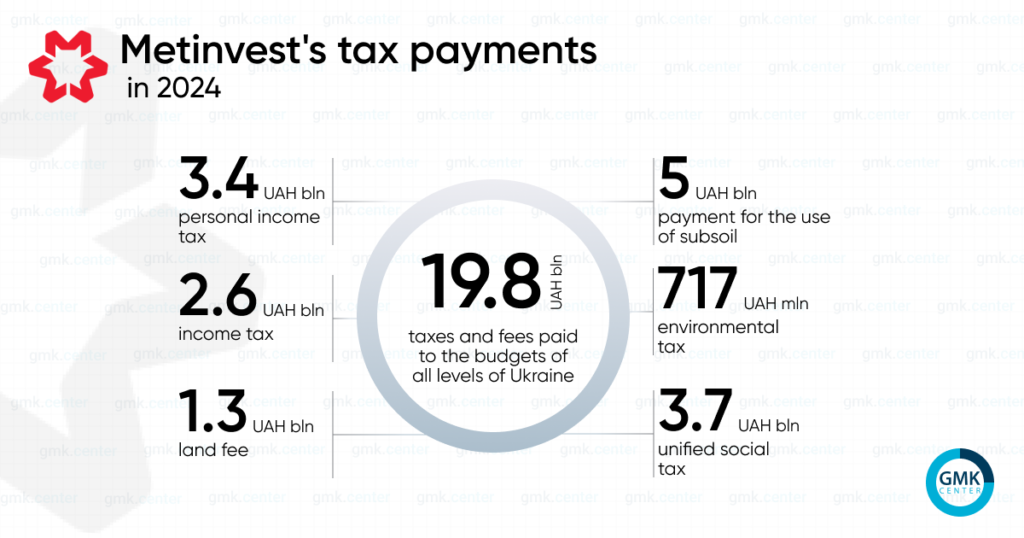

Payments increased by 36% compared to 2023

Metinvest Group, including its associates and joint ventures, increased the payment of taxes and duties to the budgets of all levels in Ukraine by 36% in 2024, up to UAH 19.8 billion compared to 2023. This is stated in the company’s press release.

The largest payment in terms of deductions is the fee for subsoil use, which has more than doubled compared to 2023 – up to UAH 5 billion. The second place is taken by the single social contribution (SSC) in the amount of UAH 3.7 billion, which increased by 13% y/y. The top three largest payments include UAH 3.4 billion in personal income tax (PIT), up 11% y/y.

In addition, Metinvest’s Ukrainian enterprises paid UAH 2.6 billion in corporate income tax last year (-20% y/y). Land payments grew by 6% y/y – to UAH 1.3 billion, and environmental tax by 18% y/y – to UAH 717 million.

“The war increases the level of responsibility of business to the army, the economy and every Ukrainian. Despite all the challenges, we have not only maintained stability but also managed to reach the tax payment level of 2022, when we had a certain pre-war safety margin. This demonstrates our ability to adapt and find new opportunities. “Metinvest remains one of the largest taxpayers and private donors to the Armed Forces of Ukraine, and we continue to support the country in these difficult times,” said Yuriy Ryzhenkov, CEO of Metinvest Group.

As GMK Center reported earlier, in 2023, Metinvest Group paid UAH 14.6 billion in taxes and fees. The largest payments included a single social contribution of UAH 3.3 billion, income tax of UAH 3.2 billion and personal income tax of over UAH 3 billion.