Posts Global Market electricity prices 3655 11 December 2023

The exceptions were the Pyrenean market and Italy with record solar generation for November

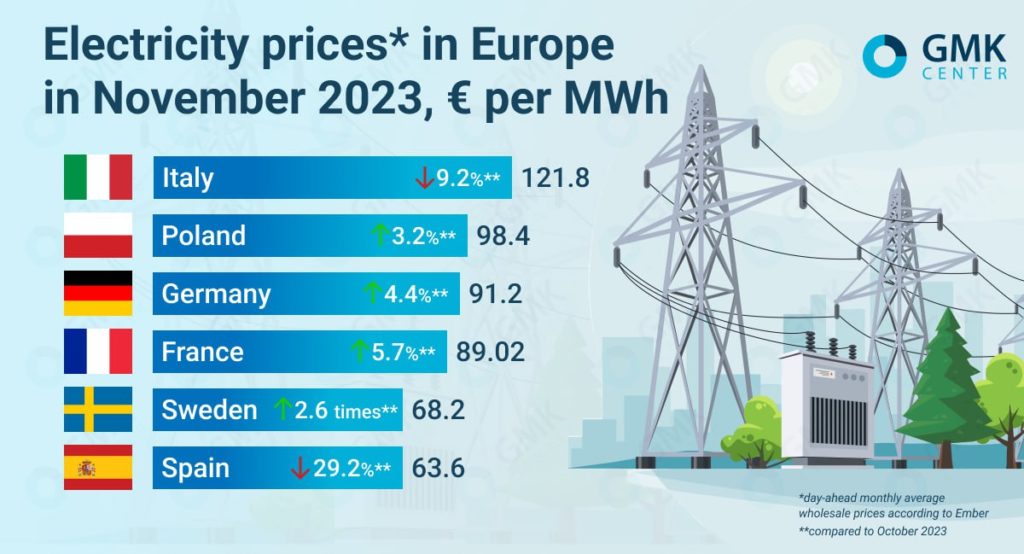

In the EU, average monthly wholesale day-ahead prices in November increased in most countries (except for Portugal, Spain, and Italy) compared to October. The Scandinavian market registered a significant increase, in particular, in Sweden, the cost of electricity increased by 2.6 times compared to October.

According to Ember, prices were:

- Italy – €121.8/MWh (-9.2% m/m);

- France – €89.02/MWh (+5.7%);

- Germany – €91.2/MWh (+4.4%);

- Spain – €63.6/MWh (-29.2%);

- Poland – €98.4/MWh (+3.2%);

- Sweden – €68.2/MWh (+2.6 times).

Electricity prices in November, GMK Center

November trends

As AleaSoft Energy Forecasting noted, the average November figure in Spain and Portugal was the lowest since March 2021, while prices in the Northern European markets were the highest since April this year.

In the Spanish, Portuguese and Italian markets, demand growth last month was the lowest compared to October. In addition, solar energy production in these countries broke records for November, and wind generation in Italy was also record-breaking.

In the Scandinavian countries, temperatures in November fell well below historical averages. This led to an increase in demand for electricity, in particular, in Sweden last month, consumption reached a maximum of 8 months. According to Argus.Media, reached a three-year high last month, this did not have a significant impact on spot electricity prices – in these countries, they rose significantly as production at gas-fired power plants increased, while wind generation fell significantly.

In Ukraine, the weighted average price of electricity on the day-ahead market (DAM) increased by 7.2% m/m in November this year to 4357.8 UAH/MWh (€110.04 at the exchange rate of 39.6 UAH/EUR), according to the Market Operator.

EU measures

In November 2023, the European Commission extended the scheme for six months (until June 2024), which allows EU countries to provide assistance to companies affected by energy price spikes caused by Russia’s invasion of Ukraine. The scheme was introduced in March 2022 and was due to expire on December 31, 2023.

This temporary measure allows the bloc’s member states to provide various forms of financial assistance to compensate companies affected by high gas and electricity prices. Although energy prices have stabilized since last year, the EC noted that «energy markets remain vulnerable» as the war in Ukraine and broader geopolitical tensions continue to be sources of uncertainty. However, Brussels noted that EU countries can continue to support Ukraine by covering part of the additional energy costs only as long as energy prices are significantly higher than pre-crisis levels.

