News Global Market rebar prices 1998 17 May 2023

Turkish rebar remain competitive in foreign markets

Global rebar prices continued to decline last week as market sentiment remained largely negative and uncertain. Turkiye broke out of the general trend at the beginning of the current week, as domestic consumers resumed purchases after a long hold.

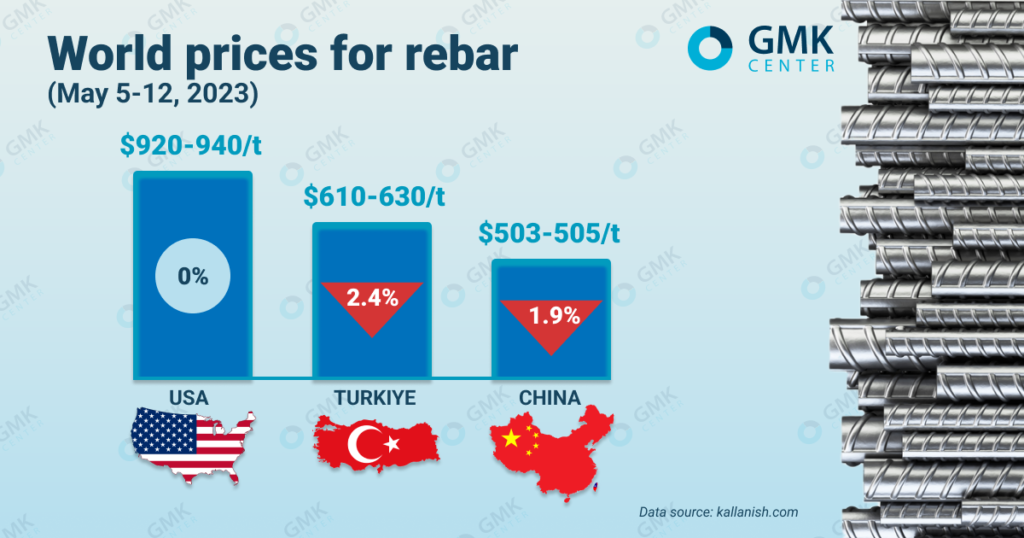

Quotation of rebar in Turkiye, according to Kallanish, for the week of May 5-12, 2023, were stable – at the level of $610-630/t. Starting from May 15, rebar quotations began to grow and as of May 16 amounted to $615-635/t.

Turkish rebar prices fell last week as international buyers showed little interest in Turkish-made products, which still struggle to compete in export markets due to high costs.

The global steel market is stagnant due to uncertainty, so Turkish producers are forced to lower prices to sell some volumes of production. Buyers, in turn, buy only those volumes of products that they need urgently.

Local producers are under pressure from financial problems in the country, including limited access to foreign currency and credit. This limits the purchase of raw materials for the production of rebar and increases the cost of finished products, which is already too high for competitiveness in export markets.

At the same time, in the period of May 16-17, 2023, the market of rebar in Turkiye began to recover. The domestic demand for products increased significantly after the first round of presidential elections in the country. Consumer-importers also began to increase purchases. Turkish rebar are sold to South America, Middle East, EU, the UK and Africa. However, these volumes are far from traditional sales in previous years and are weak compared to the available capacities.

Steelmakers note that the difference between the value of scrap and rebar is insignificant, which may cause losses to small producers in the future at current price levels. In addition, the gradual increase in domestic product prices once again makes domestic products uncompetitive on export markets. This could hurt the recovery in exports, which has been flat since the beginning of the week.

On Chinese rebar market for the week of May 5-12, 2023, prices for rebar decreased by 1.9% compared to the previous week – to $503-505/t FOT. Chinese producers have been forced to cut product prices as demand for products remains weak and expectations that the market will recover after the holidays in early May have not been met.

Negative market sentiment is putting pressure on prices, but buyers are staying away from purchases. The decline of the steel market provokes a drop in prices for raw materials, so end consumers wait for the bottom of the market to buy the required volumes at the most favorable price. Local traders predict that this trend will last at least until the end of May.

The main challenge for the market is supply pressure. Although local steelmakers are reducing production capacity, this is not enough to balance the market and stop the fall in prices. Instead, some of them are looking at restarting the furnaces that were shut down in April, as there is some recovery in profits, to some extent due to the drop in raw material prices.

In general, during the first half of 2023, China does not expect positive changes in the rebar market. It is expected that in May-June, product prices will be around $470/t.

Quotation of rebar in USA are stable for the third week in a row – at the level of $920-940/t. Among the main factors that negatively affect the market, limiting the volume of trade – a decrease in scrap prices, an increase in interest rates, an increase in the overall cost of construction and a shortage of skilled labor in the construction industry.

Construction contractors are taking on fewer projects as their costs for building materials continue to rise. The low volume of new projects in the current construction season will make it difficult to supply large volumes of rebar and put pressure on producers as supply exceeds demand.

According to GMK Center forecasts, closer to autumn, the global steel market will reach a balance between supply and demand. The fall in prices for raw materials and steel will stop amid increased demand. The negative scenario predicts a deepening of negative price trends.

«There are well-founded fears about the banking crisis in the USA, where several large financial institutions have already gone bankrupt – it is quite possible that negative trends in the banking sector will intensify in the fall. Negative events in the American economy may occur even earlier, as negotiations on raising the national debt ceiling continue and no single solution has yet been found. In the case of a pessimistic scenario, the global economy will find itself in a state of crisis and the prices of steel and raw materials will fall even more,» it is stated in GMK Center’s post.

As GMK Center reported earlier, Ukrainian steelmakers reduced the export of long rolled products by 17.5% compared to the previous month – to 35.95 thousand tons. In monetary terms, the export of such products fell by 13.5% m/m – to $35.31 million. The main consumers of such products were Poland, Romania, Germany and Moldova.