News Industry long products 608 18 May 2023

Ukrainian consumer spending on imported long products increased by 56.8% m/m

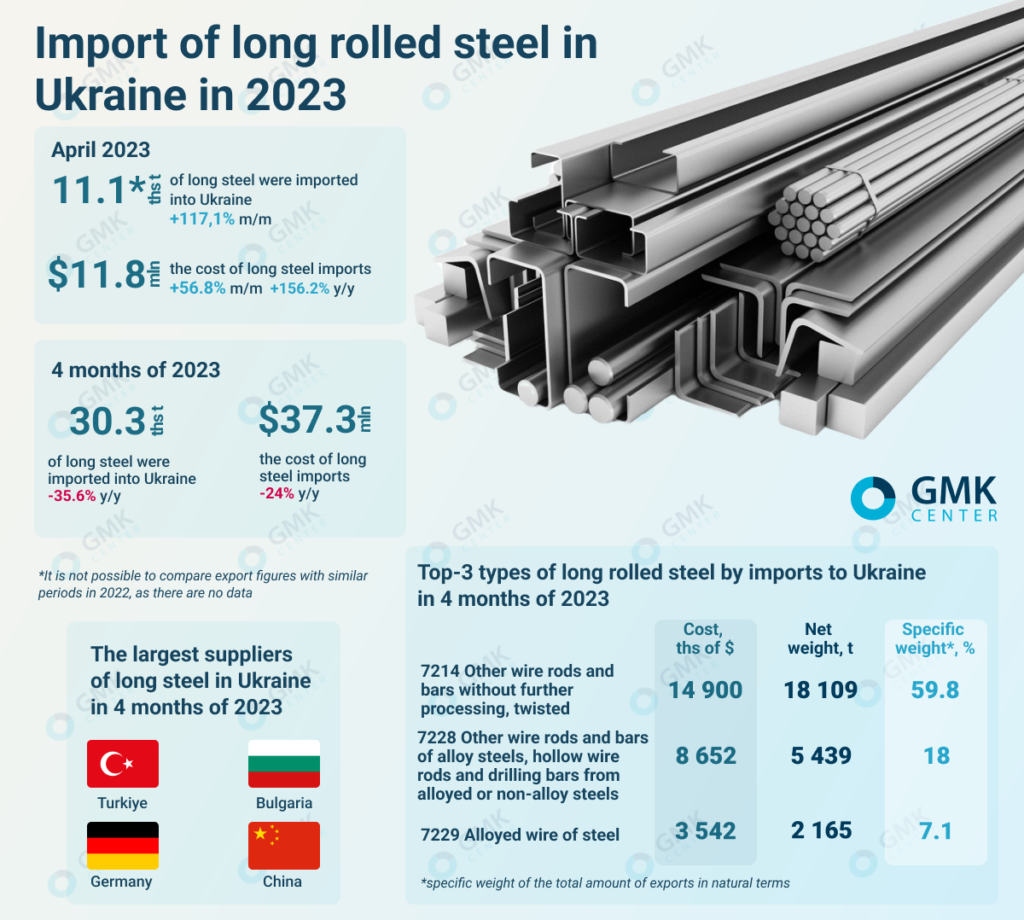

In April 2023, Ukraine increased imports of long products by 2.2 times compared to March 2023 – up to 11.13 thousand tons. Import costs for the month increased by 56.8% m/m – up to $11.8 million. This is evidenced by State Customs Service’s data.

Compared to April 2022, in April 2023, Ukraine increased the cost of importing long products by 2.6 times. It is impossible to calculate the difference in export volumes in natural terms due to the lack of data.

In January-April 2023, Ukraine consumed 30.27 thousand tons of imported long products worth $37.28 million. The cost of importing foreign products decreased by 24% compared to the same period last year, and the volume of deliveries – by 35.6%.

Most of all, in January-April 2023, other twisted bars without further processing (Nomenclature 7214) were imported to Ukraine – 18.11 thousand tons for $14.9 million. In April, 8.53 thousand tons were delivered (+4.8% times m/m) for $6.84 million (+6.7 times m/m). Also 5.44 thousand tons of other bars and rods from alloyed steels, hollow bars and rods for drilling from alloyed or unalloyed steels (Nomenclature 7228) were imported for $8.65 million, in April – 1.12 thousand tons (-37% m/m) for $1.68 million (-18.1% m/m).

The third place in terms of supplies to Ukraine among the types of long products in the first quarter of 2023 was occupied by alloy steel wire (Nomenclature 7229) – 2.16 thousand tons for $3.54 million. In April, supplies of such products to Ukraine fell by 16.7% compared to the previous month – to 439 thousand tons, and in monetary terms – decreased by 18.1% m/m, to $716 thousand.

The largest suppliers of other rods and twisted bars without further processing are Turkiye and Bulgaria – 62.8% and 28.3%, respectively, in monetary terms. Germany (64.3%) and Turkiye (14.7%) shipped more than 70% of other alloy steel bars and rods, alloyed or non-alloy steel hollow bars and rods for drilling. The main wire suppliers are Germany and China – 50.1% and 26.4% respectively.

After the Russian invasion of Ukraine, the export of ferrous metals decreased sharply due to the blockade of ports, logistical problems, the negative situation on the world markets, as well as the destruction of large steel plants in Mariupol – Azovstal and Ilyich Iron and Steel Works. Enterprises located in the territory controlled by Ukraine are working with low load due to problems with logistics, unfavorable conditions in the world steel markets. Until recently, the negative impact on local steelmakers was caused by interruptions in energy supply as a result of shelling of the Ukrainian energy infrastructure by Russian troops, but now the situation has stabilized.

As GMK Center reported earlier, in 2022, Ukraine reduced imports of long products by 70.5% compared to 2021 – to 96.06 thousand tons. Import costs for the year decreased by 60.6% y/y – to $113.65 million.

Export of long products from Ukraine in 2022 amounted to 748.95 thousand tons, which is 59.7% less compared to 2021. In monetary terms, the supply of such products fell by 54.3% m/m – to $23.84 million.