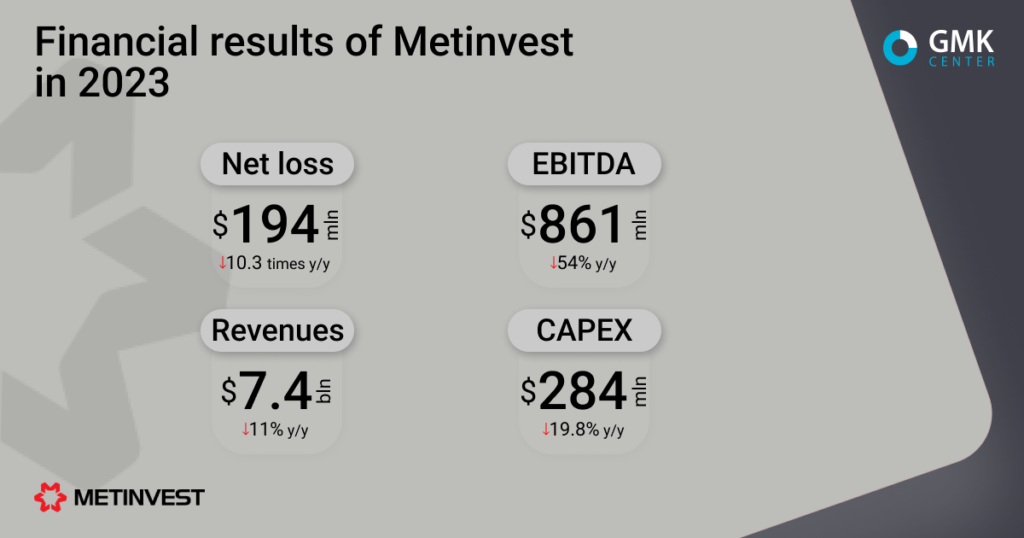

The company's revenue fell by 11% y/y

Metinvest Group ended 2023 with a consolidated net loss of $194 million, while in 2022 this figure was $2.193 billion (-10.3 times y/y). This is stated in the financial report published on the company’s website.

The company’s revenue for the past year decreased by 11% compared to 2022 – to $7.397 billion. EBITDA decreased by 54% y/y – to $861 million.

«The decline in revenue was mainly due to lower prices for steel, iron ore and coking coal. In addition, shipments decreased as a result of the suspension of production at the Mariupol steel mills,» the statement said.

Revenue of the steel division in 2023 amounted to $4.846 billion, down 15.2% compared to 2022, and mining – $2.551 billion (-0.8% y/y). At the same time, the adjusted EBITDA of the steel segment was $159 million (-40.4% y/y), and the mining segment – $770 million (-50.2% y/y).

«The decline in the company’s financial results was due to the deterioration in global markets. Flat products in the EU fell in price by 20-25%, as did coking coal. At the same time, the price of iron ore remained flat, thanks to strong production in China. This year, we expect the price of iron ore products to decline by 5% as the trend in China has reversed and local plants are cutting back on output. We can also expect a moderate decline in rolled steel prices of around 5-10% as raw materials and energy become cheaper. The EBITDA margin of the company’s steel division was 3% in 2023, meaning that the resilience reserve is minimal. Therefore, the decline in global prices may negatively affect the volume of exports of steel products from Ukraine amid expensive logistics,» adds Andriy Tarasenko, Chief Analyst at GMK Center.

In 2023, the company’s capital investments amounted to $284 million, down 19.8% compared to 2022. The company invested $65 million in steel production and $213 million in mining. Last year, Metinvest invested almost a third (32.9%) of EBITDA.

The company maintains plans to build a steel plant in Italy. In January 2024, Metinvest signed a memorandum of understanding on the development of the steel sector in the Tuscany region to create conditions for the restart of the Pembino steel plant. The plant’s capacity could reach 3 million tons of steel per year. Iron ore products from Ukraine will be used as the main raw material. This will help to utilize the company’s mining capacities in Ukraine and improve its financial performance.

As GMK Center reported earlier, Metinvest reduced steel production by 69% year-on-year – to 2.918 million tons in 2022. Pig iron production in 2022 amounted to 2.743 million tons, down 72% from 2021. Production of iron ore decreased by 66% y/y – to 10.71 million tons.

In 2023, Metinvest, including its associates and joint ventures, paid UAH 14.6 billion in taxes and fees to the budgets of all levels in Ukraine. Since the beginning of the full-scale war, the company has allocated UAH 4.8 billion to help Ukraine and its citizens, including more than UAH 2.5 billion for the needs of the army.