Infographics EU 3267 18 September 2024

High energy costs and stagnation in the economy restrain market development

Production

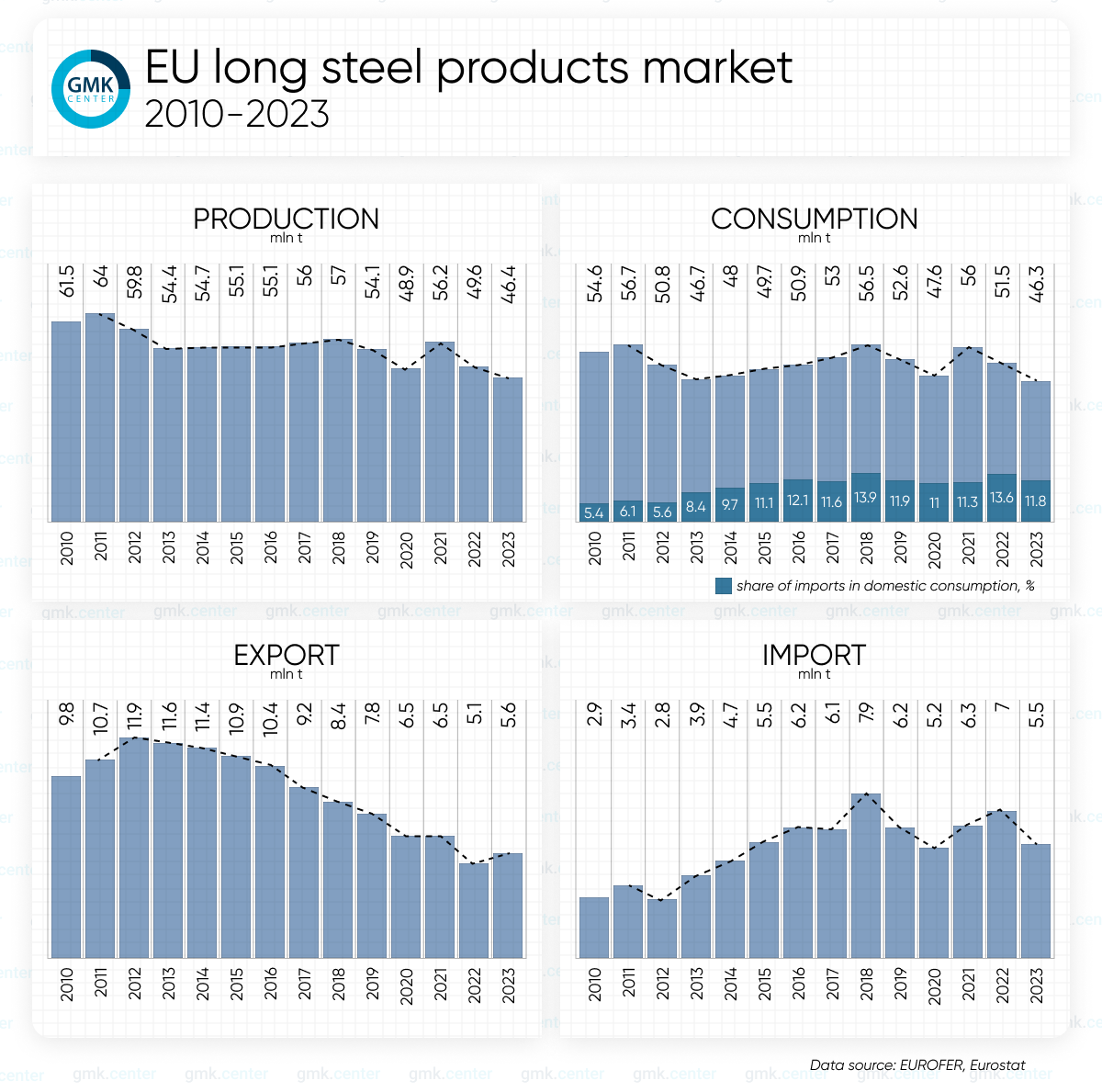

The EU long steel market went through a number of development stages in 2010-2023. The recovery from the 2008 global financial crisis brought a slight increase in production at the beginning of the decade, but growth was restrained due to weak demand in the construction and infrastructure sectors.

One of the important factors influencing production was the global economic recovery from 2015 to 2018, when a significant increase in infrastructure projects in the EU had a positive impact on steel consumption. As a result, production volumes stabilized at 54-57 million tons. Countries such as Germany, Italy and Spain increased production, but the introduction of new environmental standards somewhat restrained production growth.

Consumption

Consumption of long steel products directly depends on the state of the construction sector, which experienced significant fluctuations in 2010-2023. After the financial crisis, demand remained volatile, but in 2015-2019, construction activity in the EU peaked, leading to record consumption of rolled products. In particular, increased investment in transport infrastructure, residential construction and industrial facilities was a key market driver.

However, the COVID-19 pandemic in 2020 brought a significant decline in demand. The freezing of construction projects, the shutdown of many factories, and reduced investment in construction limited the consumption of rolled steel. In 2021-2022, the market began to grow thanks to government incentives aimed at supporting infrastructure projects and economic recovery. At the same time, 2023 was one of the lowest years in terms of consumption in the last decade, at 46.3 million tons. This figure is the result of the stagnation of the European economy and macroeconomic problems, which led to a slowdown in demand for steel products.

Export and import

Exports of long steel products from the European Union have always played a major role. The EU had particularly strong export positions in the Middle East and North Africa, where infrastructure projects were being actively implemented. At the same time, competition from countries such as China and Turkey has seriously affected the capabilities of European producers. Chinese and Turkish companies offered cheaper products due to lower raw material costs and less stringent environmental regulations. The largest share of long products produced in the EU was exported in 2012-2016 – 18-21%, but due to the loss of competitiveness, this figure dropped to 10-12% by 2023.

Imports still play a significant role in the EU long products market. However, increased supply of cheap Chinese and Turkish rolled products has led to increased competition in the EU domestic market. This, in turn, has forced European producers to optimize their production processes and focus on value-added products to remain competitive.

The growth of imports began in 2014, and by 2018, the volume reached record levels of 7.9 million tons. Since then, this figure has been fluctuating at 5-7 million tons, with a slight decline to 5.5 million tons in 2023, mainly due to restrictions and generally weak consumption.

“European producers of long products have underutilized electric arc furnace-based capacities. The introduction of CBAM may have a positive impact on their utilization rate, as long products made through BF-BOF route will be pushed out of the market,” said Andriy Glushchenko, GMK Center analyst.

Development prospects

The outlook for the EU long products market in the coming years remains ambiguous. Lower ECB rates and the expected growth in construction are expected to be one of the main growth drivers over the next 5 years. However, high energy costs and global economic uncertainty may restrain growth. EU government programs aimed at infrastructure development may support the market in the medium term.

In general, a balanced government policy to support domestic producers by ensuring adequate electricity prices is essential for the stabilization and development of the long products market.