News Industry long products 810 22 March 2023

In monetary terms, the export of such products increased by 22.3% month-on-month

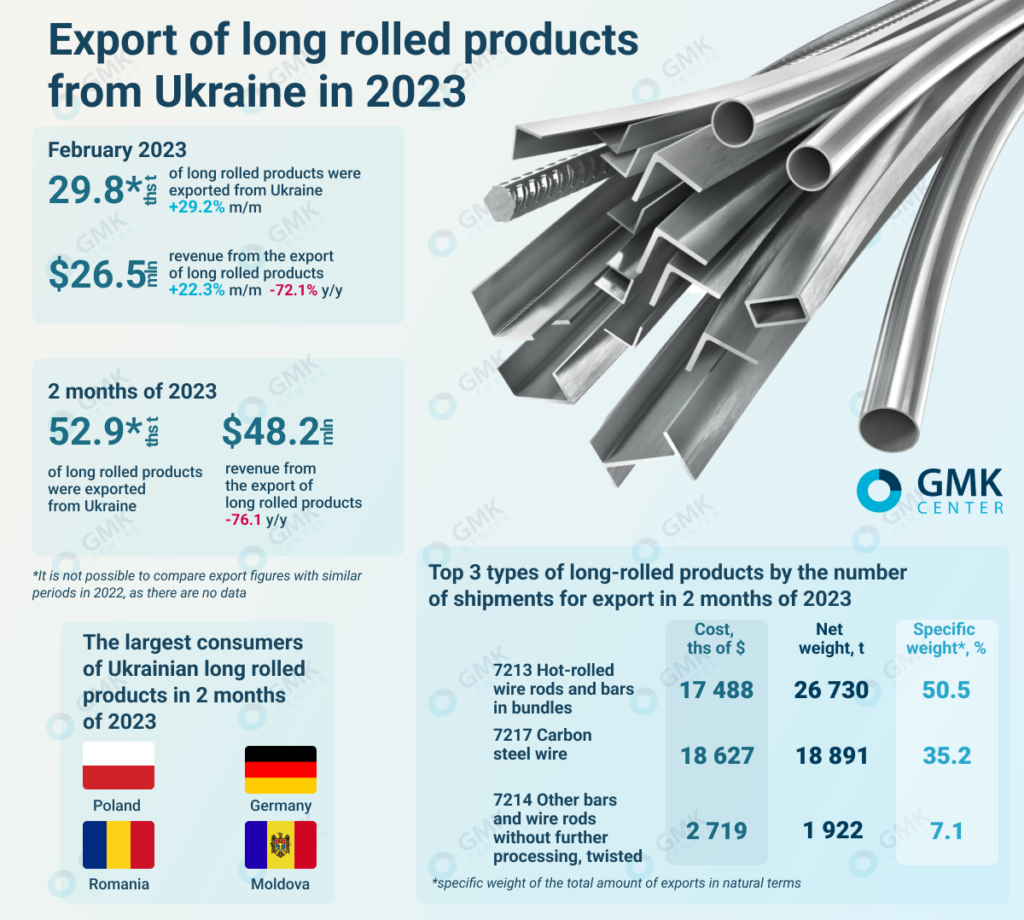

In February 2023, steel enterprises of Ukraine increased the export of long rolled products by 29.2% compared to the previous month – up to 29.81 thousand tons. In monetary terms, the export of such products increased by 22.3% m/m – up to $26.5 million. This is evidenced by State Customs Service’s data.

Compared to February 2022, in February 2023 steel enterprises of Ukraine reduced the revenue from the sale of long rolled products by 72.1%. It is impossible to calculate the difference in export volumes in natural terms due to the lack of data.

In January-February 2023, Ukraine exported 52.89 thousand tons of long-rolled products worth $48.18 million. The revenue from the sale of products abroad decreased by 76.1% compared to the same period last year.

In two months, hot-rolled wire rods and bars were exported the most (Nomenclature code – 7213) – 26.73 thousand tons for $17.5 million. In February, 16.08 thousand tons were shipped (+51.1% m/m) for $10.79 million (+60.9% m/m). Also, 18.63 thousand tons of carbon steel wire (Nomenclature – 7217) were exported for $18.89 million, and in February – 9.94 thousand tons (+14.4% m/m) for $9.94 million (+11% m/m).

Other carbon steel rods and bars, without further processing, twisted (Nomenclature – 7214) – 3.76 thousand tons for $2.72 million are the top three leaders among long-rolled products by volume of exports from Ukraine in January-February 2023. For February steel companies increased the export of such products by 4.5% compared to the previous month – up to 1.92 thousand tons. Revenue from its shipment increased by 9.2% m/m – up to $1.42 million.

The largest consumers of Ukrainian hot-rolled wire rods and bars are Romania and Poland – 37.76% and 33.41%, respectively, in monetary terms. Poland (37.88%) and Germany (18.65%) consumed about 60% of Ukrainian-made wire rod. Among the main buyers of other rods and bars are Moldova (74.29%), Slovakia (12.69%) and Poland (11.07%).

Export of long rolled products from Ukraine in 2023

After the Russian invasion of Ukraine, the export of ferrous metals decreased sharply due to the blockade of ports, logistical problems, the negative situation on the world markets, as well as the destruction of large steel plants in Mariupol – Azovstal and Ilyich Iron and Steel Works. These problems were compounded by the shelling of Ukraine’s energy infrastructure by Russian forces at the end of 2022, which forced steel companies to reduce production to a minimum or completely suspend production.

Now the situation with energy supply has stabilized, steelmakers are increasing capacity, and demand on world markets is picking up. Although the pre-war indicators are still unattainable for Ukrainian steelmakers, the monthly dynamics indicate a gradual increase in steel exports and production. The main factor holding back production now is the blockade of sea ports, which makes it impossible to ship significant volumes of products and open new markets, since steel is delivered mainly to Europe by rail, and logistics costs exceed pre-war indicators several times.

As GMK Center reported earlier, in 2022 steel enterprises of Ukraine reduced the export of long rolled products by 59.7% compared to 2021 – to 748.95 thousand tons. The revenue of steelmakers from the export of such products fell by 55% y/y – up to $693.53 million. Hot-rolled wire rods and bars in bundles (Nomenclature code – 7213) were exported the most – 406.6 thousand tons for $310 million, which is 56.1% and 54.2% less, respectively, compared to 2021.