The Group transferred over UAH 3.8 billion to the Ukrainian budget in Q2, which is 51% more than the previous quarter

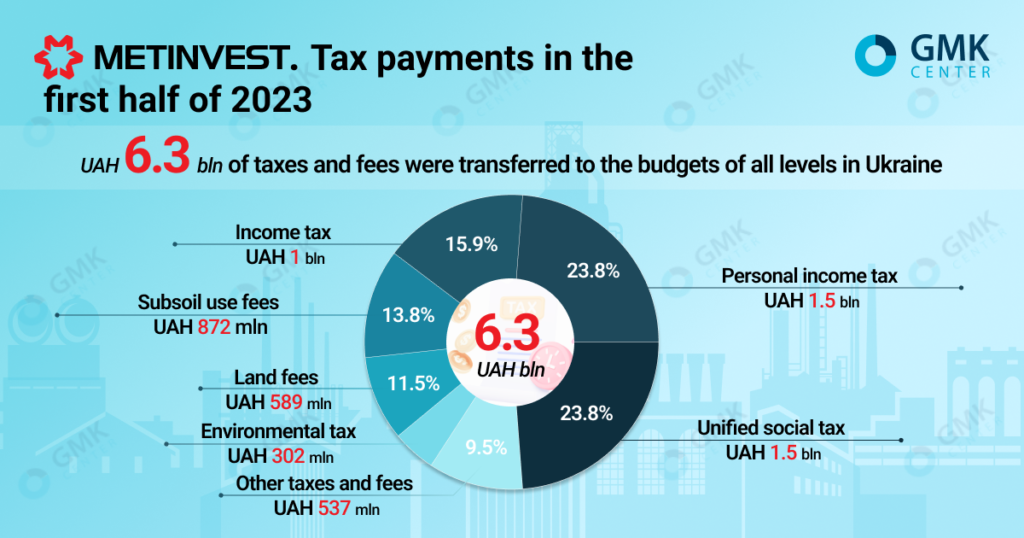

Metinvest Group, taking into account associated companies and joint ventures, transferred more than UAH 6.3 billion in taxes and fees to the budgets of all levels in Ukraine in January-June 2023. This is stated in the press release on the company’s website.

In half a year, the company paid more than UAH 1.5 billion in single social contribution (SSC), almost UAH 1.5 billion in personal income tax and more than UAH 1 billion in income tax.

Subsoil use fees – 872 million, land fees – 589 million UAH and environmental tax – 302 million UAH were also significant payments to the state and local budgets of Ukraine.

In Q2 2023, the Group increased payments to the Ukrainian budget by 51% compared to the previous quarter – to more than UAH 3.8 billion. In particular, for April-June, the payment of SSC amounted to UAH 813 million (+12% q/q), personal income tax – UAH 819 million (+26% q/q), and income tax – UAH 643 million (+45% q/q).

In April-June, the fee for the use of subsoil increased by 4 times – to UAH 698 million, the fee for land – by 4%, to UAH 301 million, the environmental tax – by 23%, to UAH 167 million.

«Since the beginning of the great war, Metinvest Group has given up the tax benefits to which it is entitled under the law, and pays taxes in full. We understand that our stability and endurance increase the state’s ability to strike in the economic, defense and social directions. We will continue to be a point of support for the country, the army and Ukrainians. We will help as much as necessary – both before victory and after it,» commented CEO of Metinvest Yuriy Ryzhenkov.

As GMK Center reported earlier, in 2022, the Metinvest group, taking into account associated companies and joint ventures transferred UAH 20.5 billion taxes and fees to the budgets of all levels in Ukraine. In the structure of taxes and fees, the largest were the income tax – UAH 6.6 billion, the single social contribution – more than UAH 4 billion, and the personal income tax – UAH 3.7 billion.

Metinvest Group’s Zaporizhzhia enterprises under martial law refused tax benefits for more than UAH 350 million in favor of the state. Businesses of the Zaporizhzhia district could take advantage of benefits and not pay part of the tax assessments – in particular, land tax, real estate tax and environmental tax for the period from March to December 2022.