Posts Global Market hot-rolled prices 2331 14 September 2023

Quotas for the IV quarter are likely to be filled in early October, which will affect prices in the EU

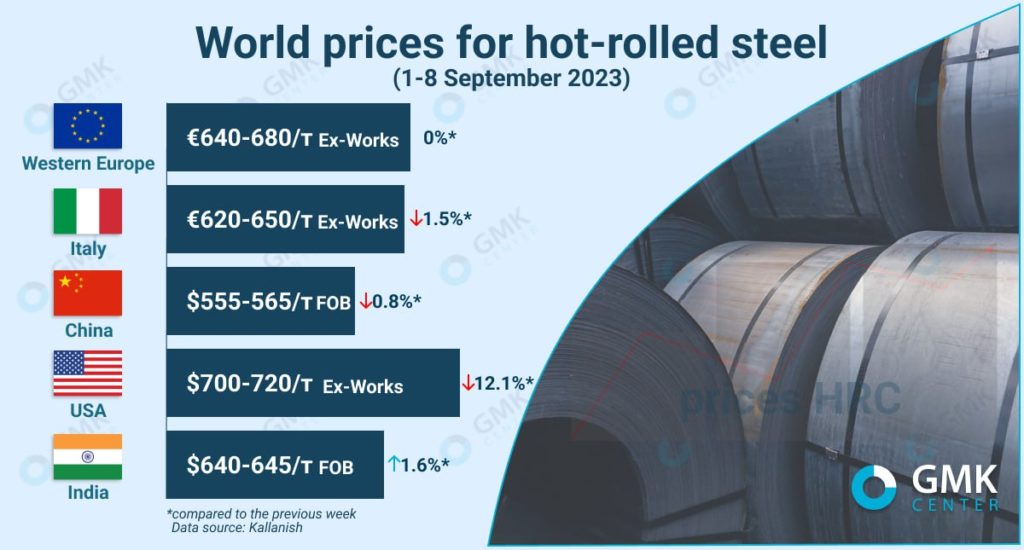

In Western Europe, the upper price range for hot-rolled sheet, according to the price indicator Kallanish, remains unchanged since the beginning of August – €680/t EXW, the average price at the end of last week (September 1-8) was €660/t.

European market

On the Italian market, HRC quotations on September 1-8 decreased by 1.5% compared to the previous week – to €620-650/t EXW, according to the forecast, they will remain unchanged until the end of the current week. In general, the price of HRC in Italy has been in the upper range of €650-660 since mid-July.

European HRC buyers continue to refrain from buying these products, despite lower offers from some factories, notes Fastmarkets. Distributors are focused on reducing inventory amid negative market trends. Sources in the market say that the issue is not the price, but the lack of demand for these steel products.

Italian HRC producers have taken a wait-and-see attitude in view of the weak market. One of the local integrated mills still has the ability to offer hot-rolled coil for delivery in early October, indicating short order books.

The market believes that September will be a month with very few transactions, and the influx of imports in October will affect European prices.

It is expected that the quotas for the fourth quarter will be filled already in the first days of October, as significant volumes were waiting for customs clearance in European ports. So buyers are looking to sell current stocks before cheaper products will be cleared by customs. There is a possibility that steel mills in Europe will try to extend maintenance to prevent prices from falling.

«We adhere to the position that the demand from the end consumers in the flat rolled segment in the EU is stable. This is confirmed by data on production in the main sectors of consumption. But market players do remain pessimistic and cautious, wary of an influx of imports in October. But the price of imports from Asian countries is increasing amid more expensive raw materials. It is difficult to make assumptions about non-customs-cleared rolled steel in ports, as its volumes are unclear. This may turn out to be a kind of market horror», noted the chief analyst of GMK Center Andriy Tarasenko.

US prices

The US steel market has recently been pressured by a possible strike by the workers of the Big Three car producers (Ford, General Motors and Stellantis) – the companies have not yet agreed with the union (United Auto Workers) on the levels of wage increases and social guarantees. According to Argus.Media, HRC prices in the US continued to fall earlier this week amid uncertainty about demand and where it will go.

According to the price agency, there were deep discounts on potential tonnages of 2 to 20,000 tons.The lowest recorded price for larger volumesin question was $610 per short ton, but there was no confirmation of any deals. The lead time for hot-rolled coil orders from American producers was 4-5 weeks.

However, as Kallanish writes, some sources in the market believe that a potential strike by auto workers will have minimal impact on domestic steel production in the US. At the end of last week, the price of steel coils in North America fell by 12.1% compared to the previous week – to $700-720/t EXW.

HRC prices, GMK Center

Demand in India

Indian mills have good demand for hot-rolled coil in the domestic market and better prices, which are forecast to grow further. Therefore, the country’s steel mills set export quotations equal to domestic ones, which foreign buyers consider unacceptable amid the availability of cheaper options. According to SteelMint, at the beginning of the current week, Indian HRC offers to the EU remained stable compared to the previous week at $690-695/t CFR Antwerp.

The situation in China

In China, during the past week, the price of hot-rolled steel continued to fall amid low demand, which is not typical for September. In addition, after several weeks of growth, HRC production also fell. Factories also accelerated deliveries to retailers to relieve pressure on inventories. The decline in domestic prices and the devaluation of the yuan began to affect the export prices of Chinese steel products. On September 8, HRC quotations in China were $555-565/t FOB, which is $5/t less than the previous week.

According to SMM, HRC purchases by Chinese steel companies were cautious at the start of this week as market players were skeptical about further improvement in consumption. Trading sentiment was positively influenced by macroeconomic data for August. Given the prices of raw materials, HRC prices are unlikely to fall significantly, but the imbalance between supply and demand is expected to increase.