Limited logistical opportunities for export remain a restraining factor

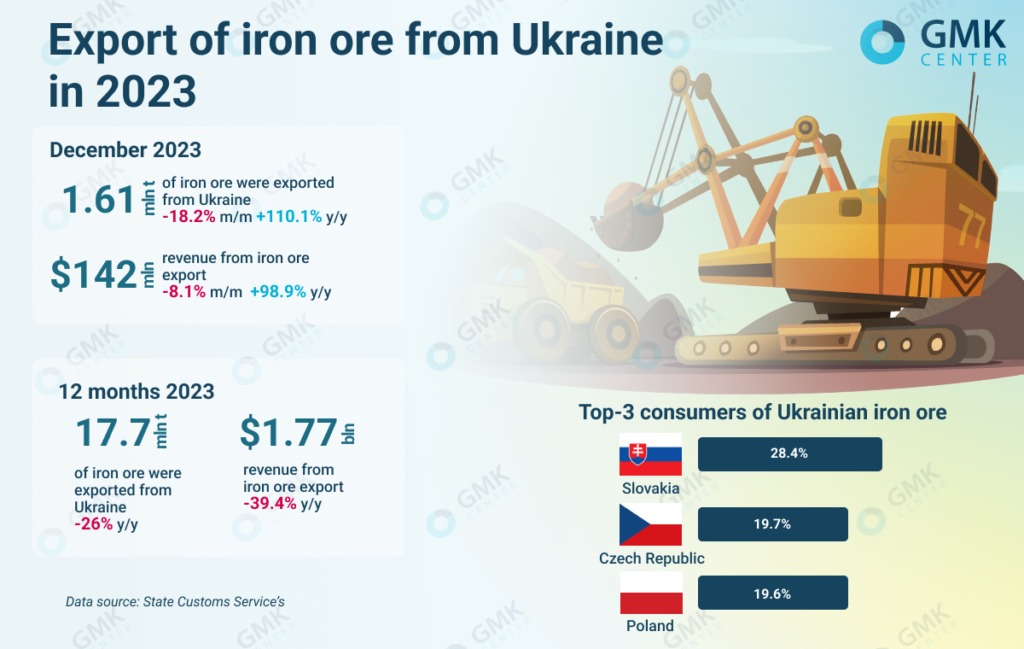

In 2023, Ukrainian mining companies reduced iron ore exports by 26% compared to 2022, to 17.75 million tons. Exports of raw materials decreased by 60% compared to pre-war 2021. This is evidenced by data from the State Customs Service.

Revenues of Ukrainian iron and steel companies from iron ore exports last year decreased by 39.4% compared to 2022 – to $1.77 billion. In 2021, exports of raw materials in monetary terms amounted to $6.89 billion, up 74.4% compared to 2023.

In December 2023, Ukraine exported 1.61 million tons of iron ore, down 18.2% month-on-month and 2.1 times more than in the previous month. Export revenues for the month decreased by 8.1% m/m and increased by 98.9% y/y.

In 2023, Slovakia was the largest consumer of Ukrainian raw materials, accounting for 28.39% in monetary terms. The Czech Republic accounted for 19.7% of export shipments and Poland for 19.6%. In 2022, the top three importers of iron ore from Ukraine were also Slovakia (19.2%), the Czech Republic (17.3%), and Poland (16.5%). At the same time, in 2021, China was the main destination for iron ore exports, accounting for 41.9%. The Czech Republic and Poland accounted for 9.6% and 8%, respectively.

«The loss of the Chinese market since the outbreak of the war has had the most serious impact on the decline in iron ore exports. The maritime corridor opened last year allows Ukrainian producers to return to the Chinese market, but due to limited capacity and significant security risks, we cannot hope to restore pre-war transportation volumes,» GMK Center analyst Andriy Glushchenko says.

2023 proved to be a more stable year for Ukrainian mining companies compared to 2022, when the industry was recovering from the start of the full-scale invasion and adapting to the new business realities. The beginning of the year was difficult, as in January some companies operated at minimum capacity due to blackouts caused by Russian shelling of Ukraine’s energy infrastructure. Thus, in January 2023, 927 thousand tons of iron ore were exported, which is the lowest figure for the year.

Since January, exports have been gradually increasing, but in June, Russian troops blew up the Kakhovka hydroelectric power plant, causing a large-scale environmental disaster that affected iron and steel industry’s facilities in Kryvyi Rih. Most of the Ukrainian iron and s coteelmpanies are concentrated in this city: ArcelorMittal Kryvyi Rih, Kryvyi Rih Iron Ore Plant, Northern, Central, Ingulets, and Southern Minings, Rudomine Mining Company, and Sukha Balka Mine. It took time for the companies to adapt to the new operating conditions and find alternative sources of water supply.

Limited logistics capabilities for exports are currently a constraint for the industry, although prospects have improved with the opening of the sea export corridor last August. Metinvest’s mining and processing plants are currently operating at 35-40% of capacity due to the lack of a full-fledged export option for raw materials by sea. Ferrexpo’s enterprises operated one or two production lines out of four during the year. The company noted that if sea exports resume, it plans to launch an additional production line and resume supplies to customers in the Middle East and Asia.

As GMK Center reported earlier, in 2022 Ukraine reduced the export of ferrous metals by 45.9% compared to 2021 – to 23.98 million tons. In monetary terms, the indicator fell by 57.8% y/y. – up to $2.91 billion.

The major iron ore producers in Ukraine include: Ingulets GOK, Kryvyi Rih Iron Ore Plant, Poltava Mining, Northern GOK, Central GOK, Southern GOK, ArcelorMittal Kryvyi Rih, Sukha Balka GOK and Zaporizhzhia Iron Ore Plant.