Enterprises could not pay part of the tax assessments, but they refused benefits in favor of the state

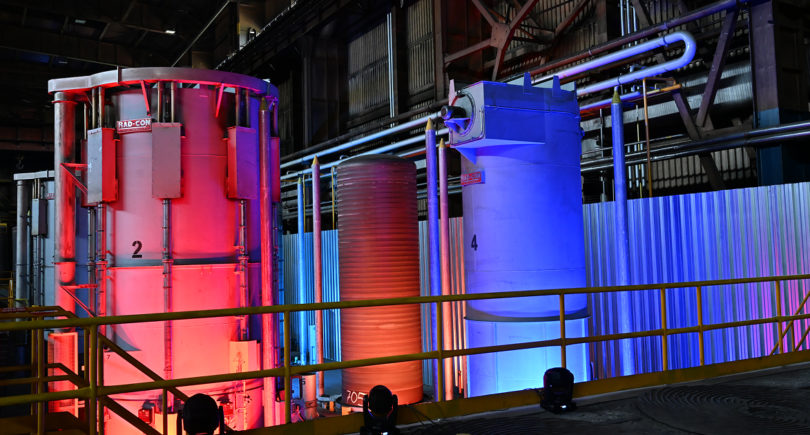

The Zaporizhzhia enterprises of the Metinvest Group – Zaporizhkoks, Zaporizhvognetryv, Zaporizhia Foundry and Mechanical Plant and the joint venture Zaporizhstal – in the conditions of martial law, refused tax benefits worth more than UAH 350 million in favor of the state. This is stated in the press release on the Zaporizhstal website.

According to the new norms of the law, enterprises of the Zaporizhzhia district could take advantage of benefits and not pay part of the tax assessments – in particular, tax on non-land, real estate and environmental tax for the period from March to December 2022. If the business transferred these payments for a certain period to the budgets in full, the company has the right to adjust the amount of charges and consider them as payments made to the state budget in advance.

The amount of tax payments additionally paid by Metinvest’s Zaporizhzhia steelmakers to the state budget during the grace period exceeds UAH 350 million, more than UAH 200 million went to local budgets.

«Metinvest’s principled position is to maximally and comprehensively support Ukraine in this difficult time for all of us. For example, programs to help the defenders of Zaporizhzhia or provide financial support to Zaporozhzhians who suffered from shelling would be impossible without multimillion-dollar payments from Metinvest in Zaporizhzhia. With our decision, we guarantee today the financing of vital items of the city’s expenses. We are working for Ukraine’s victory and bringing it closer in various ways, and the decision to refrain from using tax benefits for the benefit of the state and the city in the conditions of martial law is one of them,» emphasized the operational director of Metinvest Oleksandr Myronenko.

As GMK Center reported earlier, in 2022, Metinvest Group, taking into account associated companies and joint ventures, transferred UAH 20.5 billion in taxes and fees to the budgets of all levels in Ukraine. In the structure of taxes and fees, the largest were the income tax – UAH 6.6 billion, the single social contribution – more than UAH 4 billion, and the personal income tax – UAH 3.7 billion.

Zaporizhzhia plants of the Metinvest Group for the past year transferred to the budgets of all levels UAH 3.4 billion in taxes and fees.

In the first quarter of 2023 Metinvest, taking into account associated companies and joint ventures, transferred more than UAH 2.5 billion in taxes and fees to the budgets of all levels in Ukraine.