Posts Global Market Türkiye 4191 24 March 2025

Major steel consuming industries showed a decline at the beginning of the year

Turkey’s steel market at the start of 2025 maintained the high rates taken last year. There are prerequisites for further growth. But there are also a number of factors threatening the well-being of the local steel industry.

The Association of Steel Exporters (CIB) insists on state support for the industry, citing the examples of the United States, China and the European Union. However, so far official Ankara limits itself to point measures to protect against imports of steel products.

The ball is on the side of producers

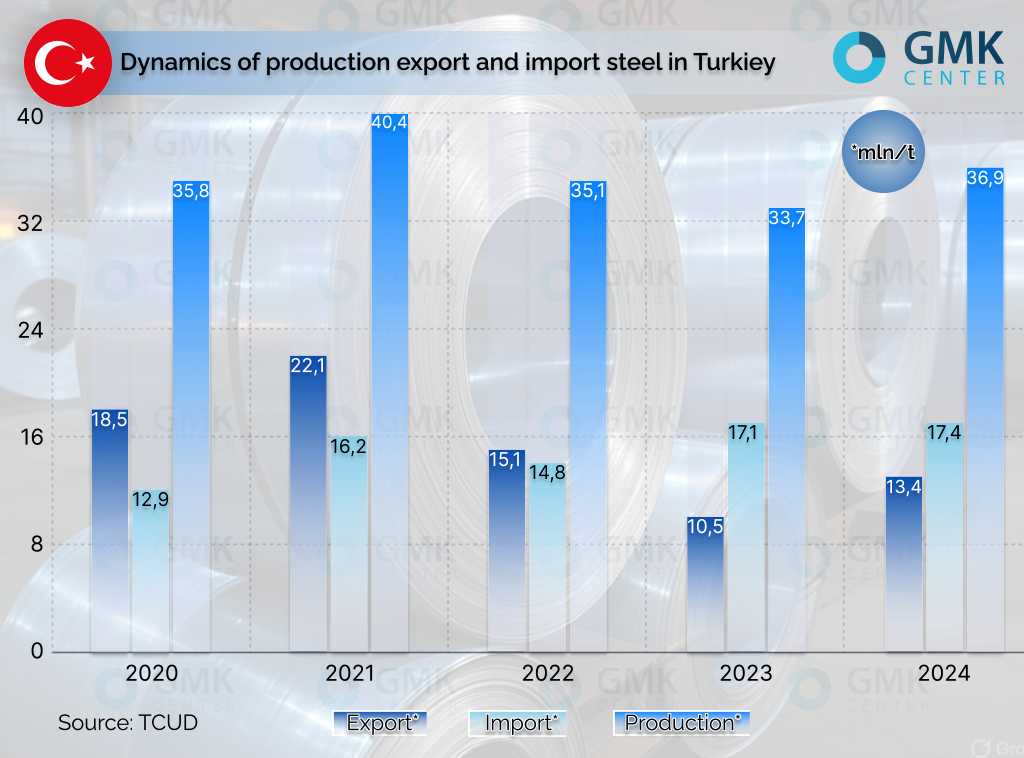

The record year for Turkish steelmakers was 2021. At that time, smelting soared to an all-time high. This was followed by a decline. In 2024, the industry returned to a positive trend. The dynamics of exports of steel products was similar. A slightly different picture with imports. In 2023, it increased despite the deep devaluation of the Turkish lira – by 60%.

The monetary policy of the local central bank had a mixed effect on the steel industry. On the one hand, the production costs in dollar equivalent decreased: labor, electricity and internal logistics. This allowed exporters to gain an advantage on foreign markets. On the other hand, the costs of raw materials – ore, scrap, pig iron, coking coal, which Turkey imports – increased.

At the same time, the rise in the price of imports could not restrain its growth. It compensated consumers for the reduction in domestic supply. In 2024, foreign producers continued to expand their presence in the Turkish market. Even despite the increased capacity utilization of local steel mills. This gave an excuse for official Ankara to impose anti-dumping duties on imports of hot-rolled products from China, India, Japan and Russia starting from October.

Consumers reacted negatively. According to A. Eren, a board member of the Turkish Engineering Federation, the products of local steelmakers do not meet expectations in terms of quality, delivery time and prices. Therefore, they cannot replace imports. Nevertheless, the Turkish Ministry of Trade in late December announced the start of a new investigation. This time with regard to x/k and n/a rolled products, as well as galvanized steel from China and South Korea.

