce water consumption after the Kakhovskaya HPP dam was blown up. And in the fall-winter season of 2022/2023 the enterprises of the industry partially or completely stopped work due to disruptions in energy supplies.

PFP has not produced ferroalloys since November 2022, as the enterprise depends on imported raw materials and cannot ensure their stable supplies amid impossible delivery through seaports

Focus on Europe

In January-September 2023 ferroalloy enterprises of Ukraine increased exports of products by 14.6% y/y – to 325.1 thousand tons, despite the decline of ferroalloy production. Due to logistical reasons, the main markets for Ukrainian ferroalloys are European countries. Ferroalloys supplies from Ukraine to the EU in 2022 decreased by 27.2% – to 237.5 thousand tons, but in January-September 2023 increased by 9.2% – to 228.1 thousand tons.

Over the nine months, ferroalloys exports from Ukraine were mainly to Poland (54.7% in financial terms), Turkiye (12.7%) and the Netherlands (8.5%). Notably, the share of exports to Turkiye reached almost 13% compared to 5% in 2022, while the share of MENA countries fell to 6% from the pre-war 30%.

The significant decline in production in the last few months is a direct threat to exports. For example, in August and September 2023, compared to the same months last year, ferroalloy exports fell 23.5% to 13,000 tons and 46.4% to 12,600 tons, respectively. Suspension of production from November threatens to stop ferroalloy exports completely.

Ferro prospects

In the long term, analysts expect the global ferroalloys market to grow. This is due to the growing demand for specialty steels in a wide range of industries such as electronics, automotive, construction, medical devices and aerospace.

Although estimates for the global ferroalloys market growth vary significantly, but the dynamics of increase is quite high. For example, RationalStat estimates that in 2022, the global ferroalloys market was valued at $48.1 billion. It is expected to grow at a compound annual growth rate of 7.1% through 2030 to reach $83.2 billion by the end of the period. At the same time, Market Research Future forecasts that the global ferroalloys market will grow at a compound annual growth rate of 5.6% between 2022 and 2030 to reach $187.2 billion by 2030.

In turn, the prospects for the ferroalloy industry in Ukraine depend on many factors. On the one hand, with a proper level of cooperation and planning, the Ukrainian ferroalloy industry could play a major role in the European metallurgy. For example, increased utilization of ferroalloy plants could be facilitated by the growth of exports to the EU as a substitute for products from Russia. However, the volumes of Ukrainian capacity and Russian ferroalloy exports are not comparable. The total capacity of NFP and ZFP is about 1.6 million tons, which is slightly less than all ferroalloy production facilities in the European Union. In turn, the volume of ferroalloys imported to the EU from Russia in the first nine months of this year amounted to only 37.3 thousand tons (-67.9% y/y).

On the other hand, it is still difficult to predict how the Ukrainian ferroalloy industry will emerge from the period of forced shutdown in spring 2024 (as planned). The situation is influenced by many economic variables and military risks. Despite the martial law and the complexity of the economic situation, the government could have a positive impact on the development of the industry, all capacities of which have stopped working for various reasons.