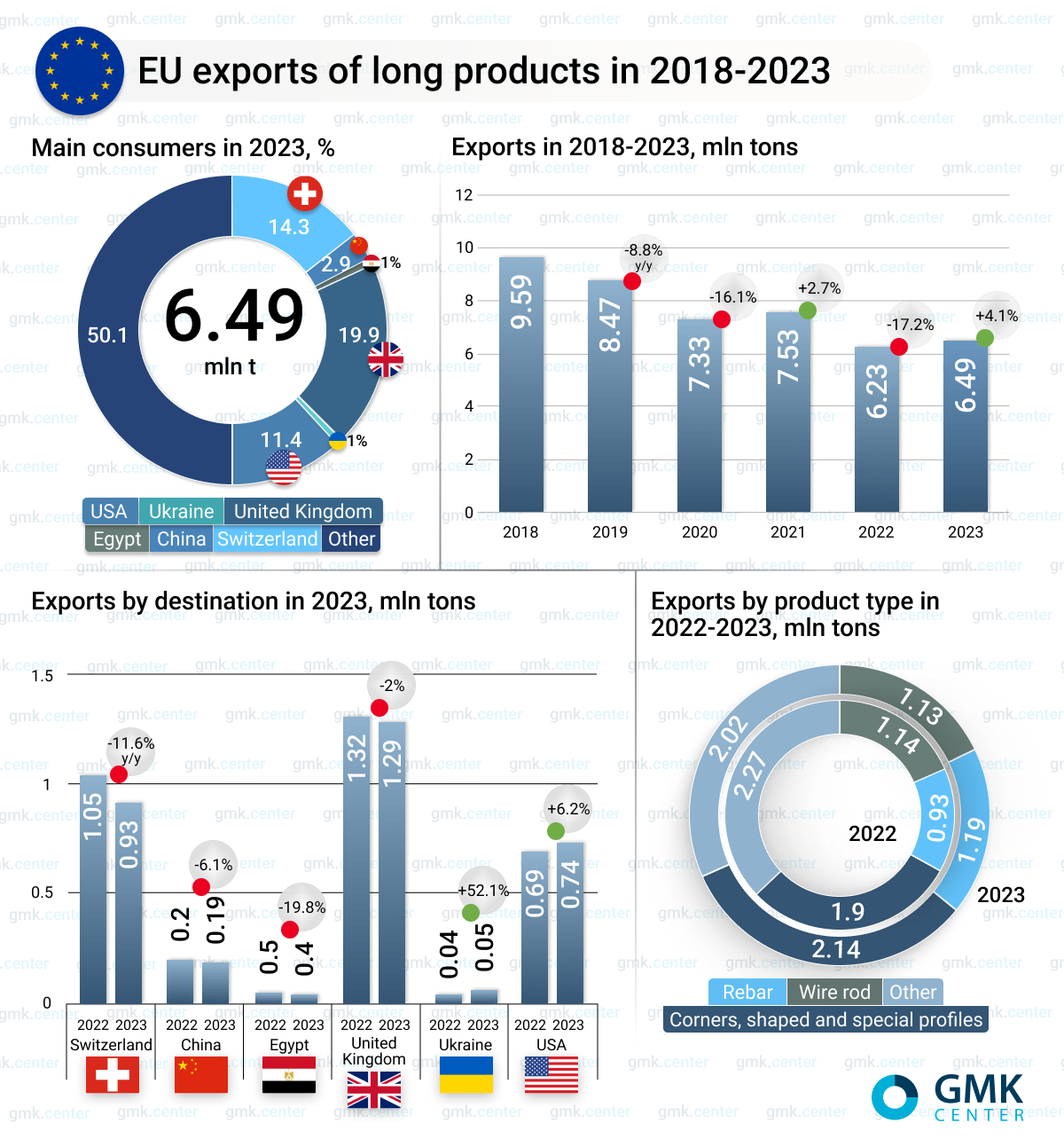

Infographics EU 3165 28 March 2024

The main consumers of long products in the EU last year were the US, UK and Switzerland

In 2023, the European Union increased exports of long products to third countries by 4.1% compared to 2022, to 6.49 million tons. This is based on GMK Center’s calculations based on Eurostat data.

The dynamics of long products exports over the past 6 years is as follows:

- 2018 – 9.59 million tons;

- 2019 – 8.74 million tons (-8.8% y/y);

- 2020 – 7.33 million tons (-16.1% y/y);

- 2021 – 7.53 million tons (+2.7% y/y);

- 2022 – 6.23 million tons (-17.2% y/y);

- 2023 – 6.49 million tons (+4.1% y/y).

The main consumers of long products from the EU are the United States – 739.6 thousand tons (+6.2% y/y), the United Kingdom – 1.29 million tons (-2% y/y), Switzerland – 926.37 thsd tonnes (-11.6% y/y), China – 186.8 thsd tonnes (-6.1% y/y), Egypt – 38.68 thsd tonnes (-19.8% y/y), Ukraine – 54.2 thsd tonnes (+52.2% y/y). These countries accounted for about 50% of EU long products exports in 2023.

The largest exports over the year were angles, shapes and special profiles – 2.14 million tonnes (+12.8% y/y), rebar – 1.19 million tonnes (+27.9% y/y), and wire rod – 1.13 million tonnes (-0.4% y/y).

«In the European Union, 85% of long products production facilities are electric arc furnaces. Therefore, the increase in long products exports was primarily due to lower electricity prices, which account for the bulk of production costs,» said Andriy Glushchenko, GMK Center analyst.

Shipments of European steel to Ukraine saw a sharp rise last year, up 52.2% y/y, driven by increased steel consumption in the country, along with a shortage of certain products on the domestic market due to the loss of some steelmaking capacity as a result of the war. The upward trend in imports will continue, as local steelmakers are unable to supply domestic consumers in full. This will be especially noticeable during the period of post-war recovery in Ukraine.