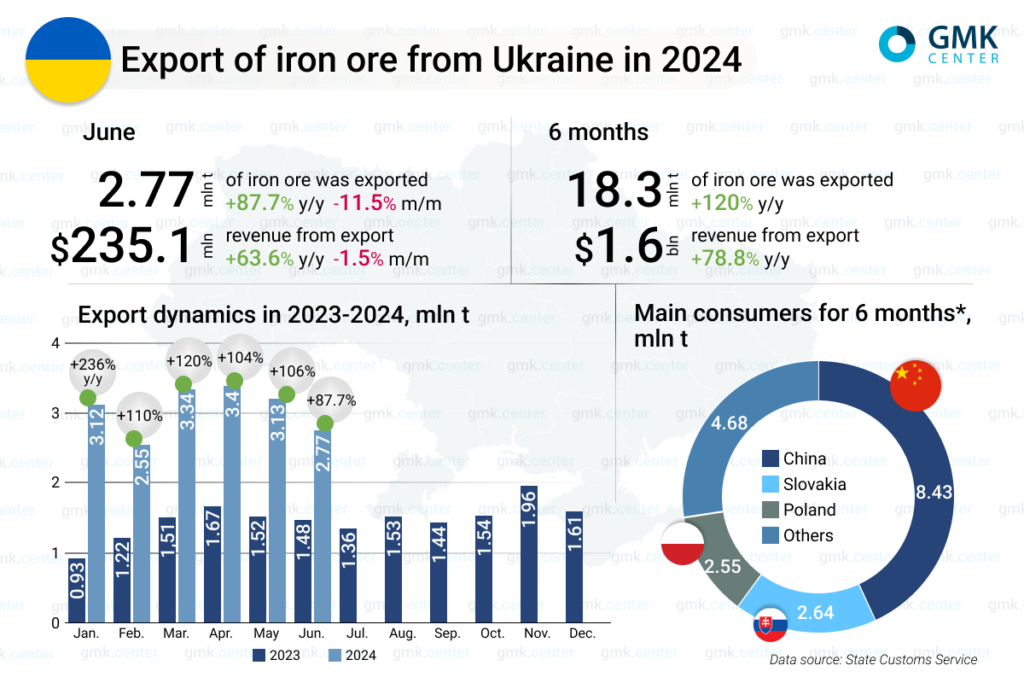

The main consumers of raw materials are China, Slovakia and Poland – 8.43 million tons, 2.64 million tons and 2.55 million tons, respectively

Ukrainian mining companies in January-June 2024 increased iron ore exports by 2.2 times compared to the same period in 2023 – up to 18.31 million tons, according to data from the State Customs Service.

In June, shipments of iron ore raw materials abroad amounted to 2.77 million tons, which is 11.5% less than in the previous month, and 87.7% more than in June 2023. The June figure is the lowest since February of this year, and the average monthly export volume for the first half of the year is 3.05 million tons (1.39 million tons a year earlier).

The resumption of iron ore exports in 2024 is facilitated by the opening of an offshore export corridor for iron and steel cargo from January. Thanks to this, Ukrainian mining companies have resumed supplies of raw materials to distant markets, in particular to China, which since the beginning of the year has again occupied a leading position among importers of iron ore from Ukraine. In January-June, Chinese consumers imported 8.43 million tons of Ukrainian iron ore raw materials, and in June – 1.06 million tons (-14.8% m/m). At the same time, European countries remain in the top three main importers, in particular, 2.64 million tons of air defense systems were shipped to Slovakia in the 6 months of 2024, and 456.3 thousand tons in June (+ 34% m/m), Poland – 2.55 million tons and 512.9 thousand tons (-7% m/m), respectively.

In particular, on June 1, 2024, CMU Resolution No. 661 amended the «Regulation on the peculiarities of electricity imports under the legal regime of martial law in Ukraine,» which obliges Ukrainian producers to buy at least 80% of electricity in the EU at a European price in order to avoid forced restriction of electricity supply. Previously, this proportion was 30/70. Previously, the mandatory share of imports was 30%.

Such a decision of the Ukrainian government can lead to numerous negative consequences for domestic energy-dependent industrial companies, especially for manufacturers of air defense systems and metallurgists. Thus, the share of electricity in the production of iron ore concentrate reaches 60%, and pellets – 32%. Rising electricity costs lead to a sharp increase in cost, which makes the continuation of production economically unprofitable. Ingulets Mining in a letter to the Prime Minister and a number of chairmen of parliamentary committees warned that the acquisition of imported electricity in the amount of 80% of its own consumption could lead to a complete shutdown of the plant.

According to GMK Center estimates, the decline in iron ore exports in the second half of the year may be 15% or 2.7 million tons, which means a loss of $250 million in export revenue.

Revenue from iron ore exports in January-June 2024 amounted to $1.6 billion (+78.8% y/y), and in June – $235.09 million (-1.5% y/y; + 63.6% y/y).

As GMK Center reported earlier, in 2023, Ukraine reduced iron ore exports by 26% compared to 2022 – to 17.75 million tons. Compared to pre-war 2021, exports of raw materials decreased by 60%. Revenue of Ukrainian MMC companies from export of iron ore decreased by 39.4% y/y – up to $1.77 billion.

The main producers of iron ore raw materials in Ukraine – Ingulets Mining, Kryvyi Rih Mining, Poltava Mining, Eristovsky Mining, Northern Mining, Central Mining, Southern Mining, ArcelorMittal Krivoy Rog, Sukha Balka, Rudomain.