Based on the results of the investigation, additional tariffs may be introduced already this year. Fixed duties on imports of wire rod are also among the protective measures. They were set at the beginning of 2024. And in July, the Turkish Ministry of Trade extended them until January 6, 2027. Thus, in the eternal dispute between producers and consumers of steel products, the ball is now on the side of producers, in terms of state regulation.

So far this has not affected the dynamics of steel imports. In January this year, it increased by 24.9% y/y, to 1.73 million tons. The increase was mainly due to the expansion of supplies of flat products – by 22%, up to 900 thousand tons. Whereas long products were imported 0.4% less, 98 thousand tons. Imports of semi-finished products increased by 33% – to 730 thousand tons. At the same time, steelmaking fell by 1.9%, to 3.2 million tons.

This is exactly why local steelmakers were criticized in the Turkish Engineering Federation: instead of increasing their own production, they prefer to buy slabs on the side. This strategy casts doubt on the realism of the goal announced by TCUD Secretary General V. Yayan. According to him, Turkish steelmakers intend to increase capacity utilization to 70% this year compared to 62.6% in 2024. This will mainly depend on the “weather” in the main sectors of steel consumption.

Turkish car industry: a bad signal

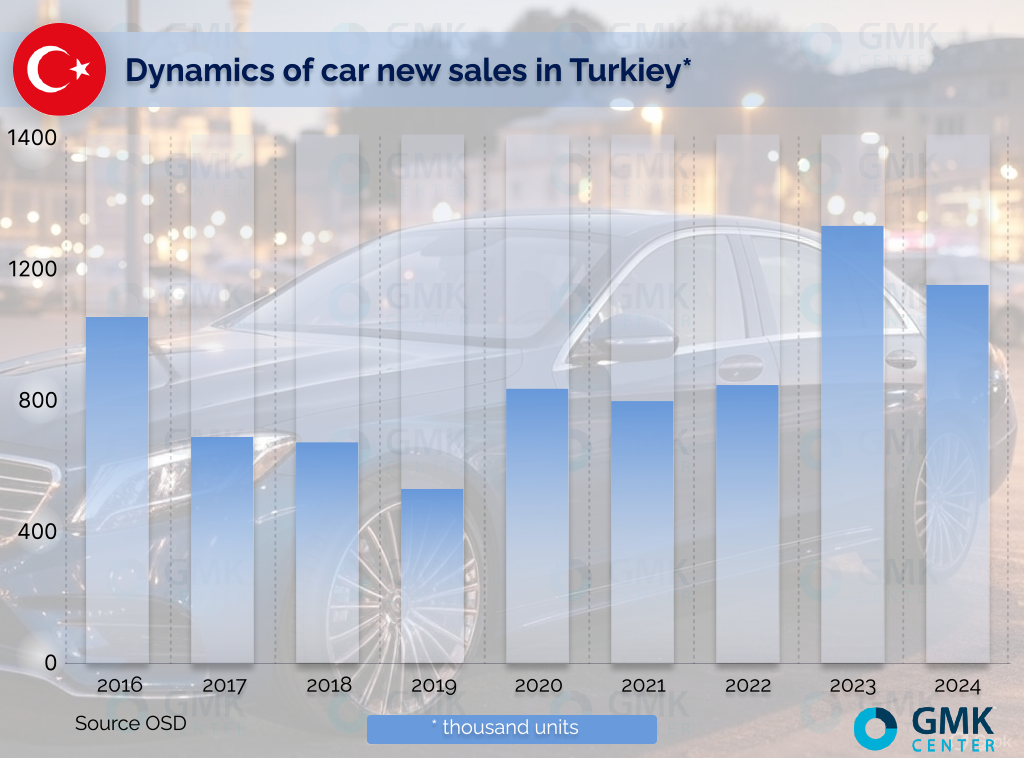

The Turkish car market has experienced a series of ups and downs in recent years. After the record high reached in 2016, the peak began. As a result, sales fell to the lowest level in a decade. But the “coronavirus” crisis did not prevent a recovery. And after a small decline in 2023, a new upswing followed. Which, however, was short-lived.

