News Industry semi-finished products 910 15 May 2023

The income of steelmakers from the export of slabs and billets for the month increased by 24% m/m

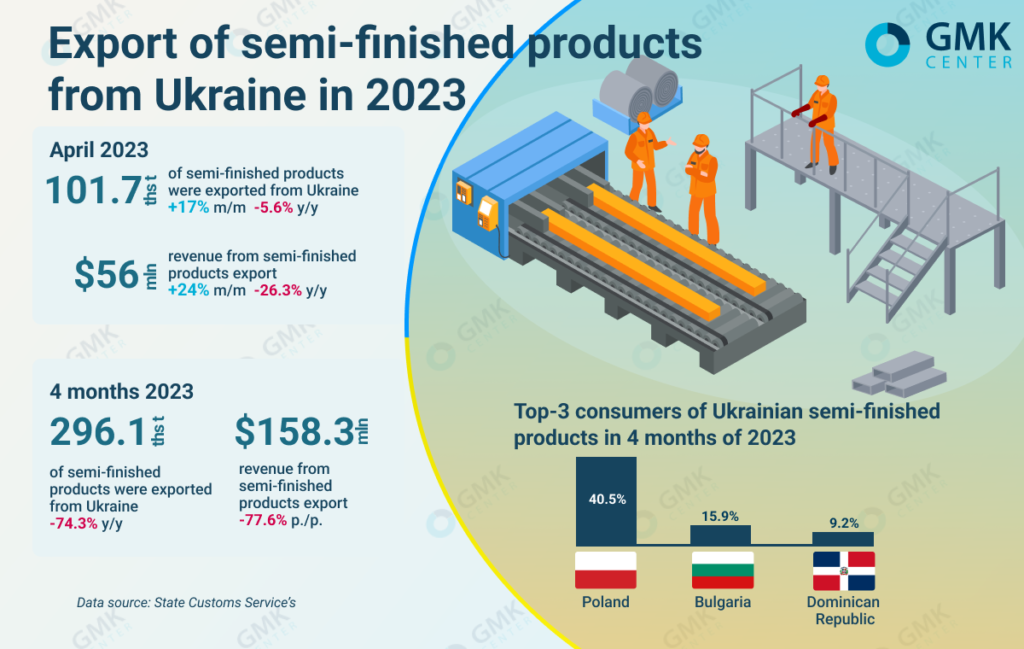

In of April 2023, Ukrainian steel enterprises increased the export of semi-finished products by 17% compared to the previous month – up to 101.7 thousand tons. The income of producers from exports for the month increased by 24% m/m – up to $56.01 million. This is evidenced by State Customs Service’s data.

Compared to April 2022, in April 2023, steel enterprises of Ukraine reduced revenue from the sale of semi-finished products by 26.3%. In natural terms, exports decreased by 5.6%.

In January-April 2023, Ukraine exported 296.13 thousand tons of semi-finished products worth $158.3 million. The revenue of steelmakers from the export of slabs and billets decreased by 77.6% compared to the same period in 2022, and product deliveries – by 74. 3%

The main importers of semi-finished products from Ukraine in January-April 2023 were Poland (40.53% of deliveries in monetary terms), Bulgaria (15.87%) and the Dominican Republic (9.21%).

Since the beginning of 2023, the export of semi-finished products from Ukraine is gradually recovering and growing in monthly dynamics, in particular, in February, the indicator in natural terms increased by 80.6% m/m, and in March – by 25.5% m/m. This trend reflects the increase in steel production by Ukrainian steelmakers.

«Steel production has been increasing in Ukraine since the beginning of 2023. In April, 474,000 tons of steel were produced in Ukraine – this is the maximum volume of production since the beginning of the war. In the future, most likely, growth will slow down and production volumes will stabilize, since the existing logistical restrictions, in particular the blockade of the Black Sea ports, will not allow to significantly increase the use of capacities,» commented the GMK Center analyst Andriy Glushchenko.

Export of semi-finished products from Ukraine in 2023

The low volumes of production of Ukrainian steelmakers are connected with logistical problems, the unfavorable situation of the world market, as well as with the destruction due to hostilities of the two largest steel enterprises of Ukraine – Azovstal and Ilyich Iron and Steel Works in Mariupol.

After the Russian invasion of Ukraine at the end of February 2022, the only way to deliver Ukrainian pig iron abroad now is by rail. Due to the large influx of cargo, as the sea ports are blocked, Ukrainian Railways cannot process and transfer wagons with Ukrainian products to the European Union quickly and on time. In addition, logistics costs for the delivery of goods have increased at least by 2 times. The shelling of Ukraine’s energy infrastructure by Russian forces, which forced steelmakers to reduce and stop production in order to preserve capacity, were added to the main problems.

At the beginning of 2023, the energy supply situation stabilized, so the future of Ukrainian steel industry depends on logistical capabilities, in particular, the unblocking of sea ports, as well as the demand for steel products and raw materials.

As GMK Center reported earlier, in 2022 export of semi-finished products from Ukraine decreased by 72% compared to 2021 – to 1.89 million tons. In monetary terms, the export of semi-finished products fell by 70.9% y/y last year – to $1.19 billion. The main importers of Ukrainian semi-finished products in 2022 were Bulgaria (25.55%), Poland (13.97%) and Italy (12.13%).