News Global Market iron ore prices 2750 13 January 2023

The limited supply of iron ore on the Chinese market contributes to the increase in prices

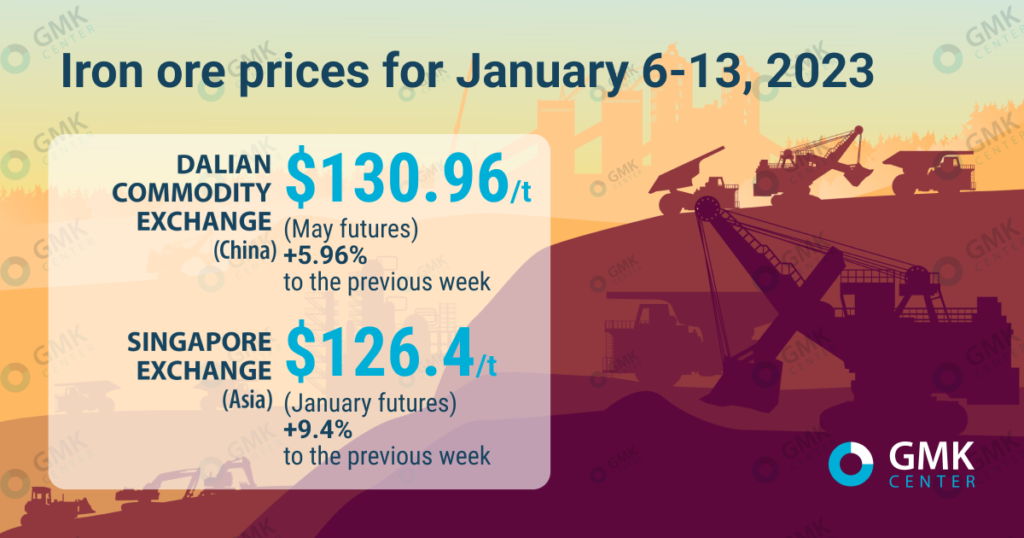

May iron ore futures on the Dalian Commodity Exchange for the week of January 6-13, 2023, increased by 5.96% compared to the previous week –up to 881 yuan/t ($130.96/t). Thus, quotations of iron ore reached a 17-month high. This is evidenced by the data of Nasdaq.

January iron ore futures on the Singapore Exchange increased by 9.4% compared to the price as of January 6, 2023, – up to $126.4/t.

Iron ore prices in 2023

In early 2023, Chinese iron ore prices fell slightly on concerns about the near-term demand outlook as a surge in coronavirus infections dampened domestic economic activity. Other negative factors include weaker demand for steel during the festive and winter seasons in China, as well as the intention of China’s state planning agency to step up efforts to regulate steel prices to prevent malicious price speculation.

From January 10, 2023, iron ore prices began to rise after reports of the peak of coronavirus infections in many regions. The positive price trend in the market is also supported by concerns about limited iron ore supply in the short term due to lower supply volumes, particularly from Brazil.

“Supplies of iron ore from the Brazilian company Vale to China fell significantly due to the impact of the rainy season. Global iron ore supplies will decline in the first quarter of 2023 due to mine maintenance programs and weather-related disruptions,” Sinosteel Futures analysts said.

Although China will face challenges in the first quarter due to high infection rates, the economic situation is expected to improve in the second quarter thanks to the recovery of domestic consumption, further stabilization in the real estate market and supportive monetary and fiscal measures. Positive expectations also play a role in the growth of prices for iron ore and the increase in their consumption.

The country’s authorities also plan to introduce further policies to support the real estate market, which will include a stimulus plan with a budget of 100 billion yuan.

“In the near term, a potential supersurge of COVID-19 infections could lead to a sharp decline in iron ore prices. But by the second quarter of 2023, pent-up consumer demand will contribute to a significant recovery, supporting China’s economy as a whole,” forecast HSBC economists.

As GMK Center reported earlier, the prices for iron ore completed 2022 with the increase of 43% compared to quotations as of the end of 2021 – $124.1/t. The rise in prices at the end of last year is associated with the optimism of market participants regarding the easing of pandemic control in China and possible economic support programs in the country.

Also, international credit rating agency Fitch Ratings confirmed the predictions regarding iron ore prices for 2023 and 2024 years. The world demand for steel continues to slow down, but the steel market is not overcrowded – the decrease in supplies from Ukraine and the Russian Federation is compensated by the drop in demand in Europe and other regions. It is predicted that the price of iron ore will be $85/t by the end of 2023, and $75/t in 2024.