Ferrexpo

Ferrexpo plc is the parent company of the Ferrexpo Group. Since 2007, Ferrexpo plc shares have been listed on the London Stock Exchange.

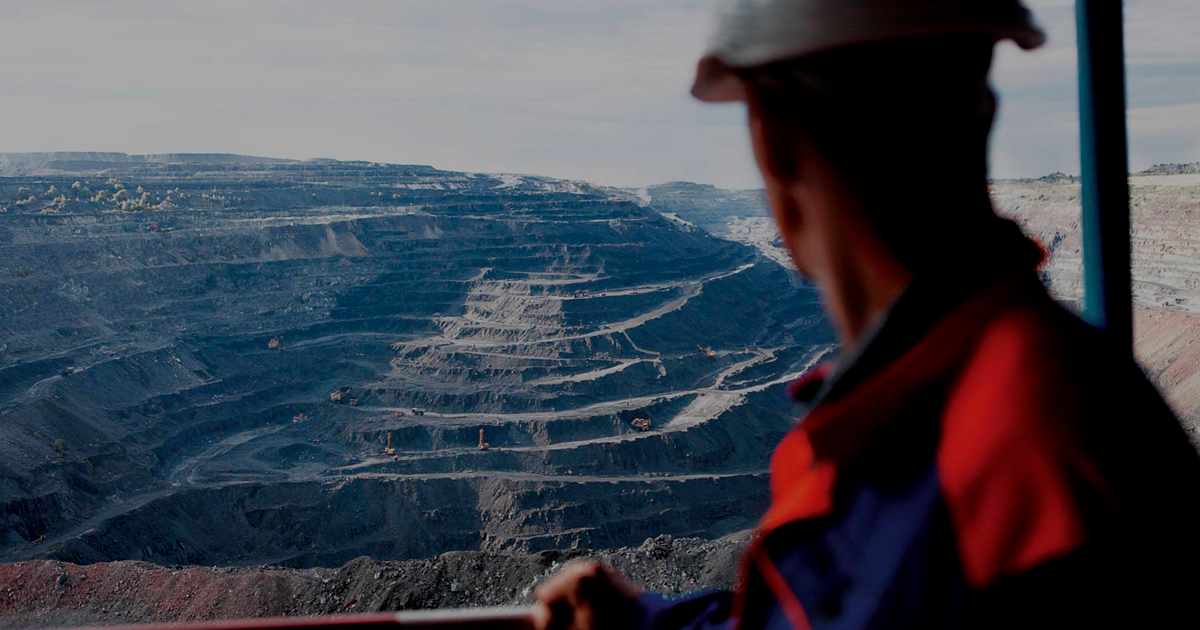

Ferrexpo’s raw material base includes 9 iron ore deposits with estimated resources of 19.7 billion tons. Iron ore is currently mined at two deposits, Gorishne–Plavninske–Lavrykivske (FPM, Ferrexpo Poltava Mining) and Yeristivske (FYM, Ferrexpo Yeristovo Mining). Another two deposits, Bilanivske and Galeschynske, will be exploited by FBM (Ferrexpo Belanovo Mining), the construction of which has just begun. The remaining areas (‘northern deposits’) are in reserve.

Ferrexpo is the world’s third largest exporter of iron ore pellets. Its global market share is 8.5% (2019). Over 99% of its output are high-quality 67% and 65% Fe pellets. All pellets produced by Ferrexpo are exported.

Ferrexpo lacks its own concentrate production capacity. It therefore buys iron ore concentrate for the production of pellets from other companies.

In 2018, the Group produced 10.6 million tons of pellets. The annual production is expected to rise to 12 million tons by 2020, and up to 20 million tons in a long-term perspective.

Charts and tables

Production results, thousand tons

Indicative sales structure by products in 2020*

Indicative sales structure by markets in 2020*

* structure of sales volumes, metric tons

Financial performance, $ million

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| Sales | 1581 | 1388 | 961 | 986 | 1197 | 1274 | 1507 | 1700 |

| EBITDA | 506 | 496 | 313 | 375 | 551 | 503 | 586 | 859 |

| EBITDA margin | 32.0% | 35.7% | 32.6% | 38.0% | 46.0% | 39.5% | 39% | 50.5% |

| Net income | 264 | 184 | 31 | 189 | 394 | 335 | 403 | 635 |

| Net income margin | 16.7% | 13.3% | 3.2% | 19.2% | 32.9% | 26.3% | 27% | 37.4% |

| Net debt | 639 | 678 | 868 | 589 | 403 | 339 | 281 | n/a |

| Net debt/EBITDA | 1.3 | 1.4 | 2.8 | 1.6 | 0.7 | 0.7 | 0.48 | 0 |

| CAPEX | 278 | 235 | 65 | 48 | 103 | 135 | 247 | 206 |

Key facts

2021

MSCI Ratings Upgrades Ferrexpo’s ESG Rating.

Ferrexpo announced a special interim dividend ($ 0.132 per share). The total dividend for 2020 was $ 0.33 per share.

2020

Ferrexpo’s board of directors has decided to pay a final special dividend for the 2019 fiscal year of $ 0.033 per share.

2020

In 2020, Ferrexpo is going to ramp up pellet production by 9.5% to 11.5 million tons.

2019

Ferrexpo plc signed the first long-term contract for pellet supplies with the largest German steel producer, ThyssenKrupp.

In 2019, Ferrexpo increased its CAPEX volume to $247 million by 83% against 2018.

In 2019 Ferrexpo AG applied “squeeze out” procedure for minority shareholders of Poltava Mining and increased its stock to 100%. Before that, Ferrexpo had held a 99.11% stock in Poltava Mining.

In 2019, Ferrexpo plans capital investment worth $220–300 million. It includes investing around $35 million in the Concentrator Expansion Program 1 (CEP1) which will enable the Group to increase pellet output up to 12 million tons per annum, by 2021.

2018

Ferrexpo to pay record big dividends. The amount of dividends will increase by 40% compared to 2017, up to $0.231 per share.

In 2018

Ferrexpo increased the amount of pre-export financing facility, approved in 2017, from $195 million to $400 million, and extended its maturity from 3 to 4 years. Financing will be arranged by BNP Paribas and Deutsche Bank. The rate under the new pre-export financing facility is USD LIBOR +4.5%.

In 2017

Ferrexpo invested $20 million in FYM, and $4.4 million in exploitation and development of Bilanivske, Galeschynske and northern deposits.

In 2017

Ferrexpo resumed its concentrate production expansion program. Its goal was to increase production of pellets by 1.5 million tons. The program is expected to be completed by 2020. The necessary volume of investment is estimated at $65 million.

In 2017

Dividends paid amounted to $0.165 per share.

Sources: websites of the companies, media outlets