Posts Global Market electricity prices 9240 09 June 2023

Electricity demand continued to decline in most markets in May 2023

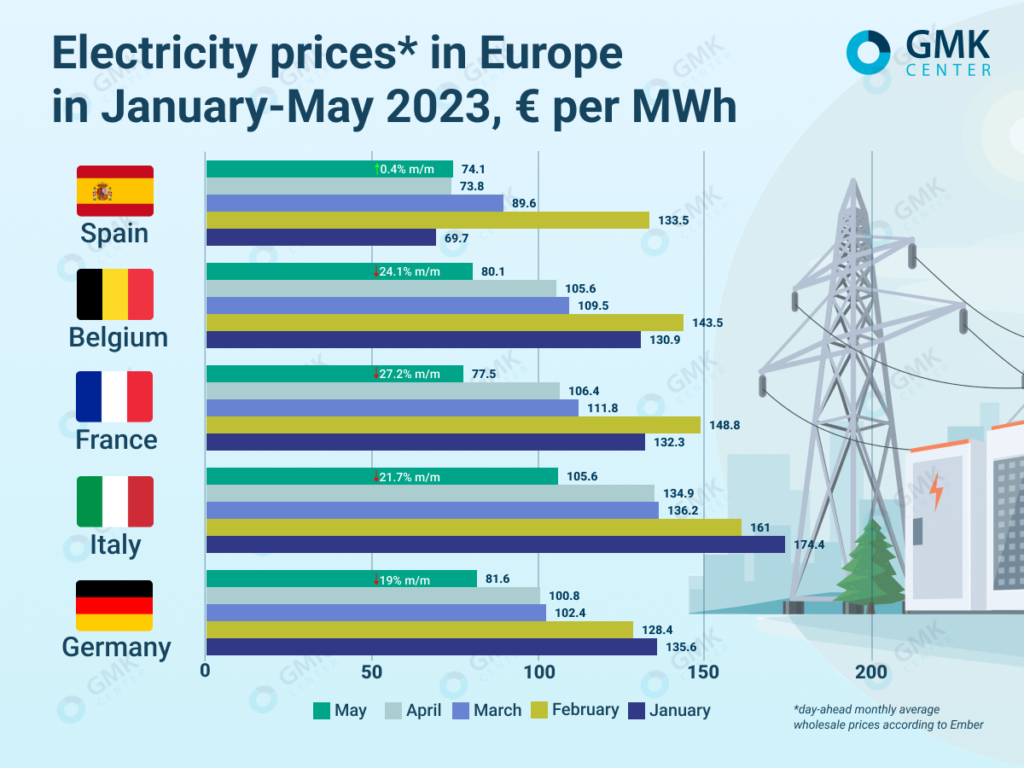

In the EU, average monthly wholesale prices for the day ahead, according to Ember, in May were:

- Italy – €105.6/MWh (-21.7% m/m);

- France – €77.5/MWh (-27.2%);

- Germany – €81.6/MWh (-19%);

- Spain – €74.1/MWh (+0.4%);

- Belgium – €80.1/MWh (-24%).

In the UK, according to Nordpool, the monthly average day-ahead spot price in February was €93/MWh.

Electricity prices in Europe, January-May 2023, GMK Center

According to AleaSoft Energy Forecasting’s analysis, a significant decrease in the price of electricity in European markets (with the exception of Spain with a slight increase of 0.4%) compared to April resulted in a drop in gas prices and a decrease in demand in most countries. At the same time, compared to the previous month in Europe, there was a decrease in the production of wind or solar energy, which limited the fall in prices.

In May, a decrease in demand for electricity was observed in most markets, the most in France (by 14% m/m). It slightly increased only in Italy, Spain and Portugal – by 0.8%, 1.5% and 1.6%, respectively, compared to April.

The decrease in the price of CO2 emissions contributed to the decrease in the price of electricity last month (the average price of the base contract for emissions in December 2023 in May was €86.05/t, which is 6.9% lower than the average price in April).

EU measures

At the end of May, the European Commission (EC) called all EU countries to curtail current energy support measures by the end of 2023 in order to keep budget and fiscal targets within the recommended limits. If new energy price hikes require them to be implemented again, these measures should be aimed at protecting vulnerable households and companies, be affordable from a financial point of view and preserve incentives for energy savings, the EC said in a statement.

At the beginning of June, the European Commission also announced that decided not to propose a continuation of the pan-European emergency measures that were introduced at the end of 2022 to protect consumers from a sharp rise in energy prices. It is about the limits of the marginal income of power plants, the mandatory goal of reducing electricity consumption by 5% during peak hours, and limiting retail prices.

In its report, the institution acknowledged that these temporary anti-rice measures helped calm European energy markets. Electricity prices have now fallen to less than €80/MWh, and gas prices have not only fallen, but stabilized to the extent that the spikes in electricity prices seen throughout 2022 are considered less likely next winter.

Germany

At the end of May, German steel producers and the steelworking industry called on the authorities to contribute to the establishment of the general upper limit of the industrial price for electricity at €0.04/kWh. The industry federation Wirtschaftsverband Stahl-und Metallverarbeitung (WSM) criticized the federal government for proposing a limit of €0.06/kWh. The offer is limited to energy-intensive industries, and many federation members will not meet these criteria.

Tthis plan was proposed by the Minister of Economy of Germany Robert Habek at the beginning of May. According to it, 80% of the electricity needs of energy-intensive industries should be met at a subsidized price. It was suggested that the measure should be in effect until 2030. On May 22, Habek announced that the plan is likely to cost around €4 billion per year and is planned to be financed through the German Economic Stabilization Fund (WSF). However, the economy minister is facing resistance to his proposal from coalition partners in the government, who are concerned about its potential impact on the budget.

Meanwhile, Euractiv writes, according to research by the German Business Federation (BDI), more companies are moving jobs and production abroad, and many others are considering following suit. Almost two-thirds of firms surveyed by the organization consider energy and resource prices to be among the most pressing challenges. In addition, there are concerns about the country’s economy and competitiveness.

At the same time, the head of the German energy company RWE Marcus Crabber expressed concern, that critical industrial enterprises may leave the country, as Germany will continue to face electricity shortages due to the closure of the last nuclear plants, which will lead to a sharp rise in prices.

Italy

Germany’s plans to subsidize the price of electricity and help industry finance green transition projects (the total fund will be about €50 billion) are causing concern in other countries.

In particular, according to the Italian association of steel producers Federacciai, the German limit on the price of electricity for enterprises may threaten the future of the Italian steel industry. President of the Federacciai Antonio Gozzi on the sidelines of a profile event on energy market issues noted, that more powerful countries in terms of budgets have resources that Italy probably cannot afford. At the same time, this means that the country at the European level should claim to preserve the single market and the impossibility of introducing competitive asymmetry.

Gas prices

In mid-May, according to the London ICE exchange, gas prices in Europe fell to a two-year low, falling below $350 per 1,000 cubic meters for the first time since June 7, 2021. However, at the beginning of June, they jumped due to supply problems in Europe and steady growth in demand in the US and some Asian countries. However, analysts point out, that natural gas prices continue to remain lower than last year, and the latest changes are seasonal, mainly observed in June-July. Index of gas storage capacity of the European Union countries, according to the AGSI platform, as of June 1, 2023, in general in the EU was almost 70%.