СВАМ will deprive Ukraine of competitive advantages, i.e. access to iron ore

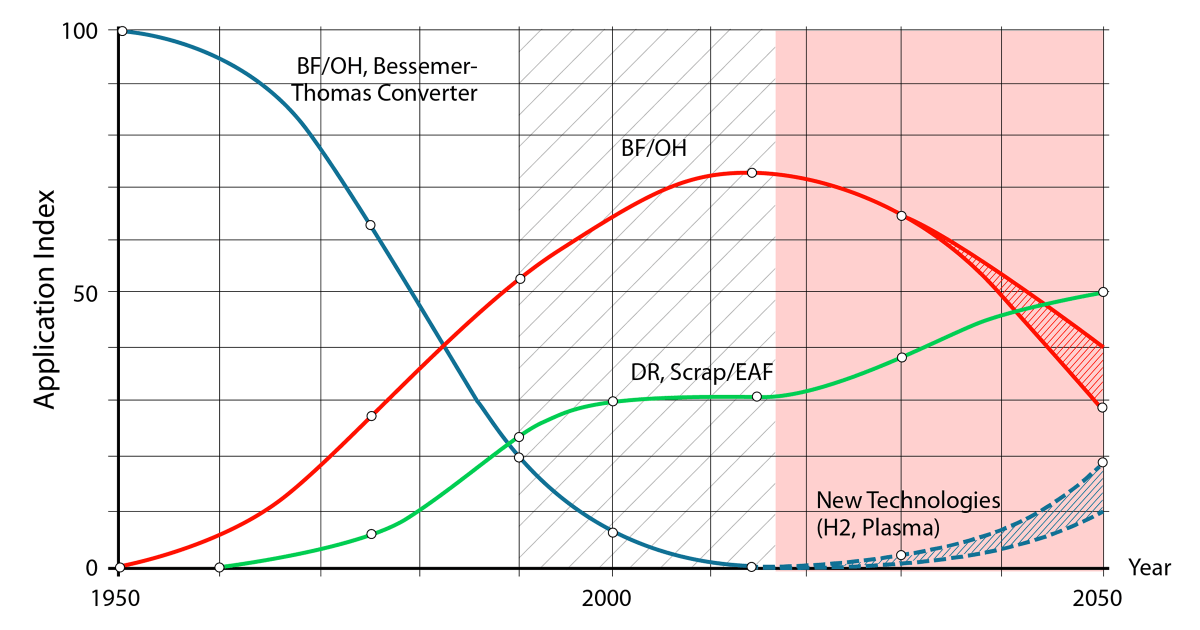

Technological change is a traditional process in the steel industry which takes decades, and each new technology turns out to be more efficient than the previous one. The mass steel production was launched in the mid-19th century based on the Bessemer process. In the begin of the 20th century, steel production surged due to the construction of open-hearth furnaces. After the World War II, basic oxygen furnaces and electric arc furnaces started to be introduced, gradually replacing Bessemer-Thomas converters and open-hearth furnaces.

The proliferation of basic oxygen furnaces and electric arc furnaces has made steel production more environmentally friendly than before. The demand for environmentally friendly production has particularly grown in recent years. A lot of pilot projects and start-ups have appeared in development of carbon-free steel production technologies. However, the transition to these technologies would take a long time. According to the most optimistic estimates, they will only be ready for industrial introduction between 2030-2040, and time should also be provided to restructure the existing capacities (which is also a long-lasting process that will not be carried out in a couple of years).

Importantly, the technological change that took place earlier was due to economic factors. New technologies allowed producing steel in a cheaper way and improving product quality. Now the government stimulates technological change with the aim of reducing emissions. CBAM (carbon border adjustment mechanism), which is to be introduced in 2023, is one of the instruments of such stimulation beside the targets created during the parisian climate agreement.

СВАМ by its nature is discriminatory to BF-BOF route, which implies the use of iron ore as the main raw material to produce pig iron and steel. 70% of steel in Ukraine is manufactured with the use of this technology. BF-BOF route together with BF-OHF route account for about 95% of steel production. Direct СО2 emissions from basic oxygen furnaces in combination with blast furnaces are almost 5 times higher than from electric arc furnaces (calculated per tonne of steel).

At the same time, BF-BOF route was introduced based on market factors, the main one being the access to raw materials. This is especially relevant for Ukraine with its extensive iron ore resources. Iron ore is an important competitive factor and advantage of Ukrainian steel industry. However I believe that scrap will reach a dominant role in the future. On a long term basis a major portion of the steel to be produced in a close circulation. For this reason the technology for scrap preparation will be extremely challenging.

Moreover, the volumes of scrap generated globally are insufficient to fully meet the global demand for steel products through recycling. Hence, it is impossible to abandon production of steel from iron ore.

It is potentially possible to produce from iron ore products which will further be used in electric arc furnaces (for example, hot briquetted iron). However, as we considered above, technological change is a long-lasting process. Steelmaking is a capital-intensive industry with a large investment horizon. СВАМ alone will not be able to significantly accelerate the modernization of existing and the construction of new production capacities.

It should be admitted that Ukrainian companies cannot, for objective reasons, develop new steel production technologies on their own. Therefore, full decarbonization of Ukrainian steel industry can begin when carbon-free technologies ready for implementation appear on the market. It has to be mentioned that Ukraine will have a preferable position for producing hydrogen in the future and also utilizing the existing pipeline system to Western Europe (currently operating for delivering natural gas).

In a short-term perspective, Ukrainian companies can reduce СО2 emissions through improving operational efficiency, particularly energy efficiency. This factor has already allowed European companies to minimize their СО2 emissions. However, these operational efficiency reserves were deployed due to the systemic environmental policy of the European Union: the introduction of the EU Emissions Trading System (EU ETS) and state support for companies’ environmental projects.

The EU Emissions Trading System was introduced in 2005. Its first phase lasted until 2007. During the first phase, almost all allowances were allocated free of charge. During the second phase (2008–2012), the share of free allowances decreased to 90%. Only during the third phase (2013–2020), the auctioning of allowances became the main method of allocation.

At the same time, the European Union supported local producers’ decarbonization. In particular, funding for R&D projects was allocated through the Horizon Europe program. According to the current EU ETS system, a part of the income from the sale of allowances during 2013–2020 was allocated to finance large demonstration projects in the areas of carbon capture and storage, as well as innovative renewable energy technologies. Within the framework of the new EU ETS phase (2021–2030), two new funds are expected to be created: the Modernization Fund and the Innovation Fund, which will support energy efficiency projects and the introduction of new technologies. The European Green Deal includes instruments that will help raise €1 trillion in investment in decarbonization.

Ukrainian steelmakers, unlike European ones, did not enjoy access to the sources of environmental funding. But Ukraine is not the only country encountering such problems. One of the goals of СВАМ is to synchronize environmental policies of different countries. Where developing economies failed to keep up with the EU in terms of the rigidity of goals and standards, they consequently fail to keep up in environmental incentives as well. Therefore, СВАМ will not be able to create equal rules of the game — it will further exacerbate the gap between European and Ukrainian companies, and this gap will widen in the future if other countries are unable to build up their policies in line with the European one.

It is obvious that the decarbonization of steel industry and Ukrainian economy as a whole will take a long time and require an integrated approach that will not be limited to the introduction of CBAM. First of all, Ukrainian companies need access to funding of environmental modernization on a par with European peers. Coordination of efforts between Ukraine and the EU is a precondition for significant reduction in СО2 emissions and creation of new green economy.

Technological change cycle in the steel industry