The largest tax in terms of payments is the single social contribution – UAH 3.3 billion

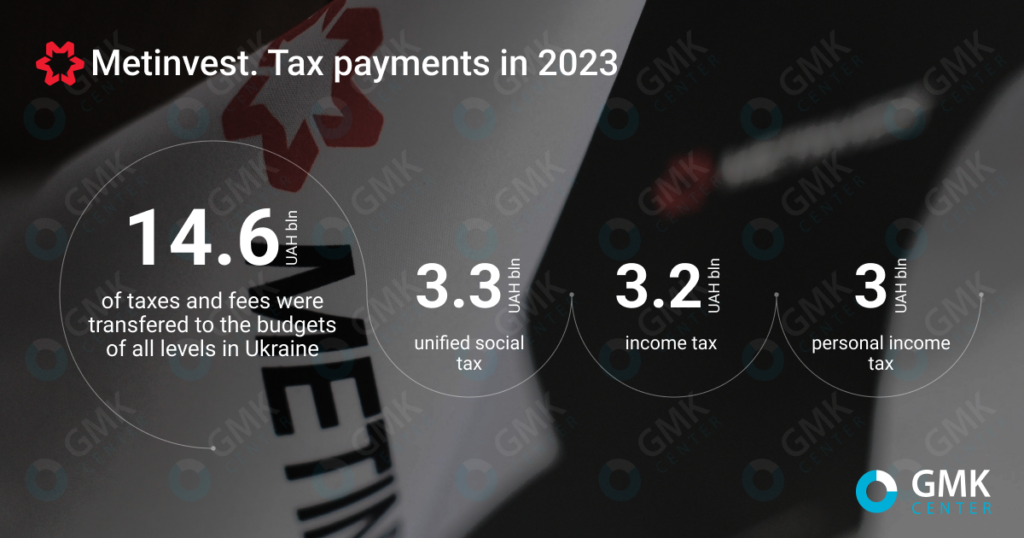

Metinvest Group, including its associates and joint ventures, paid UAH 14.6 billion in taxes and fees to the budgets of all levels in Ukraine in 2023. This is stated in the company’s press release.

The largest payments include a single social contribution (SSC) amounting to UAH 3.3 billion, income tax – UAH 3.2 billion, and personal income tax – more than UAH 3 billion.

At the same time, Metinvest’s Ukrainian enterprises increased land payments by almost 10% last year compared to 2022, to UAH 1.2 billion. Environmental tax payments also increased to UAH 608 million.

In addition, subsoil use fees in the amount of UAH 2.2 billion became a significant source of revenues for the state and local budgets of Ukraine in 2023.

«We have survived another extremely difficult year of war. Despite the serious challenges for the country in general and Ukrainian business in particular, we managed to survive and rebuild the company’s operations to meet the new conditions. Despite the problems with asset utilization and the aggressor’s naval blockade, despite the loss of control over assets in Mariupol, the shutdown of Avdiivka Coke Plant and a significant reduction in the number of employees due to the war, Metinvest remains one of the largest taxpayers in Ukraine. And the rejection of tax benefits due to the company under the law allowed us to allocate additional funds to those areas where it is needed most,» Yuriy Ryzhenkov, CEO of the company, comments.

As GMK Center previously reported, in 2022, Metinvest Group, including its associates and joint ventures, paid UAH 20.5 billion in taxes and fees to the budgets of all levels in Ukraine. In the structure of taxes and duties, the largest were income tax (UAH 6.6 billion), unified social contribution (over UAH 4 billion), and personal income tax (UAH 3.7 billion).