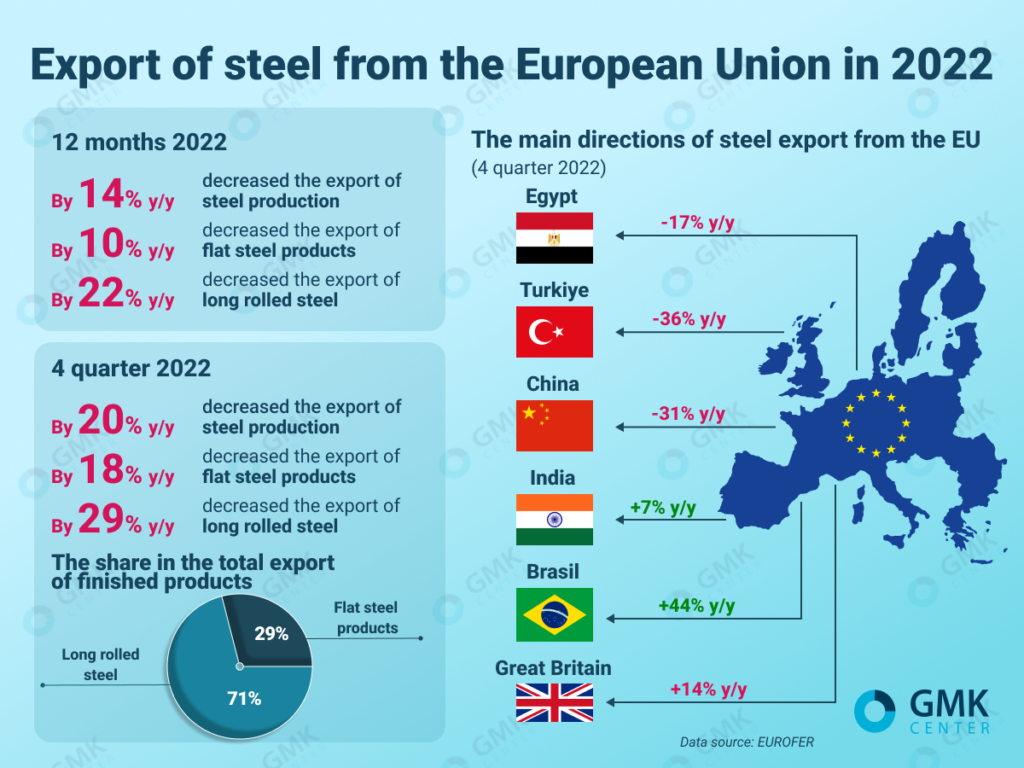

Shipments of flat rolled products from the EU decreased by 10% y/y, and of long products – by 22% y/y

In 2022, the export of steel products from the European Union to third countries decreased by 14% compared to the same period last year. It is stated in a report on the website of the European Association of Steel Producers (EUROFER).

Shipments of flat rolled products from the EU decreased by 10% year-on-year, and of long products – by 22% year-on-year.

In the fourth quarter of 2022, steel exports from the EU decreased by 20% compared to the same period in 2021. During the reporting period, shipments of flat rolled products from the EU decreased by 18% compared to October-December 2021, and of long products – by 29%.

Export of steel from the EU

During this period, the European Union exported the most steel to the UK, the USA, Turkiye, Switzerland and Egypt. Together, these countries accounted for 58% of the total volume of exports of finished products from the EU in the fourth quarter of 2022. Other export destinations include China, Brazil and India.

For October-December 2022, steel supplies from the EU to Brazil and India increased by 44% and 7%, respectively. Exports to China decreased by 31%, Turkiye – by 36%, Switzerland – by 25%, Egypt – by 17%, and the UK – by 14%.

According to EUROFER, in the fourth quarter of 2022, the share of flat products in the total volume of exports of finished products was 71%, and 29% of long products.

As GMK Center reported earlier, visible consumption of steel products in the European Union in 2022 fell by 7.2% in annual terms. In the fourth quarter of 2022, the indicator decreased by 19.3% – to 29.6 million tons, recording the second worst indicator after the pandemic. The demand for steel decreased last year due to the energy crisis and the consequences of the war in Ukraine.

According to EUROFER forecasts, visible steel consumption in the EU is expected to fall by 1% in 2023, and to increase by 5.4% in 2024, however, subject to positive changes in the industry and the recovery of steel demand.

WorldSteel Association expects growth of world demand for steel in 2023 by 2.3% compared to 2022 – up to 1.822 billion tons. In 2024, according to the association’s expectations, global demand for steel will increase by 1.7% y/y – up to 1.854 billion tons.