In 2024, the market slowed down to rates close to stagnation: the growth of car sales amounted to only 0.8%. However, the production of passenger cars decreased by 5.1%, to 904.5 thousand units, commercial vehicles – by 10.7%, to 460.8 thousand units. Thus, the positive dynamics was maintained at the expense of auto imports, mainly Chinese. But it did not prevent the Turkish automobile industry to keep the leadership in the national export with the share of 17.3%. In monetary terms, foreign sales of cars produced in Turkey grew by 6.3% to $37.2 billion.

The start of the current year for the Turkish car market was frankly not good. In January-February, the total volume of car sales fell by 15% – to 164.3 thousand units, according to the OSD Association of Automobile Manufacturers. Passenger car sales fell 10% to 132,000 units. At the same time, total car production fell 9% to 219,000 units, including passenger cars down 6% to 141,500 units. Auto exports decreased by 4% – to 158.2 thousand units.

Despite this, the participants of the car market remain optimistic. In their opinion, car sales in Turkey will amount to 1.2 million units by the end of 2025. That is, they will approximately remain at last year’s level. But this is if the exchange rate does not grow significantly, the authorities will not increase the tax on cars, and the central bank will continue to reduce the prime rate.

The prospects of Turkish auto export, historically aimed at the European Union, look problematic. Firstly, demand there is rather sluggish. In January, sales of new cars in the EU fell by 2.6% year-on-year, according to the ASEA association. Secondly, we can expect more competition from local producers in the near future.

Thanks to the postponement of new auto emissions requirements until 2028, announced by the European Commission in March, European carmakers do not have to raise the cost of cars with traditional engines. In addition, the weakening of the exchange rate from €1.04 to €1.09 against the US dollar has actually reduced the cost of raw materials and energy in the EU by 5%, World Steel Dynamics calculated. This decision, which the ECB made at the end of January, makes life easier for all local producers, including the auto industry.

Construction: a likely driver

The Turkish construction sector, the main consumer of long products, has been in decline for the last few years. At the end of last year, housing sales in the country rolled back to 2017 levels.

One of the main reasons is the decline in foreigners’ interest in buying in new buildings. At the end of 2024, they decreased by 32%, according to Ataberk estate. For a long time, it was foreign investment that provided growth in the construction industry. However, the mass denial of residence permits and the deteriorating domestic political situation in Turkey cooled the interest of foreign clients.

This year, the trend has continued. In January, foreigners bought housing by 29% less in annual comparison, only 1547 transactions were registered. But domestic sales of mortgage housing increased by 183% to 16,726. Of these, 3,856 were new-builds. The rebound in mortgage sales was certainly a positive signal for the market. Overall, January home sales were up 28% year-over-year.

A very large potential remains in the state program to provide housing for victims of the February 2023 earthquake. Then Erdogan promised that in 2024 319 thousand new houses will be built for them, and in 2025 – another 361 thousand. Nevertheless, by mid-January this year, only 169 thousand houses were built, according to the Union of Chambers of Engineers and Architects of Turkey.

Mordor Intelligence estimates the Turkish construction market at $53.31 billion for 2024 and forecasts a compound annual growth rate of 5.12% through 2029. By that time, the figure will increase to $68.43 billion. And not only due to the housing sector.

Among the significant infrastructure projects is the construction of a 2,000-kilometer high-speed railroad from Kars in the northeast to Edirne in western Turkey. This project will be partially financed by Chinese banks. In addition, there are ambitious plans in the energy sector.

According to Turkey’s National Energy Plan, approved in January 2023, the share of renewable sources in electricity generation should rise from 16.7% in 2020 to 23.7% in 2035. This implies large-scale construction of solar and wind power plants. The development of nuclear power continues as well.

Unit 1 at the country’s first nuclear power plant “Akkuyu” is to be put into commercial operation in the near future. Three more power units are in the queue. Their construction is expected to be completed by 2028. The Turkish government has also reached framework agreements with China and Russia on the construction of 2 more NPPs in Sinop and Ignead.

The Turkish central bank gives a favorable macroeconomic forecast for 2025. According to it, the country’s GDP will grow by 3%. This is a positive signal, including for steel-consuming industries. Among the main risks is the aggravation of global trade wars and escalation of tensions in the northern and southern regions of Turkey. In turn, business expects from the regulator in 2025 further easing of monetary policy and reduction of the discount rate.