News Industry long products 382 20 December 2023

Spending by Ukrainian consumers on the import of long-rolled goods decreased by 36.6% m/m

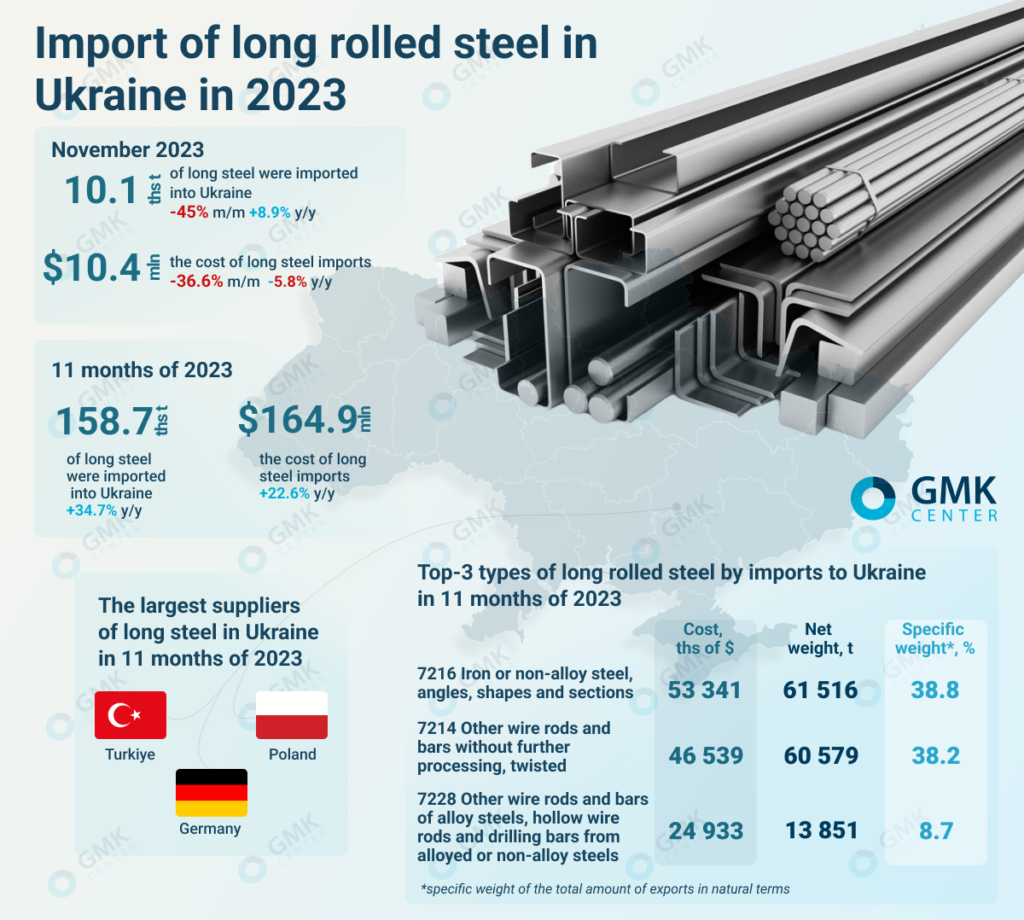

In November 2023, Ukraine decreased imports of long products by 45% compared to October 2023, to 10.13 thousand tons. Import costs for the month decreased by 36.6% m/m – to $10.41 million. This is evidenced by the data of the State Customs Service.

Compared to November 2022, in November 2023, Ukraine decreased its spending on long products imports by 5.8%. Imports grew by 8.9%.

In January-November 2023, Ukraine consumed 158.72 thousand tons of imported long products worth $164.94 million. The cost of importing foreign products increased by 22.6% year-on-year, while the volume of supplies increased by 34.7%.

In January-November 2023, Ukraine imported the largest amount of other rods and bars, twisted without further processing (HS 7214) – 60.58 thousand tons for $46.54 million, in November – 1.99 thousand tons (-74.8% m/m) for $1.51 million (-73.8% m/m). The company also imported 61.52 thousand tons of angles, shapes and special profiles made of unalloyed steel (HS 7216) for $53.34 million. In November, the company supplied 6.24 thousand tons (-21.5% m/m) for $5.25 million (-16.5% m/m).

Other rods and bars made of alloy steels, hollow rods and bars for drilling made of alloy or non-alloy steels (HS 7228) ranked third in terms of long products supplied to Ukraine, with 13.85 thousand tonnes worth $24.93 million. In November, shipments of such products to Ukraine fell by 46.4% month-on-month to 0.47 kt, and in monetary terms by 41.9% m/m – to $0.89 million.

Turkiye is the largest supplier of angles, shapes and special profiles made of unalloyed steel, accounting for 70.6% in monetary terms. Turkiye and Poland are the main exporters of other rods and bars, not further processed, with 63.6% and 20.2% respectively. Germany (40.2%) and Turkiye (19.2%) shipped about 60% of other bars and rods made of alloy steels, hollow bars and drill bars made of alloy or non-alloy steels.

As GMK Center analyst Andriy Glushchenko previously predicted, imports of rolled steel will increase in the long term, especially during the post-war reconstruction period. Imports will become the main source to meet domestic demand. In the short term, we can expect imports to stabilize at a certain level that will take into account the existing logistical constraints in the war.

As GMK Center reported earlier, in 2022, Ukraine reduced imports of long products by 70.5% compared to 2021, to 96.06 thousand tons. Import costs for the year decreased by 60.6% y/y – to $113.65 million.

Export of long rolled steel from Ukraine in 2022 amounted to 748.95 thousand tons, which is 59.7% less than in 2021. In monetary terms, deliveries of such products fell by 54.3% m/m – to $23.84 million.