News Global Market hot-rolled prices 1378 29 November 2023

The trend is expected to continue until the end of the year due to limited supply and increased demand

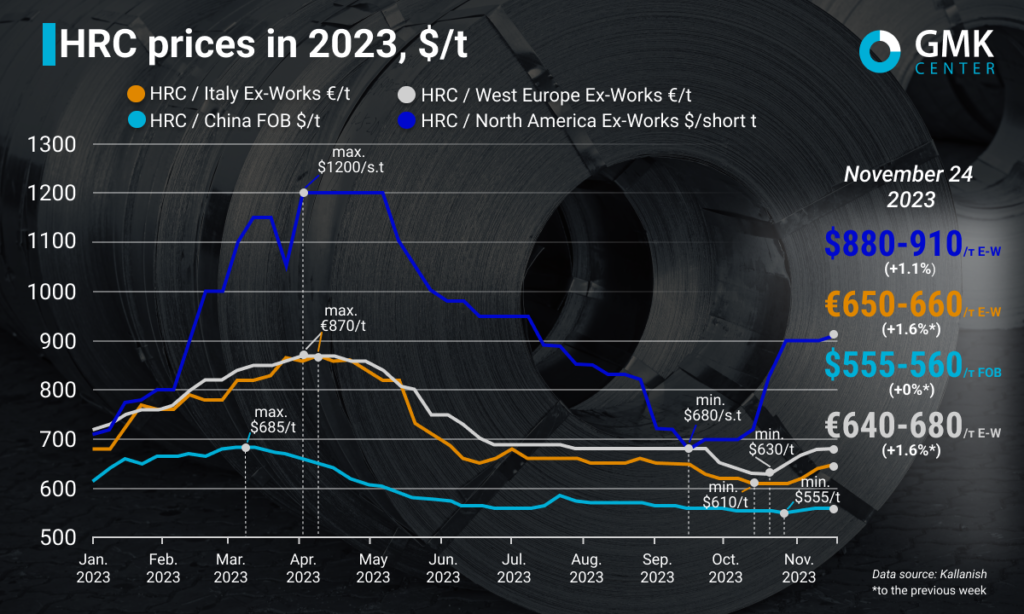

Global hot-rolled coil prices continued to rise in November, maintaining the trend that started in late October. Production capacity restrictions by steel mills in the EU and the US have had an impact, as supply has decreased and consumer demand has recovered.

Europe

In Western Europe, prices for hot-rolled steel increased by €10/t for the period November 17-24, 2023, compared to the previous week, to €640-680/t Ex-Works. At the same time, prices have risen by €30/t, or 4.6%, since the beginning of November. In general, the upward trend in prices for brewing products has been observed since mid-October. On October 20 (€610-630/t), rolled steel prices in Western Europe began to rise after a prolonged decline and increased by €50/t as of the end of November.

In Italy, prices for hot-rolled steel also rose by €10/t on November 17-24 compared to the previous week, to €650-660/t Ex-Works. Since the beginning of the month, product quotations have recovered by €50/t.

The increase in rolled steel prices in different parts of Europe was predictable, as the mills announced their intentions back in October. However, the market did not expect such a large price increase – by €50 per tonne. Steel consumers were surprised by this sharp price increase and believed that it was an unjustified step in the current situation.

Steel producers, in turn, began to raise prices in the face of a decline in steel output, which was caused by some companies shutting down blast furnaces. The reduced supply of local products, coupled with the exhaustion of import quotas for hot-rolled coils, contributed to producers’ desire to raise prices.

Asian producers are offering products with very long delivery times – March-April – and Turkish offers are currently more expensive than European ones.

Since mid-November, demand in the European market, particularly in Italy, has started to grow, as consumers are likely to anticipate a growing shortage of hot-rolled coils in the domestic market in the current environment. In addition, steel mills are targeting further price increases to around €700/t. In this environment, steelmakers have filled their order books for January in recent weeks. Bookings are currently being made for February.

Some optimism has returned to the market, and prices are moving up to €680-700/t, but growth may be limited as Turkish producers enter the European market. So far, products from Turkiye are not competitive.

USA

In the US market, prices for hot-rolled coils for the week of November 17-24, 2023 rose to $880-910/t (N America Ex-Works) compared to $870-900/t a week earlier. This is the first increase in US rolled steel prices since early November. Currently, prices are at their highest level since early July this year.

Since the beginning of November, US steel companies have started to raise their target prices for hot-rolled steel, including Cleveland-Cliffs – up to $1000/t, Nucor – up to $950/t. US Steel plans to increase its prices to $950/t.

The mills cite low inventories and stable demand as the automotive industry is currently working overtime to compensate for lost production due to strikes. For now, order lead times continue to gradually lengthen, and steel mills are unwilling to negotiate price cuts.

If steelmakers continue to limit production, thereby causing a supply shortage, hot-rolled coil prices will remain high until the end of 2023 and early 2024, reaching over $1,000-1,100/t.

China

In China, prices for hot-rolled coils for the week of November 17-24 remained stable compared to the previous week at $555-560/t FOB. Since the beginning of November, quotes have increased by $10/t.

At the beginning of the month, Chinese prices for hot-rolled steel gradually increased along with prices for raw materials amid positive macroeconomic factors. However, in the middle of the month, the increase was met with resistance due to market fears that prices had peaked.

The price increase was supported by the positive situation on export markets, while real demand was disappointing, which slowed the positive trend despite the growth in raw materials. Consumers are currently buying only urgent volumes of products.