Infographics промислова екологія 878 17 June 2025

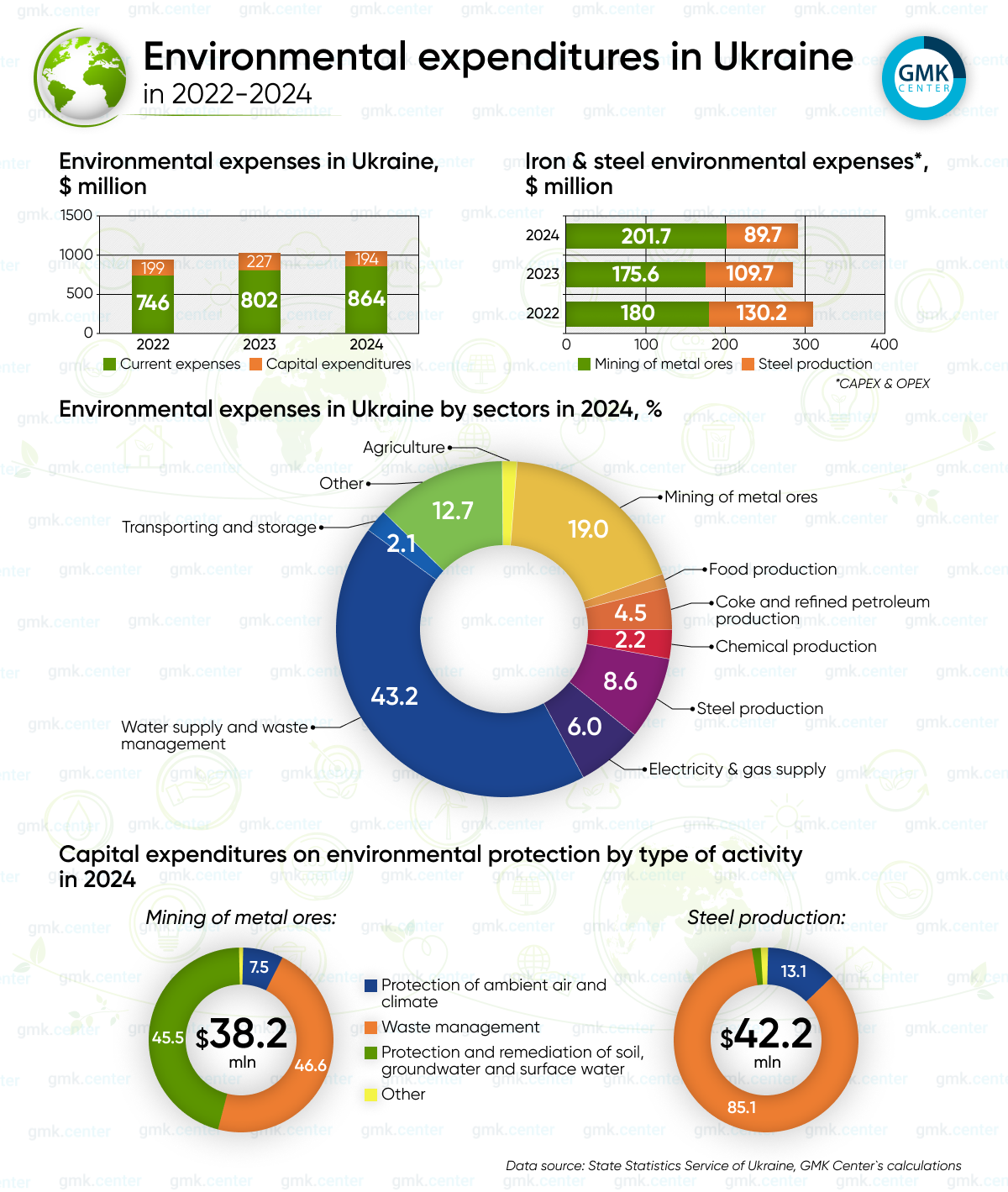

27.5% of total expenses were accounted for by the iron and steel sector

Spending on environmental protection in Ukraine has plummeted due to the full-scale aggression of the Russian Federation. Thus, current expenditures on environmental activities decreased from $1.1 billion in pre-war 2021 to $746 million in 2022, and capital investments from $517 million to $199 million, respectively. However, these volumes began to gradually recover in the following years. In particular, in 2024, current expenditures amounted to $864 million, and capital investments – $194 million.

The iron and steel sector is one of the leaders in terms of environmental costs. In 2024, environmental costs in steel ore mining accounted for 19% of total environmental costs in Ukraine. The share of steel industry was 8.6%. Current legislation requires compliance with environmental regulations, and iron and steel industry companies themselves also feel responsible for environmental protection.

In 2024, the environmental costs of steel ore mining companies increased by 12% to $202 million compared to 2022. The same indicator in steel industry decreased from $130 million in 2022 to $90 million in 2024, primarily due to the loss of assets as a result of the war and the decline in economic activity. Total capital investments in environmental protection in 2024 in the steel ore mining and steel industry sectors amounted to $38.2 million and $42.2 million, respectively.

In times of war, companies minimize capital expenditures and focus their efforts on maintaining current operations. This also applies to environmental protection measures. In particular, in the steel ore mining sector, current expenses (80%) dominated the structure of environmental costs in 2024, while capital investments accounted for only 20%. Currently, a number of iron ore companies have reduced production or ceased operations altogether due to non-reimbursement of VAT, high electricity prices, and logistical problems. These factors also negatively affect the ability to implement measures that would minimize the environmental impact of iron ore mining.

At the same time, the situation in the steel industry is somewhat different: current expenditures account for 54% of total environmental costs, while capital investments account for 46%.

Current expenditures by type of environmental protection measures in steel ore mining and steel industry in 2024 were as follows

- air protection, climate change prevention and ozone layer protection – UAH 137 million and UAH 1.25 billion, respectively;

- wastewater intake and treatment – UAH 1.2 billion and UAH 376 million, respectively;

- waste management – UAH 4.6 billion and UAH 257 million;

- protection and restoration of soil, groundwater and surface water – UAH 522 million and UAH 45 million.

Capital investments by type of activity in steel ore mining and steel industry in 2024 amounted to

- air protection, climate change prevention and ozone layer protection – UAH 121 million and UAH 221 million, respectively;

- waste water intake and treatment – UAH 6 million and UAH 16 million, respectively;

- waste management – UAH 750 million and UAH 1.4 billion;

- protection and restoration of soil, groundwater and surface water – UAH 732 million and UAH 16 million.

The Ukrainian iron and steel sector faces huge challenges as part of its integration with the EU and to achieve the climate goals set out in the Green Deal. The Ukrainian steel industry needs to significantly modernize its facilities to achieve greenhouse gas emission reduction targets. According to some estimates, $11 billion in investments are needed to implement the plans already announced by Ukrainian steel companies.

It is impossible to realize these intentions solely at their own expense and in a time of war when access to Western capital markets is closed. A realistic option for eco-modernization of steel facilities involves access of Ukrainian companies to European green financing mechanisms. As a candidate for EU accession, Ukraine should have access to them on the same terms as European companies already have.

This form of support will not only help the rapid post-war recovery of the Ukrainian steel industry, but will also allow us to integrate our green facilities into European supply chains. This will be a mutually beneficial solution for both Ukraine and the European steel market.