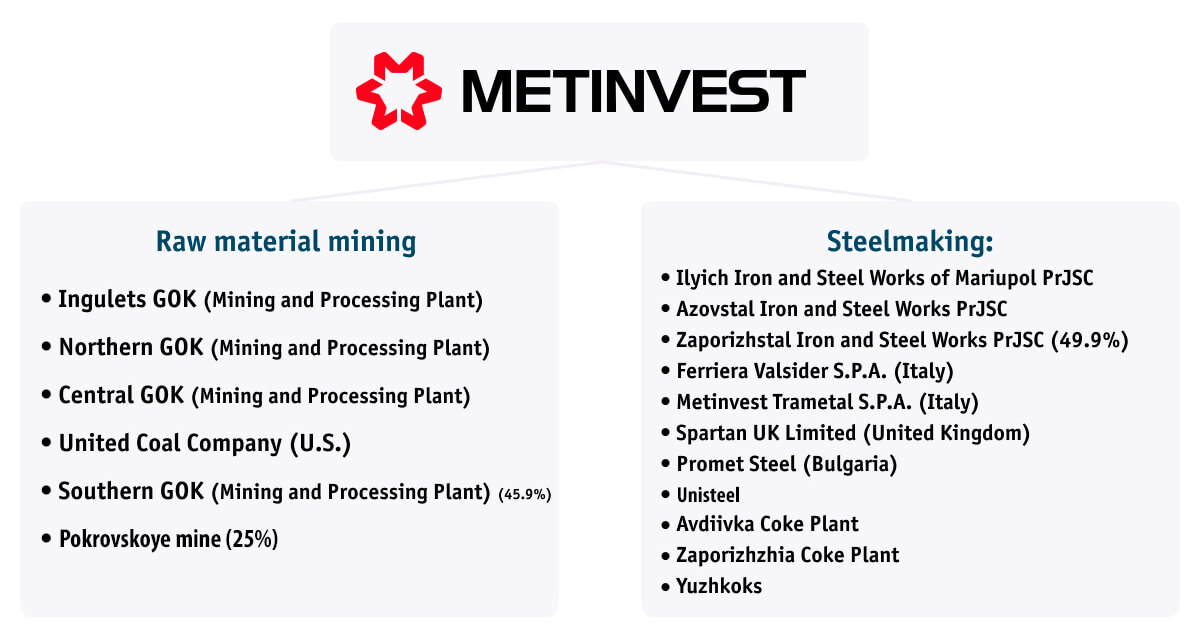

Metinvest Holding

Metinvest Holding is an international, vertically integrated mining & metals company. The Group includes coal, coking, mining, steel and rolling plants in Ukraine, the EU and the U.S. Metinvest Holding manages the complete production chain, from extracting iron ore and coal to manufacturing semi-finished and finished steel products.

In 2020, Metinvest ranked 45th among the largest steel makers in the world, and 5th in the CIS.

Metinvest Holding was 13th in late 2015 in the Deloitte TOP-500 Central and Eastern Europe ranking.

Metinvest Holding network of sales offices and service centres covers more than 80 countries.

Charts and tables

Production results, thousand tons

Indicative sales structure by products in 2020*

Indicative sales structure by markets in 2020*

* – structure of sales volumes, metric tons

Financial performance, $ million

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| Sales | 12807 | 10565 | 6832 | 6223 | 8931 | 11880 | 10757 | 10453 |

| EBITDA | 2361 | 2702 | 513 | 1153 | 2044 | 2513 | 1213 | 2204 |

| EBITDA margin | 18% | 26% | 8% | 19% | 23% | 21% | 11% | 21% |

| Net income | 392 | 159 | -1003 | 118 | 617 | 1188 | 341 | 526 |

| Net income margin | 3% | 2% | -15% | 2% | 7% | 10% | 3.2% | 5% |

| CAPEX | 747 | 613 | 285 | 374 | 542 | 898 | 1055 | 663 |

| Net debt | 3525 | 3118 | 2766 | 2318 | 2298 | 2463 | 2758 | 2111 |

Key facts

2021

Metinvest received permission from the Antimonopoly Committee to purchase the assets of Dniprovsky MK

Metinvest buys Pokrovsk coal group

Metinvest intends to invest $800-850 million in 2021

2020

Metinvest saves $50 million a year due to digitalization projects

Metinvest to invest $433 million in environmental projects by 2025

Metinvest has been included to TOP-10 global steelmakers according to the ESG risks rating

2020

Fitch expects Metinvest to reduce its investment program in 2020 to $600 million. Only environment-related projects and projects to increase operational efficiency will be carried out.

In 2020, the Metinvest Group is to ramp up sales of hot-rolled coils by 17.6% to 4 million tons against the 2019 estimation as a result of a project for the reconstruction of the hot strip mill 1700 at Ilyich Iron and Steel Works.

2019

In 2020, the Metinvest Group invested $386 million (+47% YoY) in environmental projects, according to the Group’s annual report.

In November 2019, due to negative market conditions, the Metinvest Group announced a cut in the investment program: the implementation of some projects will be suspended, except for critical ones provided for by the Technology Strategy, and projects with significant environmental effects.

In October 2019, Metinvest placed Eurobonds worth $500 million and €300 million.

In 2019, Metinvest Holding plans to increase CAPEX by 20% up to $1.08 billion.

Metinvest Holding attracted €34 mln loan from Austrian bank ODDO BHF Aktiengesellschaft with guaranties of Austrian Oesterreichische Kontrollbank Aktiengesellschaft. The aim of the loan – reconstruction of the sheet rolling shop 1700 on Ilyich Iron and Steel Works of Mariupol.

In April 2019

Metinvest Holding received a permit from the Antimonopoly Committee of Ukraine for buying a stake in Dniprovskyi Coke & Chemical Plant (Kamianske, Dnipropetrovsk oblast).

By March 2019

Metinvest Holding appeared in rankings of the major international rating agencies and got: B (positive outlook) by Fitch, B- (positive outlook) by S&P, and B3 (stable outlook) by Moody’s.

In August 2018

Metinvest Holding bought 25% of shares in Donetskstal Iron and Steel Works PrJSC. Hence, the company became an indirect shareholder of Pokrovske Coal Company PrJSC, the largest coking coal producer in Ukraine.

In 2018

Metinvest Holding announced the purchase of a 23.71% stake in Yuzhcoke, a coke producer. The deal was worth $30 million.

In 2018

Metinvest Holding bought Unisteel (Kryvyi Rih, Dnipropetrovsk oblast), a producer of galvanized rolled products with the annual capacity of 100 thousand tons.

In April 2018

Metinvest Holding successfully refinanced its debt obligations by issuing new Eurobonds worth $1.592 billion and attracting a pre-export financing facility in the amount of $765 million. These two deals brought additional $205 million to the company. Besides, the maturity of debt on bonds was extended from 2021 to 2023 ($953 million) and 2026 ($648 million).

In March 2017

Metinvest Holding said that it had lost control over its assets in the non-government-controlled territories of Luhansk and Donetsk oblasts, including Yenakieve Iron and Steel Works (EMZ), Khartsyzk Pipe Plant (KPP), Krasnodonugol.

Data source for sections “Production results”, “Sales structure”, “Financial performance”: GMK Center calculations, based on companies`annual reports and web-sites data, media sources

* – structure of sales volumes, in monetary terms