In addition, at the end of November, the European Commission proposed a plan to increase investment in European power grids (Action Plan for Grids). The bloc estimates that electricity consumption in the EU will grow by about 60% between now and 2030. This decade, Europe will need to invest €584 billion to upgrade its distribution networks, given that 40% of them are over 40 years old. Many of them need to be adapted from the traditional model of fossil fuel power plants to energy from renewable sources.

«Europe will ensure its energy security and meet its climate ambitions only if our energy infrastructure expands and evolves to be suitable for a decarbonised energy system. Networks should be a means, not a bottleneck in the transition to clean energy,» noted Kadri Simson, EU energy commissioner.

Germany

At the end of November, the German government announced that the €200 billion Economic Stabilization Fund, which subsidized electricity and gas prices for households and businesses, would be closed at the end of this year. The energy price curbs will not be extended until March 2024, as the country’s parliament had previously agreed to extend the measure. This has caused dissatisfaction among the coalition partners.

The German government faced the need to take difficult steps after a court ruling declared unconstitutional the redistribution of €60 billion from unused coronavirus funds to the Climate and Transformation Fund (KTF), which left the government with a budget gap and complicated Berlin’s ability to provide state support to companies next year.

At the same time, German businesses have significantly reduced their investment plans for the current year and 2024. This is evidenced by a study by the Ifo Institute in Munich, the FT reports. The study was based on responses from 5 thousand companies. The largest reduction in investment plans was found in the manufacturing sector, where the investment index fell from 21.4 in March to 6.8 in the latest report.

The budget crisis in Germany, among other things, threatens the planned support for domestic solar panel manufacturers, Reuters reports. As part of efforts to reduce dependence on China and stimulate economic growth, in June this year, Berlin announced plans to support companies that want to create or expand solar energy production capacity in the country. About €2.5 billion was earmarked for the program. Half of the amount was to be provided by the federal government through its climate fund.

Poland

In December, the Polish Sejm decided to freeze electricity prices for six months in 2024. For six months, a price ceiling will be in effect for certain consumer groups (households, as well as farmers, small and medium-sized businesses, which were not initially envisaged, which caused criticism). In addition, the law provides for a cap on electricity prices for eligible consumers who have entered into contracts with a fixed price guarantee. The cost of freezing energy prices was estimated at PLN 16.5 billion, and the source of funding was identified as the COVID-19 Fund.

The draft law also contained provisions to liberalize the construction of wind farms and windmills in Poland. However, it was subsequently amended to exclude the provision on wind farms. The issue remains closed for now, and the proposal may return as a separate government project unrelated to the energy price freeze. Poland has one of the highest spot electricity prices in Europe, as it produces about 70% of its electricity from coal, which is expensive due to the cost of carbon emissions, so wind power is a hotly debated issue in the country.

Fullness of gas storages

According to Moody’s, the record high level of gas storage capacity at the end of November (about 97.5%) allows the EU to face the winter season with very limited risks of energy shortages.

According to the baseline scenario, Europe is likely to come out of the winter with 55% of its storage facilities filled, which will ensure a good position for their replenishment before the winter of 2024/2025.

Even under a negative scenario (further reduction of Russian pipeline gas supplies, colder winter), the level of gas storage in the storages will still be around 35% at the end of March, which is comparable to the ten-year average at the end of the heating season. However, Moody’s analysts note that Europe remains vulnerable to a supply shortage.

The ING financial group expects that the level of gas storage this winter will be lower than last year’s winter season, but significantly higher than average. Analysts also noted that new LNG export capacities will start appearing on global gas markets at the end of 2024 (mostly from the United States), which will make Europe less vulnerable from this period on.

According to the AGSI platform, the average EU gas storage capacity utilization rate was 94.8% as of December 1, 2023.

However, in late November, the European Commission proposed a 12-month extension of the emergency measures introduced in 2022 in response to the energy crisis provoked by Russia’s invasion of Ukraine. Although the situation on the European energy market is more secure than it was a year ago, the EC is proposing this step to further improve security of gas supply and strengthen market resilience.

The extension proposal includes three measures, including the gas price cap, which is set to expire in February 2024. Since this mechanism came into force in February 2022, gas price caps have never been applied. However, the EC believes that the market remains unstable and has seen a number of episodes of significant volatility in recent months. The mechanism was supposed to be triggered if the TTF base contract price exceeds €180/MWh and is at least €35/MWh higher than the benchmark global LNG price for three consecutive business days.